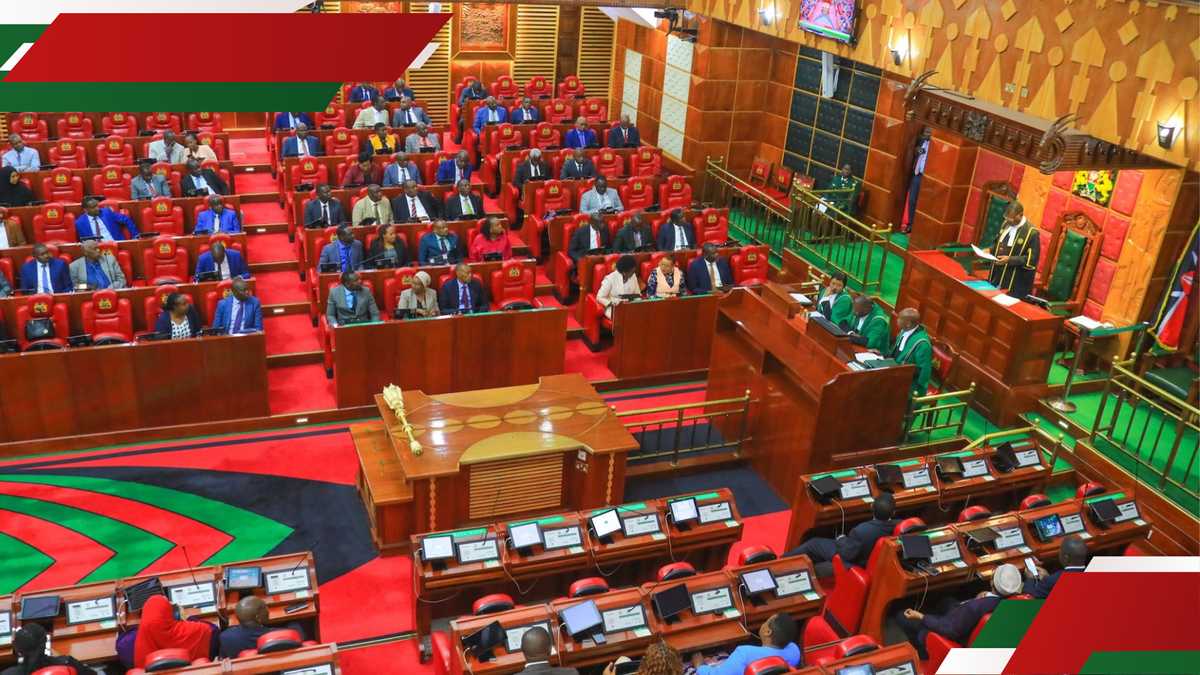

- Treasury Cabinet Secretary John Mbadi published the Finance Bill 2025 and presented it to Kenyan MPs for debate

- Mbadi noted that the government’s emphasis had shifted from levying taxes on the populace to enacting internal changes that encourage efficiency and accountability

- Kenyans have up to May 27 to submit their handwritten comments on the bill before lawmakers make amendments

TUKO.co.ke journalist Japhet Ruto brings over eight years of experience in financial, business, and technology reporting, offering profound insights into Kenyan and global economic trends.

Kenyans can now voice their opinions on the Finance Bill 2025 through a window that has been created by the National Assembly.

Source: Twitter

When’s the deadline to submit views on Finance Bill 2025?

Parliament has set a deadline of Tuesday, May 27, for individuals, companies, and lobby groups to hand-deliver written comments on the bill.

Search option is now available at TUKO! Feel free to search the content on topics/people you enjoy reading about in the top right corner 😉

The views should be sent to the clerk’s office of the National Assembly, or via email to the clerk or the Departmental Committee on Finance and Planning.

“The bill contains proposals relating to revenue-raising measures, including provisions to ease tax administration and clean up the statute book of terms and cross-references to provisions that have previously been repealed,” the National Assembly’s clerk stated in a notice.

For additional input, the department is also anticipated to hold a one-on-one session with some of the players face-to-face.

The invitation is in line with the constitutional requirement for public participation in legislative processes.

Stakeholders are urged to submit their views before the bill is debated in Parliament.

Source: Facebook

What are the Finance Bill 2025’s proposals?

There are no additional taxes included in the draft bill, which is set to be debated by MPs.

This is anticipated to give businesses and taxpayers who are currently struggling financially a much-needed reprieve.

Pensioners are one of the main beneficiaries, as their emoluments will not be taxed.

The measure also suggests that when determining employees’ Pay As You Earn (PAYE), employers should take into account all applicable tax reliefs and exemptions.

Micro, small, and medium-sized enterprises would also benefit from the proposed reforms that would allow them to fully deduct the cost of common tools and equipment in the year of purchase, thereby supporting small firms.

Poultry and horticulture farmers would be relieved as the bill proposes to eliminate the excise tax on eggs, onions, and some types of potatoes from the list of excisable commodities.

According to Treasury Cabinet Secretary (CS) John Mbadi, the government’s emphasis has now moved from levying taxes on the populace to enacting internal changes that encourage efficiency and accountability.

Will Digital Service Tax be cut?

In related developments, Mbadi suggested that the Digital Service Tax (DST) be lowered by 50%.

He noted that if MPs approved the plan, the Digital Service Tax rate would be reduced from 3% to 1.5%.

The CS clarified that to keep tax laws in line with economic demands, the Exchequer periodically examines them to find any obstacles to business and makes necessary revisions.

The top government official promised to systematically lower the Value-Added Tax (VAT), Pay-as-You-Earn (PAYE), and other tax rates.

Source: TUKO.co.ke