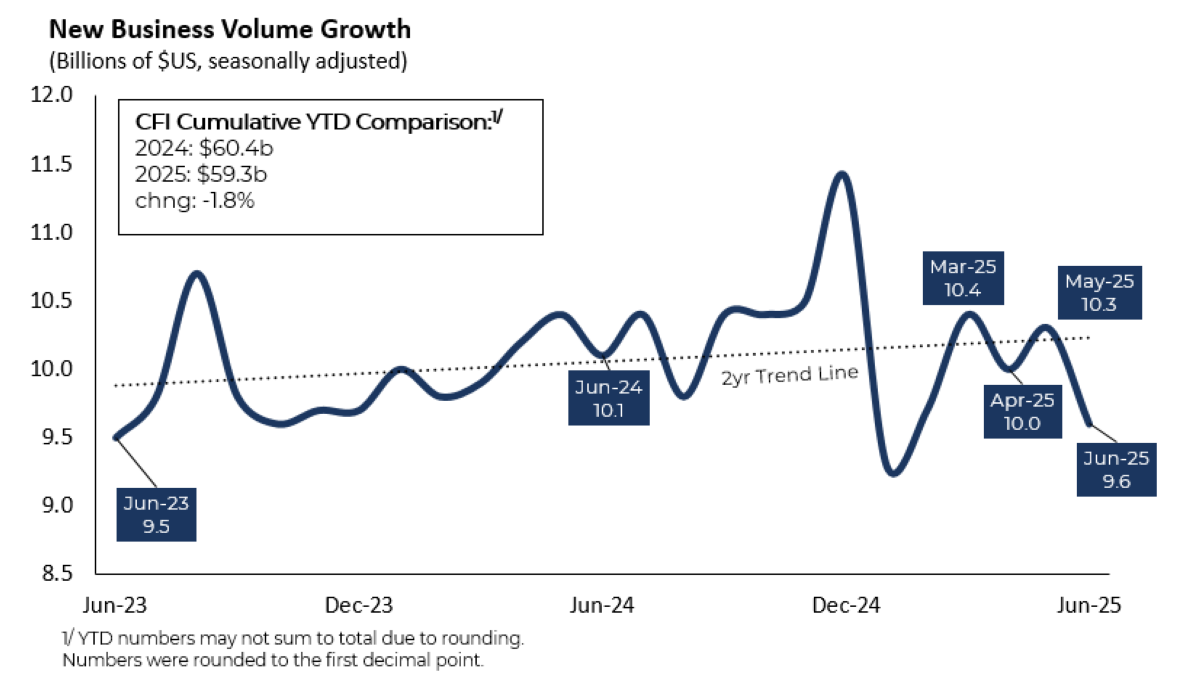

FORECAST: The change in new business volumes (NBV) suggests a 4.5% decline in new durable goods orders in June. Total new business volume was $9.6 billion on a seasonally adjusted basis in June, a decrease of 7.4% from May.

NBV year-to-date contracted by 1.8% relative to the same period in 2024.

Year-over-year, NBV dropped by 3.8% on a non-seasonally adjusted basis.

WASHINGTON, July 24, 2025 (GLOBE NEWSWIRE) — “The latest CapEx Finance Index survey shows an easing in equipment demand and a moderate rise in losses, but delinquencies retreated. Volatility across many indicators is up in 2025, so I’m not taking too much signal from one month of data,” said Leigh Lytle, President and CEO at ELFA. “Still, we’ll be watching the incoming data closely this summer to see if trade policy uncertainty is finally beginning to weigh on equipment and software demand. Even if a slowdown materializes over the next few quarters, our sector is well positioned to handle the turbulence. The drop in the delinquency rate and the relatively low level of losses show that financial conditions remain healthy, providing a buffer against an economic downshift. And the recent passage of permanent 100% expensing and EBITDA-based interest deductibility should strengthen equipment demand over the next few years.”

Equipment demand eased. Month-over-month NBV had the second-largest drop of the year in June; the largest was in January, when volumes decreased by 17.8%. The volume of small ticket deals was $3.1 billion in June, representing a 6.0% decrease from May. Small ticket volumes have been volatile recently, experiencing either a double-digit percentage increase or decrease in every month since January. That trend ended in June with volumes decreasing by 6.0%. All three institution types – banks, captives, and independents — experienced slower demand last month as well.

The credit approval rate dipped but remains elevated. The average credit approval rate dropped to 76.8% but remained near its recent peak of 77.4%. The rate at banks decreased by 3.3 percentage points to 75.7%. That drop outweighed the 4.1 percentage point and 3.0 percentage point increases at captives and independents, respectively. The approval rate for small ticket deals was also up slightly from May.

Losses rose, but delinquencies dropped. The overall delinquency rate fell to 1.9% in June, down 0.27 percentage points month over month. The rate at banks decreased by 0.49 percentage points, offsetting the 0.41 percentage point increase observed in the prior month.

The overall loss rate rose by 0.06 percentage points to 0.50% in June. The increase was driven by a 0.13 percentage point increase at banks, which more than offset the modest declines at both captives and independents.

Headcounts rose for the first time this year. The 12-month change in total employment was up 4.3% from June 2024. All three institution types experienced job gains over the last 12 months.

“The recent CFI results point to continued strength in equipment financing, even as businesses face rising input costs and output prices-pressures partly driven by tariffs,” said Hollis Bufferd, Founder & CEO, Star Hill Financial, LLC. “At Star Hill, we continue to see steady demand from companies investing in growth, particularly in the manufacturing sector. While the broader economic outlook is mixed, financing activity has proven resilient. That said, while the overall picture is complex, the steady financing activity signals strength. We’re mindful of geopolitical uncertainties and policy shifts, so these results should be viewed within the context of a wider economic landscape, where uncertainty could pose challenges ahead. No single data point tells the full story, but we remain cautiously optimistic and focused on delivering flexible, fixed-rate financing solutions that meet our clients’ evolving needs.”

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, climbed to 61.6 in July, revealing a third consecutive month of increasing confidence.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released monthly from Washington, D.C., generally one day before the U.S. Department of Commerce’s durable goods report. More detail on the data and methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing & Finance Association (ELFA) represents financial services companies and manufacturers in the $1.3 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org.

Follow ELFA:

X: @ELFAonline

LinkedIn: https://www.linkedin.com/company/115191

Media/Press Contact: Jane Esworthy, VP, Communications & Marketing, ELFA, [email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/557fd3e5-7d8f-419a-b8c7-23288677798b