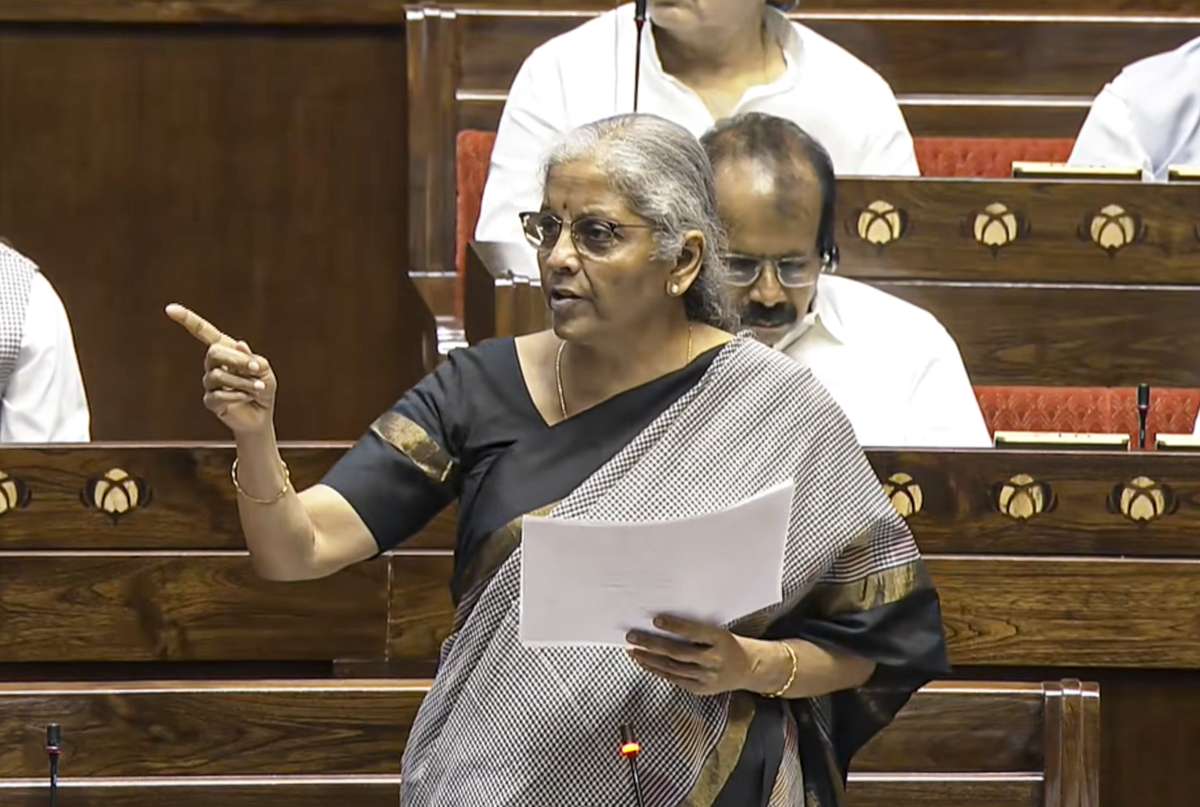

The first full-time woman Finance Minister of the country, has played a key role in major tax reforms, banking consolidation, and economic recovery initiatives.

Finance Minister Nirmala Sitharaman was born on August 18, 1959, and turned 66 on Monday. With a background in economics and a master’s degree from Jawaharlal Nehru University, she rose through the ranks to become the country’s first full-time woman Finance Minister in 2019. Before this, she served as Defence Minister and held key roles in the NDA government.

Look at FM Sitharama’s major achievements

Major GST reforms under watch

One of her most notable recent moves includes a proposal to simplify the Goods and Services Tax (GST) structure, announced around Independence Day 2025. The plan aims to eliminate the 12% and 28% slabs, retaining only 5% and 18%. This is expected to ease the tax burden on the middle class, with 99% of items under 12% moving to 5%, and 90% of those under 28% moving to 18%. The GST Council is set to take this up in a meeting later this year.

Amendments to GST laws and betting tax

Sitharaman also spearheaded the Central Goods and Services Tax (CGST) Amendment Bill, which imposes a 28% GST on the total value of bets placed in online gaming, casinos, and horse racing.

The move, passed during the monsoon session despite Opposition protests, is expected to generate substantial revenue for the government.

Banking sector consolidation

She oversaw the amalgamation of public sector banks in 2020, one of the largest reforms in the Indian banking sector. Key mergers include Oriental Bank of Commerce and United Bank of India with Punjab National Bank; Syndicate Bank with Canara Bank; and Andhra Bank and Corporation Bank with Union Bank of India. This move aimed at creating stronger, more competitive financial institutions.

Introduction of new income tax regime

To ease compliance and offer relief to the middle class, Sitharaman introduced a new income tax regime with simplified slabs. Under this, the exemption limit was raised to ₹7 lakh, making it the default tax regime, though the old regime remains optional.

Push for flagship government schemes

She has consistently urged Regional Rural Banks (RRBs) to prioritise key Central government schemes such as PMJJBY, PMSBY, Atal Pension Yojana, PM SVANidhi, PM Mudra Yojana, and Kisan Credit Card (KCC), among others, to ensure deep financial inclusion in rural India.Through the COVID-19 pandemic and global inflationary pressures, Sitharaman led multiple relief packages, supported key sectors, and introduced strategic reforms that helped India’s economy rebound quickly.