Despite the bulls’ dominance on the crypto market just days ago, traders have submitted to bears now, resulting in a massive crash today. Bitcoin, Ethereum, XRP, and the rest of the altcoins are facing a sharp correction, pushing the collective market cap down to $3.97T. In addition, BTC price has crashed to a week’s lowest point $115k, as the uncertainty and volatility grew in the crypto space.

Top Reasons Why the Crypto Market is Down Today

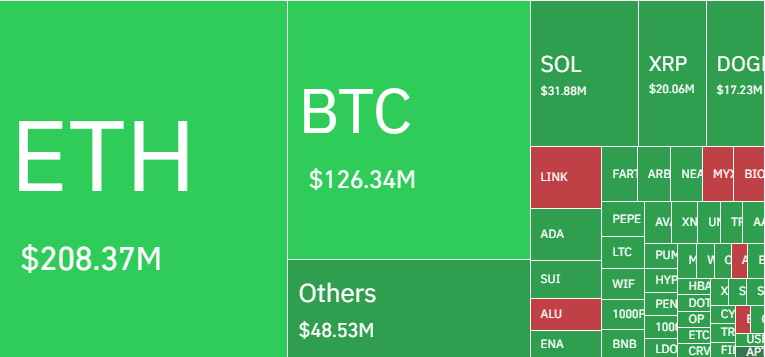

After setting a fresh all-time high, the crypto market seems weak today, as real signs of turbulence emerge among digital assets. Bitcoin, which recently hit a new ATH of $124.4k, has crashed down to $115k, Ethereum also declined to $4.2k, XRP marched below $3.0, and much more.

- Source: CoinMarketCap, Crypto Market Heatmap

This turbulence emerged with the release of various macroeconomic reports in the previous week.

The release of hotter-than-expected U.S. PPI data created concerns about the upcoming Fed’s decision on interest rates. Notably, investors worldwide have been awaiting September rate cuts to witness a major crypto rally.

However, despite Trump’s pressure on Powell and the experts’ suggestion, there are still doubts about potential cuts. In the list of macroeconomic factors, the upcoming U.S. retail earnings reports are adding additional volatility to digital assets.

Not to mention, Central banks are buying gold, and the asset is at its highs, resulting in capital rotation from crypto to gold. Additionally, the disappointment with the Treasury Secretary Scott Bessent’s statement is keeping the traders’ trading activity grounded.

Recently, Bessent disclosed that the U.S. is not planning to acquire any crypto assets for the Bitcoin reserve. The White House crypto policy report also missed the discussion on this reserve, influencing negative sentiments.

-

US-Russia-Ukraine Tension

After meeting with Russian President Vladimir Putin with no peace deal, Trump is now set to meet Ukraine’s President Volodymyr Zelenskyy for peacemaking and influence a ceasefire between Ukraine and Russia. There’s certain caution ahead of the meeting, resulting in traders’ sell-off.

Experts also note the bearish divergence in the RSI and MACD across top assets like Bitcoin and Ethereum.

-

Profit Taking and Technical Barriers

The top crypto assets saw massive growth in the last few days. However, as the tokens reached their peak, sellers emerged. The prime example is XRP, where 94% of its holders were in profit, creating overheated and profit-taking conditions.

In the case of Ethereum, $272M outflows were noted on August 15 after the massive inflows week. Whale On-chain data further confirmed the profit taking, with one wallet alone moving $54M worth of ETH to the exchange.

🚨 🚨 🚨 12,202 #ETH (54,663,356 USD) transferred from #FalconX to unknown wallethttps://t.co/Ka2T5BXY9g

— Whale Alert (@whale_alert) August 17, 2025

Crypto Market Crash Results in $550M Liquidation

As Bitcoin fell below the critical support of $118.8k, currently trading at $115.2k, and Ethereum followed a similar trajectory, millions have been lost from the market. CoinGlass data reveals that more than $550M has been liquidated in the last 24 hours. Traders’ mass sell-offs hit tokens, fueling long positions’ liquidation.

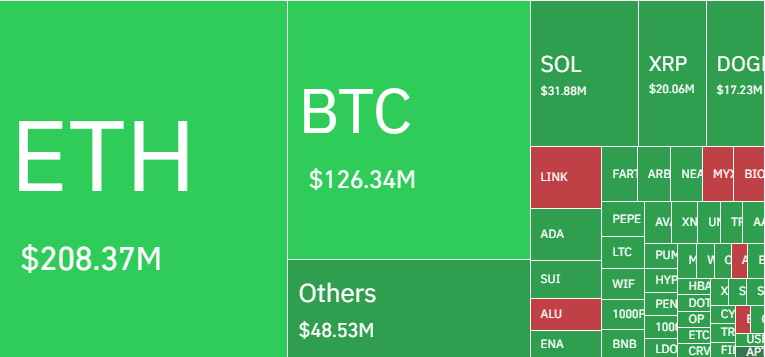

- Source: CoinGlass, Crypto Liquidation Heatmap

Notably, the long Ethereum position has been liquidated the most, $179M in 24 hours, followed by Bitcoin with $123M positions. Overall, 131,459 traders were affected, and the biggest single liquidation took place on Bitmex – XBTZ25, valued $7.83M

Frequently Asked Questions (FAQs)

Most assets are suffering today, with Bitcoin declining to its week’s low, and XRP crashing down to the key $3 mark.

CoinGlass data reveals that more than $550M was liquidated in the last 24 hours alone.

Profit-taking by whales, technical resistance levels, RSI/MACD divergence, and numerous other factors contributed to the downtrend.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: