[SINGAPORE] Proceeds from environmental, social and governance (ESG)-labelled debt instruments in South-east Asia fell sharply in the first quarter of 2025, as companies and investors grew more cautious amid geopolitical tensions, economic uncertainty and rising scrutiny over greenwashing risks.

According to financial data provided by LSEG, ESG bond proceeds fell 15 per cent year on year to US$4.6 billion in the three months from January to March, while ESG loans dropped by a steeper 23.4 per cent to US$10.2 billion.

Sustainable finance analysts said corporates and investors might have been more cautious amid current geopolitical and economic uncertainties, with the global pullback on climate action spurred by the US.

However, they noted that US President Donald Trump’s climate policies may not be the decline’s only key driver.

“Increased global scrutiny and debate over ESG in certain markets may be contributing to a more cautious approach among both issuers and investors, although the direct impact on Asean is challenging to directly correlate and quantify,” said Melissa Cheok, associate director at Sustainable Fitch.

A maturation within Asean’s sustainable finance markets, as well as corporates becoming more aware of greenwashing risks, are other factors as well.

A NEWSLETTER FOR YOU

Friday, 12.30 pm

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

ESG bonds

The decline in ESG bond proceeds in South-east Asia outpaced the global market, which saw ESG bond proceeds come in at US$234.6 billion in Q1 2025, a 5.9 per cent dip from US$249.3 billion in the same period a year earlier.

The Asia-Pacific region bucked the trend, with ESG bond issuances rising to US$47.2 billion, a 12.1 per cent increase from US$42.2 billion over the same period.

Within South-east Asia, funding from social and sustainability bonds overtook green bonds, which usually have the highest number of issuances among ESG-labelled bonds.

After accessing debt capital markets in the last few years, large corporates in the region are now focusing on deploying and managing proceeds in a way that is aligned with sustainability or climate-related themes and projects, said Cheok.

In the meantime, small and medium-sized enterprises are in the early stages of adapting to newly implemented regulatory frameworks; they are also allocating internal resources to build the necessary capacity for compliance and reporting.

“Thus, an ongoing phase of capacity building remains a salient feature of the market landscape,” said Cheok.

With expectations that the US central bank might cut interest rates only towards the end of the year, borrowing costs will remain high and may deter some issuers from tapping the market, particularly those with weaker credit profiles or narrower operating margins.

Nevertheless, Cheok said that investor demand for ESG debt instruments remain resilient, underpinned by dedicated ESG mandates, evolving regulatory requirements, the focus on transition and the strategic importance of sustainability for both issuers and investors.

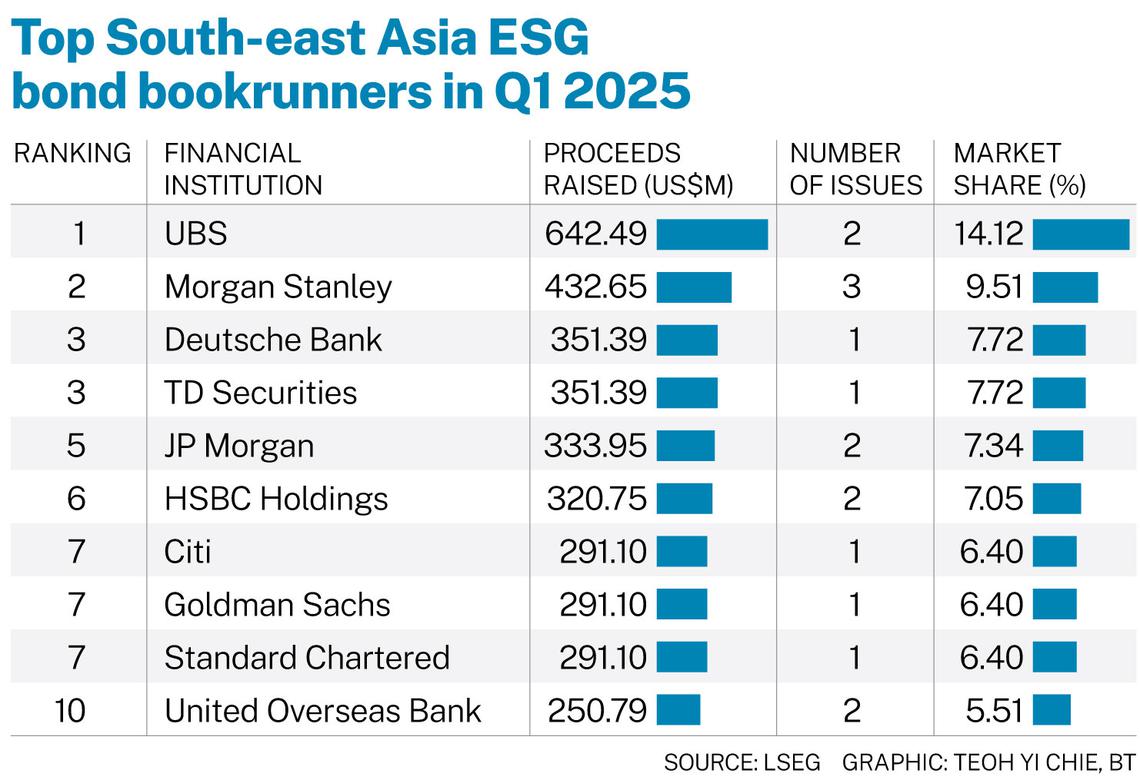

The top bookrunners for ESG bond deals in South-east Asia over H1 2025 were UBS (US$642.5 million), Morgan Stanley (US$432.7 million) and Deutsche Bank (US$351.4 billion).

ESG loans

The fall in ESG loan proceeds in South-east Asia was tamer than in the rest of the world.

Across the global market, the amount of capital raised from ESG loans fell 47.8 per cent to US$113.1 billion in Q1 2025, from US$216.6 billion in Q1 2024.

As for Asia-Pacific, funds from ESG loans came to US$20.4 billion, down 35.1 per cent from US$31.5 billion a year earlier.

Aaron Chow, SMBC’s head of loan capital markets department in Asia-Pacific, said ESG financing’s share of the total loans market has fallen substantially, given that loan issuance volumes in South and South-east Asia were up in Q1 2025 compared to the previous year.

He added that companies are adopting a more measured approach towards ESG financing particularly when it comes to setting credible targets in sustainability-linked loans (SLLs), reflecting the growing scrutiny and awareness of greenwashing risks.

In addition, price compression observed through 2024 and into Q1 2025 has made SLLs less attractive for lenders, as margins may be further reduced if these targets are met.

SLLs are loan instruments that offer borrowers interest rate discounts if they have met pre-determined sustainability- or climate-related targets.

Chow added that corporates across Asia-Pacific and South-east Asia remain committed to their long-term ESG goals, although the levels of ambition would vary by market and sector.

They are driven by domestic regulatory pressures, stakeholder expectations, and the pursuit of energy security and sustainable development.

He expects ESG loan activity in the region to remain robust over the rest of the year, particularly in the areas of energy efficiency, water and social finance.

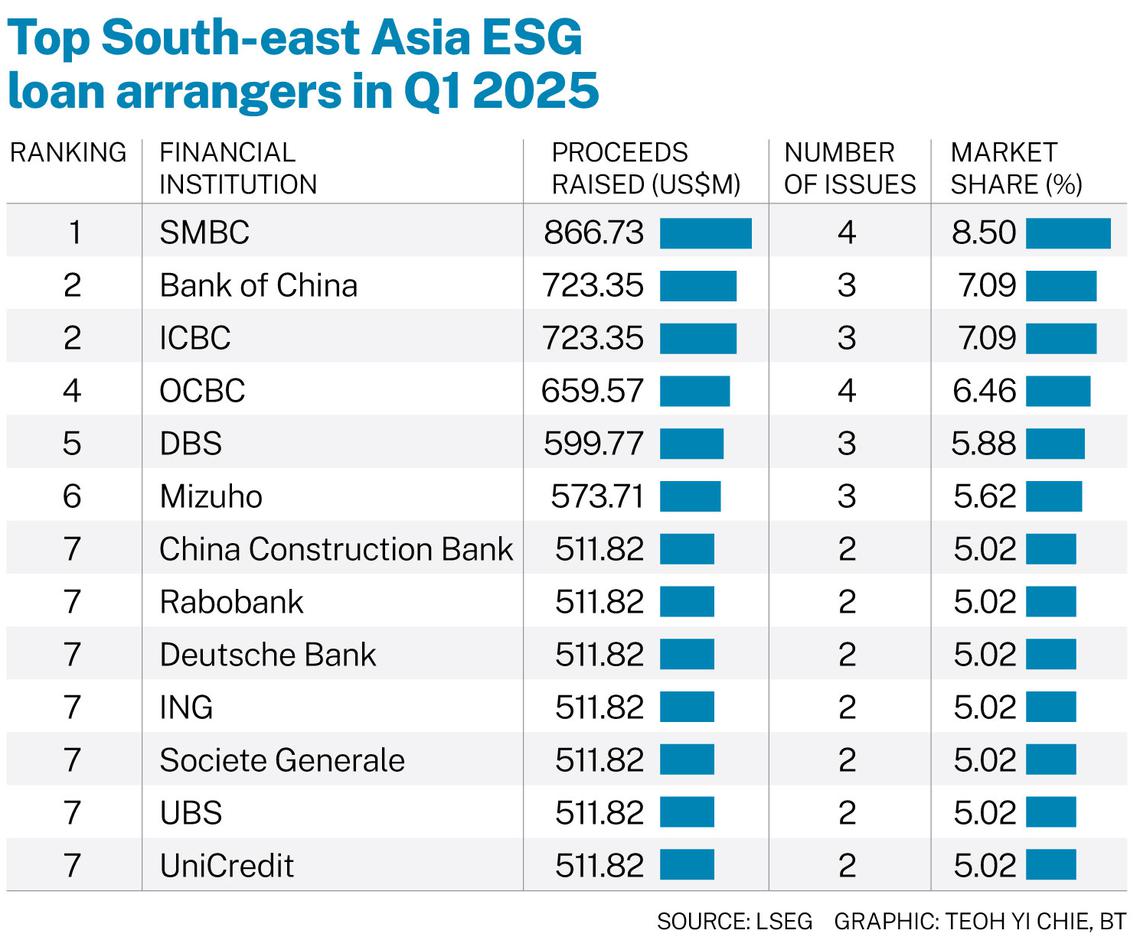

SMBC was the top arranger for ESG loans in South-east Asia across the first three months of 2025, with US$866.7 million raised. Bank of China and ICBC tied for second place, at US$723.4 million each.