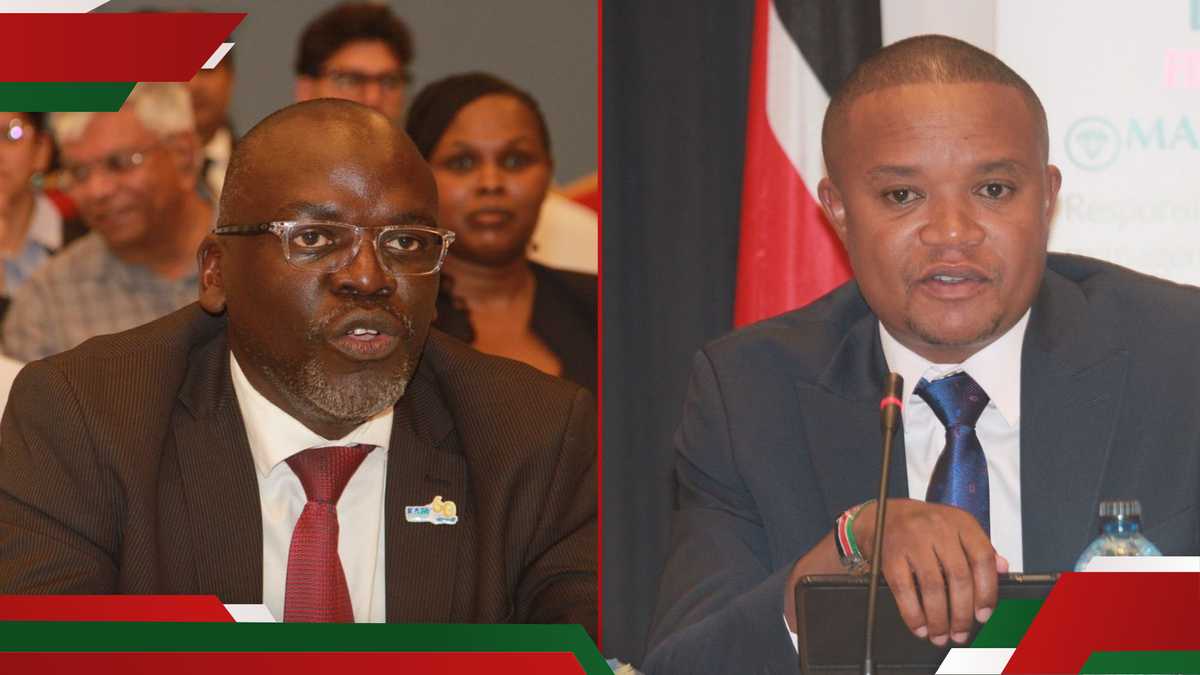

- The National Assembly’s Finance Committee, chaired by Molo MP Kuria Kiman, is collecting views from Kenyans on the Finance Bill 2025

- The Kenya Association of Manufacturers opposed the proposal regarding the shift from zero-rated to exempt, arguing that this will increase costs for businesses and consumers

- East African Device Assembly Kenya Ltd lobbied lawmakers to remove raw materials and components used in local smartphone assembly from VAT

TUKO.co.ke journalist Japhet Ruto has over eight years of experience in financial, business, and technology reporting and offers profound insights into Kenyan and global economic trends.

Several suggestions in the Finance Bill 2025 have been opposed by Kenyans from various sectors.

Source: Twitter

Citizens expressed concerns about privacy invasion, higher taxes on essential goods, and the elimination of tax breaks for affordable housing.

What are the contentious issues in the Finance Bill 2025?

The proposed change from zero-rated to standard Value Added Tax (VAT) for basic products is one of the main points of contention.

Search option is now available at TUKO! Feel free to search the content on topics/people you enjoy reading about in the top right corner 😉

Stakeholders led by the Kenya Association of Manufacturers (KAM) warned that if the proposal is implemented, it will lead to increased living costs from July 1, 2025.

They also opposed provisions that would hand the Kenya Revenue Authority (KRA) access to private information, trade secrets, and individual phone usage.

Kenyans who appeared before the National Assembly’s Finance Committee in public hearings also said that eliminating tax rebates for companies that construct 100 or more mass residential units a year would hinder attempts to provide affordable housing.

“The Finance Bill 2025 contradicts the government’s agenda of promoting affordable housing through tax incentives,” the Kenya Property Developers Association managing director, Rose Kananu, lamented.

Other controversial proposals include limiting the carry-forward of bad debt claims to five years, prohibiting tax deductions for sports sponsorship.

The bill also suggests that all businesses, including ride-hailing platforms like Bolt and Uber, issue eTIMS invoices, and give the KRA the authority to issue demand notices even in cases that are still pending at the High Court or the Tax Appeals Tribunal.

Source: Twitter

What did stakeholders propose in the Finance Bill 2025?

In order to reduce production costs, East African Device Assembly Kenya Ltd lobbied lawmakers to remove raw materials and components used in local smartphone assembly from VAT.

“We suggest that approved mobile phone assemblers be exempt from VAT on inputs,” Johnstone Kamunde, the company’s chief finance officer, proposed.

The aviation industry also raised concerns over the imposition of multiple taxes on aircraft.

The Kenya Association of Air Operators’ chair, Mburu Ngunze, informed the committee that the industry would be severely harmed by the imposition of import declaration fees, the railway development levy, and VAT on aircraft and parts.

He suggested the removal of the taxes as these measures would increase the cost of buying and leasing these items.

Which products will be slapped with VAT?

By introducing Section 66A, which penalises the misuse of exempt or zero-rated items, the bill seeks to combat the abuse of VAT exemptions and expand the tax base.

Healthcare, aviation, energy, tourism, housing, manufacturing, mining, and information storage are among the industries impacted.

Fuels, lubricants, and tires used in aid projects are among the products to be hit with VAT.

Source: TUKO.co.ke