US stocks surged on Friday, as upbeat earnings from Apple (AAPL) lifted spirits and a weaker-than-expected jobs report revived bets that the Federal Reserve could cut interest rates sooner than thought.

The Dow Jones Industrial Average (^DJI) jumped 0.9%, or about 350 points, while the S&P 500 (^GSPC) rose 0.8%. The tech-heavy the tech-heavy Nasdaq Composite (^IXIC) increased 1.6%. All three gauges are poised to build on sharp closing gains from Thursday.

The April jobs report painted a picture of a cooling US labor market, as employers added 175,000 jobs and the unemployment rate unexpectedly jumped to 3.9%. Economists had expected an addition of 240,000 jobs.

The report pushed up bets on a sooner-than-expected rate cut from the Fed. According to the CME FedWatch tool, traders saw a roughly 50-50 chance of a cut at its July meeting, up sharply from Thursday.

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

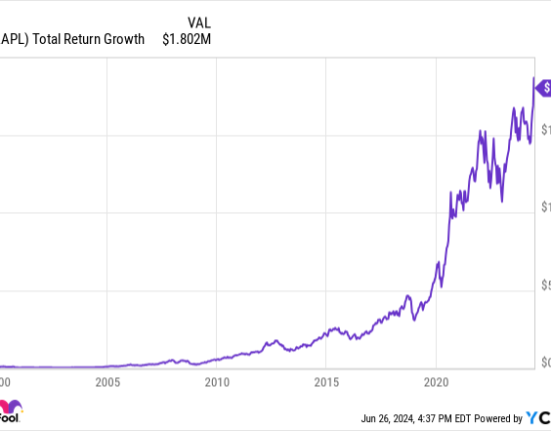

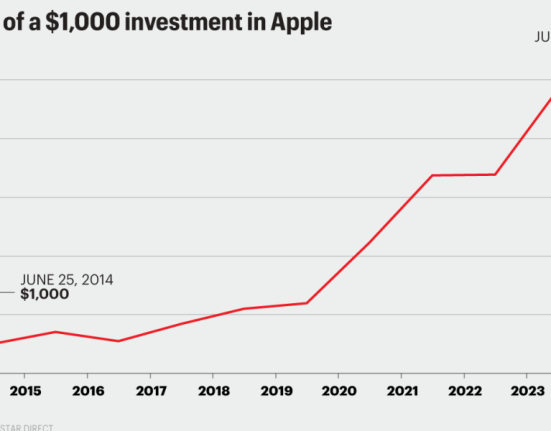

Meanwhile, Apple was the star of the corporates Friday, as its quarterly profit beat expectations and it surprised investors with better revenue out of China than estimated in the face of reports of flagging iPhone sales.

While CEO Tim Cook talked up Apple’s plans for AI development — a key focus this earnings season — it was the company’s plans for a $110 billion stock buyback, the biggest in US history, that captured the market’s attention. Apple shares rose 6% in early trading, buoying the Dow.

The blue-chip index is also seeing a boost from heavyweight Amgen (AMGN), whose shares soared almost 13% after comments by its CEO suggested its obesity drug could take on market leaders from Novo Nordisk (NVO).

Live5 updates