- National Treasury CS John Mbadi asked lawmakers to remove several items from VAT zero-rated to VAT-exempt

- This means manufacturers will no longer be able to recoup input taxes, which would ultimately force them to raise prices for consumers

- Among the items targeted are the transportation of sugarcane from farms to milling factories and the supply of locally assembled and manufactured mobile phones

TUKO.co.ke journalist Japhet Ruto brings more than eight years of expertise in finance, business, and technology, offering valuable perspectives on economic trends both in Kenya and worldwide.

The broad-based government under President William Ruto has unveiled the Finance Bill, 2025, which could raise the prices of some items if approved by Members of Parliament (MPs).

Source: Twitter

What’s Mbadi’s proposal?

National Treasury Cabinet Secretary (CS) John Mbadi urged MPs to reclassify essential products from Value-Added Tax (VAT) zero-rated to VAT-exempt status in the bill.

Read also

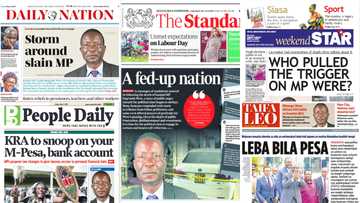

Kenyan newspapers review: Charles Ong’ondo Were’s bodyguard narrates MP’s quick hit by assassin

The distinction between zero-rated and exempt goods is how companies handle input taxes during the production process, even if both are offered to customers without VAT costs.

Manufacturers can reduce their production costs by claiming refunds for VAT paid on raw materials for zero-rated products.

However, manufacturers will no longer be able to recoup these input taxes, which would ultimately force them to raise prices for consumers.

Source: Twitter

Which items will be affected?

Products that are impacted include inputs used in the production of pharmaceuticals, transportation of sugarcane, locally produced mobile phones, electric bicycles and buses, solar and lithium-ion batteries, and ingredients for animal feed.

Basic goods such as sugar, milk, medications and solar equipment will probably become more expensive as a result of manufacturers passing the cost on to customers.

Below is the full list:

- Inputs or raw materials locally purchased or imported for the manufacture of animal feeds, upon recommendation by the Agriculture CS.

- Transportation of sugarcane from farms to milling factories.

- The supply of locally assembled and manufactured mobile phones.

- The supply of motorcycles of tariff heading 8711.60.00.

- The supply of electric bicycles.

- The supply of solar and lithium-ion batteries.

- The supply of electric buses of tariff heading 87.02.

- Bioethanol vapour (BEV) stoves classified under HS Code 7321.12.00 (cooking appliances and plate warmers for liquid fuel).

- Packaging materials for tea and coffee, upon recommendation by the Agriculture CS.

Read also

Finance Bill 2025: Kenyan govt orders employers to apply all tax reliefs in PAYE deductions

What the government aims to achieve

The government wants to reduce the amount of money it spends on tax refunds by lowering the number of items on the zero-rated schedule.

At a meeting on April 29, 2025, at the State House in Nairobi, the Cabinet, chaired by Ruto, noted the government would enact austerity measures that would result in a revision of the initial budget estimates of KSh 4.3 trillion before they are presented to Parliament.

In the fiscal year 2025/2026, the government aims to reduce the fiscal deficit to 4.5% of Gross Domestic Product (GDP), from 5.1% in 2024/2025 and 5.3% in 2023/2024.

The government stated that the purpose of the measure is to improve tax administration and close revenue leaks without introducing drastic tax increases.

Proofreading by Asher Omondi, copy editor at TUKO.co.ke.

Source: TUKO.co.ke