Roman Reznikov, Ph.D. – Driving digital transformation through innovation, leadership, and cutting-edge technology.

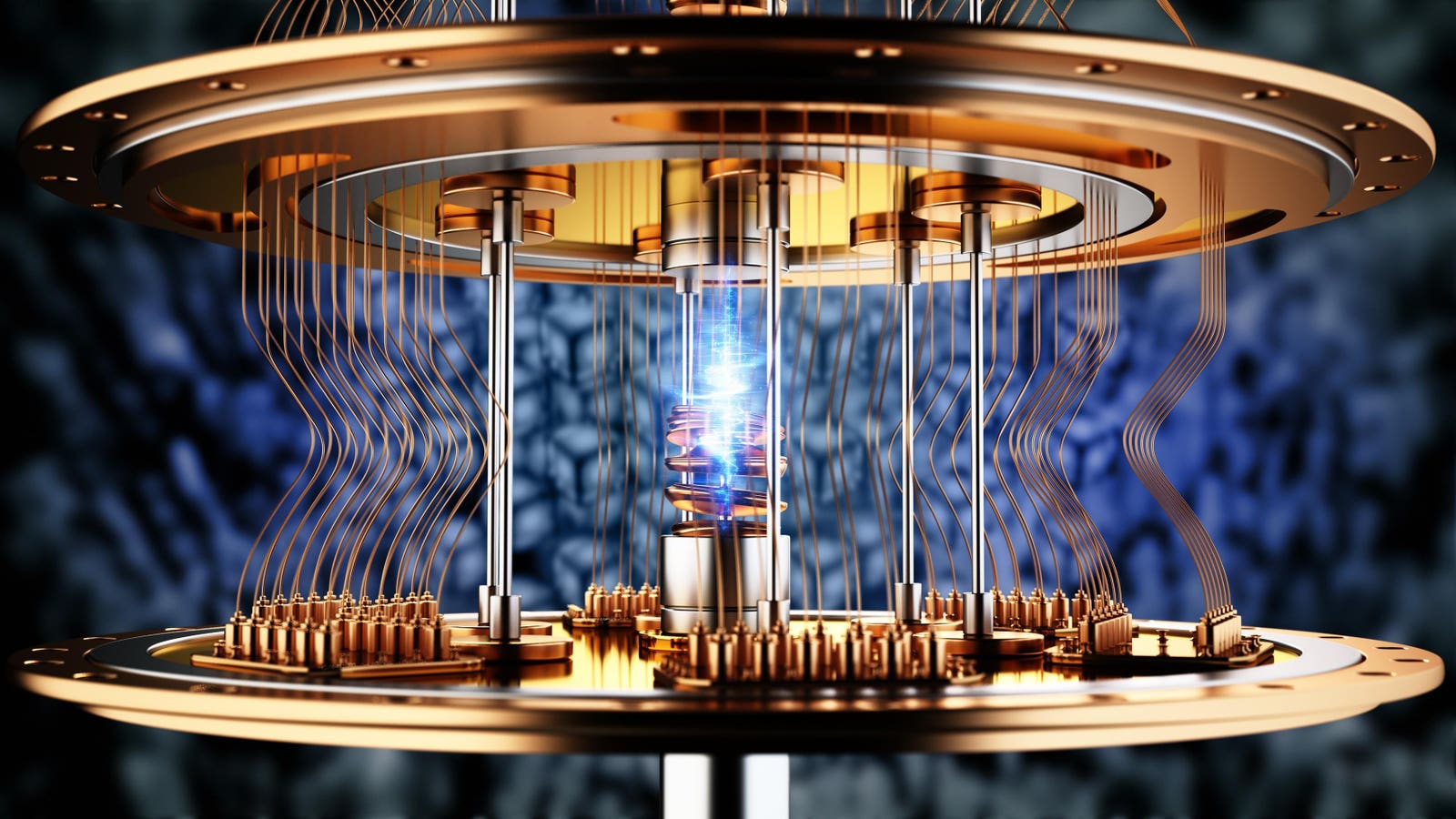

Imagine a scenario where banks can forecast market shifts in a matter of milliseconds, identify risk to a specific location and instantly rebalance portfolios—tasks that consume enormities of processing power and precious time today. It’s coming at an ever-increasing speed as a result of quantum computing.

Quantum computers tap into the principles of superposition and entanglement, processes which allow quantum bits (qubits) to process enormous amounts of data simultaneously, enabling faster solutions to complex computational problems in finance.

The Benefits Of Quantum Computing

Consider portfolio optimization—a task traditionally time-consuming and computationally intensive. Ordinary computers can manage such tasks, but are not able to work with sheer volumes and complexity of data optimally. A quantum approximate optimization algorithm (QAOA), however, slices through such datasets quickly to give robust solutions that greatly reduce complexity and computing time.

Risk management is another mainstay of the financial sector impacted by quantum computing. Financial institutions depend extensively on Monte Carlo simulations to forecast risk scenarios, something that needs enormous computational power. Quantum Monte Carlo simulations apply quantum parallelism to calculate millions of risk factors in one step, condensing weeks or months of classical computing into seconds. Banks and investment houses can respond faster and more accurately, enhancing their risk mitigation efforts.

Fraud detection can also benefit from quantum computing. Today’s financial institutions must be able to rapidly identify suspicious transactions out of billions per day. Quantum algorithms like Grover’s search algorithm excel at rapidly scanning through large databases to identify anomalies.

In insurance underwriting and actuarial science, actuaries constantly sift through data to try and forecast future risk and establish insurance premiums correctly. Machine learning algorithms boosted by quantum can process data at much faster speeds, enabling insurers to compute premiums with precision and maximize risk management.

In addition to speed and accuracy, quantum computing can also have a positive environmental impact. Traditional computing hardware, such as x86 or RISC architectures, consumes large amounts of power when running intensive tasks like large-scale simulations or combinatorial optimization. Quantum computers may eventually offer energy efficiency for certain tasks, making them a promising foundation for more sustainable financial technology infrastructure. Still, today’s machines require substantial energy for cooling and maintenance.

Quantum Adoption Challenges

Despite the potential of quantum computing, it remains far from ubiquitous across the business environment due to one fundamental reason: The majority of existing quantum computers are not yet sufficiently powerful to deliver commercial value at scale.

Another blocker these days is that there are still very few functioning quantum machines globally. Additionally, the cost of possessing and operating one, given the need for cryogenic infrastructure, remains too high for the majority of organizations. Quantum computing requires expert-level proficiency in quantum mechanics, linear algebra and quantum programming languages like Qiskit or Cirq. Building or attaining such a team is not just costly but time-consuming.

However, the environment is changing. Large cloud providers now provide access to quantum computing platforms through the cloud, where one can experiment without having physical hardware. Much of today’s early experimentation is conducted through quantum cloud services from the likes of IBM, Google or Rigetti. This democratization is similar to the emergence of ChatGPT, where existing AI ideas became popular after a breakthrough in accessibility and usability. While quantum may be heading toward greater accessibility, though, it still faces different and more fundamental adoption hurdles compared to AI.

Conclusion

From our experience with market leaders, one thing is certain: The biggest bottleneck in the future will not be machines; it will be humans. That’s why some organizations are already constructing internal R&D groups, testing small-scale use cases and exploring possible long-term value. The aim is to develop a new generation of professionals capable of making quantum theory functional in business.

For businesses considering a quantum journey, start small, be realistic and scale for long-term capability rather than short-term disruption. Begin with one or two high-impact applications, have a cloud-based quantum provider and focus on establishing internal knowledge. At the same time, have regular conversations with your compliance and cybersecurity teams.

It’s not about being first; it’s about being prepared when the time is right. Rather than waiting for the technology to go mainstream, organizations can start preparing now, investing in capability ahead of time to lead when quantum is scalable.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?