Ajai Paul | Cybersecurity Executive | Trusted Leader in Fintech And Healthcare Security | Sr. Dir of Enterprise Security at Affirm.

In the evolving digital finance landscape, robust authentication is paramount. Modern financial products offer unprecedented digital accessibility, but this convenience exists within a complex environment of sophisticated cyber threats and diverse international regulations. Therefore, strong, adaptive authentication is not just a feature but a foundational requirement for the trust and sustainability of these services.

The Global Regulatory Challenge

Fintech applications are often geographically border-adverse, meaning they can be accessed by users worldwide. While this creates opportunities for growth, it also presents significant regulatory hurdles and amplifies security risks, as malicious actors can attack from anywhere. Financial technology firms must navigate a complex and evolving patchwork of compliance mandates across multiple jurisdictions, which is both operationally demanding and costly.

Key regulations that impact authentication include:

• Strong Customer Authentication (SCA): A European mandate that includes multifactor authentication (MFA) in various payment and account access scenarios

• General Data Protection Regulation (GDPR): Governing the processing and storage of personal data for individuals in the EU

• Personal Information Protection And Electronic Documents Act (PIPEDA): A Canadian law for the collection, use and disclosure of personal information

• California Consumer Privacy Act (CCPA): Grants California residents the right to control their data

• Payment Card Industry Data Security Standard (PCI DSS): An industry standard for protecting cardholder data that often has contractual compliance requirements

To manage this complexity, fintech companies must build flexible, country-agnostic core authentication services that can incorporate specific local requirements, such as rules around SMS-based verification or device fingerprinting. Failure to do so can result in severe financial penalties and reputational damage.

The High Cost Of Neglecting Security

In the competitive fintech market, prioritizing speed over security can lead to severe consequences. Weak authentication significantly increases the risk of account takeover (ATO), where criminals gain unauthorized access to user accounts to commit financial fraud and steal personal data. Such incidents result in substantial financial losses and, more critically, erode consumer trust, a vital asset for any financial institution.

Delaying security considerations can also create fundamental architectural weaknesses that are expensive and difficult to fix later. A “security-first” approach, incorporating threat modeling from the start, is far more effective. Furthermore, inadequate security can lead to non-compliance with regulations, resulting in hefty fines, sanctions or even the suspension of operating licenses.

Modern Authentication Strategies

To navigate the complex landscape of threats and regulations, modern financial products must adopt a multilayered and adaptive approach to authentication. Relying on outdated or single-factor authentication methods is no longer sufficient to protect user accounts and comply with evolving security standards. Contemporary authentication strategies encompass several key principles and technologies:

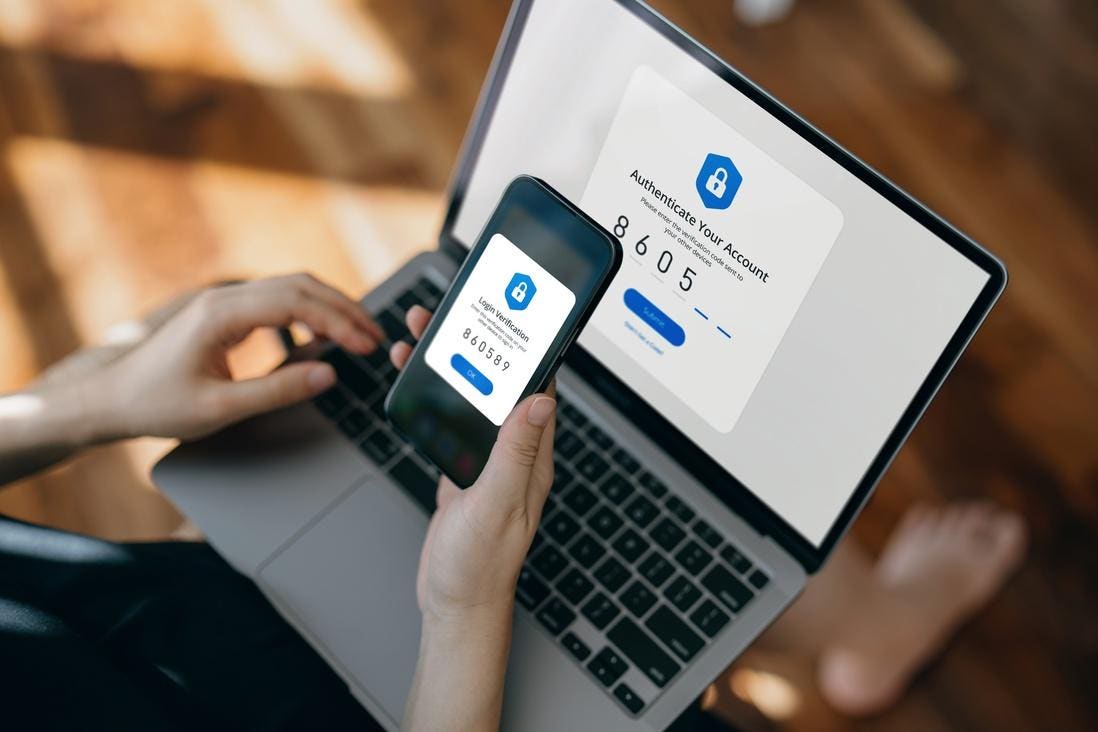

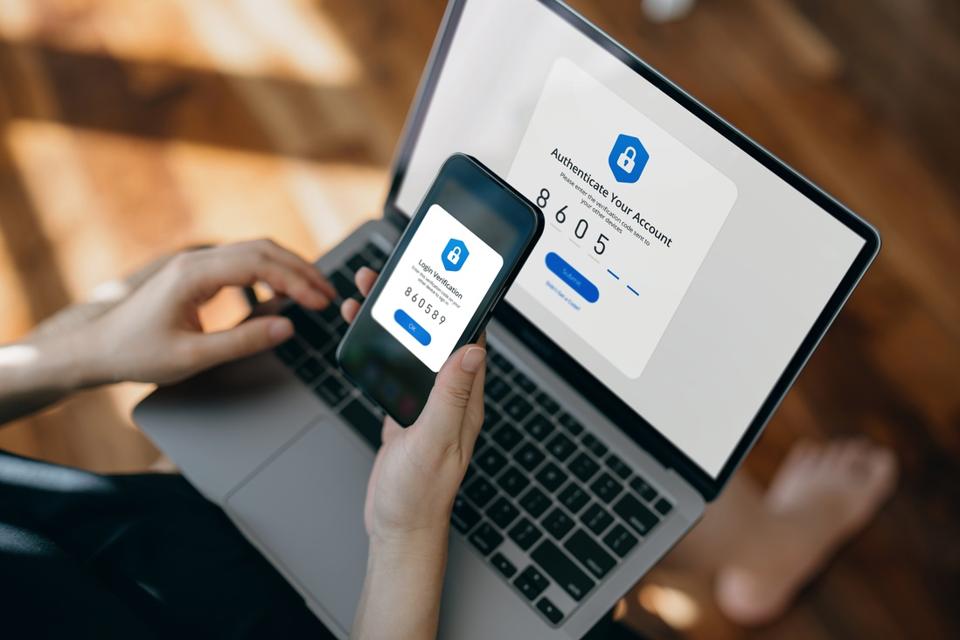

Multifactor Authentication

MFA is a cornerstone of modern security, requiring users to provide at least two distinct verification factors. This greatly reduces the risk of unauthorized access. The factors include:

• Something The User Knows: This includes passwords or PINs.

• Something The User Has: This refers to a physical token, a trusted mobile device or an authenticator app. Secure options, such as authenticator apps, are preferred over SMS-based one-time passcodes, which are vulnerable to interception.

• Something The User Is: This means biometric data, like a fingerprint or facial scan.

Offering a choice of MFA methods improves both security and user experience.

Risk-Based Authentication (RBA)

RBA is a dynamic approach that adjusts authentication requirements based on the risk level of a user’s activity. It analyzes contextual factors like user behavior, device and location data, transaction details and threat intelligence. Low-risk activities encounter minimal friction, while high-risk scenarios, such as logins from unusual locations or large money transfers, trigger “step-up” authentication for additional verification.

Device Authentication And Management

Establishing trust in a user’s device is another crucial element of modern authentication. Device fingerprinting technologies can create a unique identifier for a user’s device based on its hardware and software characteristics. Empowering users with device management tools enables them to view logged-in sessions and revoke access for lost or unrecognized devices, allowing them to detect unauthorized activity promptly.

Passkey Authentication

Passkeys are a modern, passwordless method that enhances security and usability. They use cryptographic keys stored securely on a user’s device, authenticated via biometrics or a PIN. This method is highly resistant to phishing because the keys are tied to a specific website or app.

However, robust security is crucial during passkey registration to prevent fraudsters from adding their passkeys to a compromised account. Requiring MFA before enabling a passkey is an essential safeguard.

Federated Identity

When integrating with third-party services, federated identity solutions (utilizing protocols such as OAuth or SAML) enable users to grant limited access without sharing their primary login credentials. This reduces risk and shifts some management burden to the partner who owns the identity. It is crucial to establish clear security responsibilities to ensure that critical fraud signals, such as device information, are shared consistently across platforms.

Conclusion: A Continuous Imperative

Securing modern financial products through contemporary authentication methods is a complex and crucial endeavor. It necessitates a thorough understanding of the expansive digital environment, given the varied and changing legal mandates, as well as the advanced threats facing the financial services sector.

By prioritizing security from the outset, avoiding the pitfalls of shortcuts and embracing a layered, adaptive approach (including multifactor authentication, risk-based authentication, device authentication and fingerprinting, passwordless technologies and secure partner integrations), fintech companies can build trusted and resilient platforms that protect users, ensure regulatory compliance and foster sustainable growth in an increasingly interconnected world.

The ramifications of neglecting security are severe, underscoring the imperative for a proactive and comprehensive strategy that views robust authentication not as a cost center but as a fundamental pillar of a successful and trustworthy financial product.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?