Members of the National Assembly during Plenary

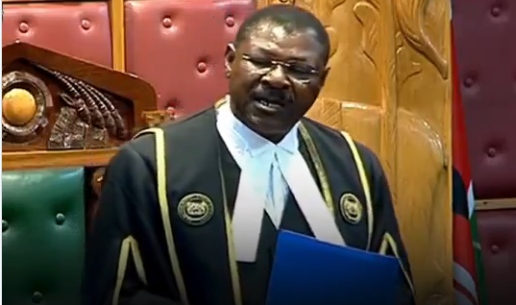

National Assembly Speaker Moses Wetang’ula has confirmed

the receipt of the draft Finance Bill, 2025 in Parliament.

The speaker said that the Bill will be committed to the Finance Committee for consideration and public participation.

He called on the MPs to acquaint

themselves with the contents of the tax estimates proposed in the Bill.

“I wish to inform the House that I

have received the draft Finance Bill, 2025 from the Cabinet, which relates to the

revenue-raising measures for the budget submitted,” Wetang’ula said.

“It will be committed to the

departmental Committee on Finance and National Planning for consideration and

public participation upon publication and first reading,” he added.

The speaker said MPs should

ensure their views and those of their electorate are taken into account during

the consideration of the national budget.

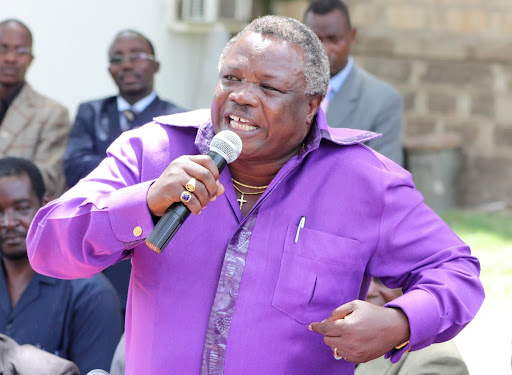

While commenting on the draft Bill, Suna East MP Junet Mohamed cautioned Kenyans about a fake version of the Finance Bill doing rounds on social media.

He said that Kenyans have been

discussing the contents of the fake bill and its proposed tax measures.

“We want to tell Kenyans that the

real Finance Bill is with us now, there should be no misinformation,

disinformation and misrepresentation to the public,” Junet said.

He said the Finance Bill, 2025, should be

interpreted in accordance with its contents.

“We have only one Finance Bill in

the House. If you want to import your things into the Finance Bill, do not

mislead Kenyans. Let us tell the public exactly what is in the Finance Bill. If

there are no more taxations, there are no more taxations,” he said.

On Tuesday, the Cabinet approved

the Finance Bill, 2025, whose main focus is on

sealing tax loopholes rather than introducing new taxes.

“The Bill seeks to minimise

tax-raising measures,” read a Cabinet dispatch sent to newsrooms after a meeting chaired by President William Ruto at State House, Nairobi.

Instead, the Cabinet said the government

aims to enhance revenue through administrative efficiency.

Key changes include streamlining

tax refunds, tightening tax dispute laws and amending key tax acts to reduce

evasion.

“Small businesses will be allowed

to deduct the cost of tools and equipment in full in the year of purchase.”