Crypto market is facing some pullback today, a day after strong upside on news of US-China trade talks and alleviating trade tensions. While Bitcoin (BTC) price is down by 1%, altcoins like ETH, BNB, DOGE, and others have corrected 2-10% today. Interestingly, this drop comes following a 3.26% surge in the S&P 500 on Monday, showing contrasting behaviour.

Will Crypto Market Catch Up With S&P 500 Gains?

Following President Donald Trump’s announcement of positive developments in the US-China trade talks, the cryptocurrency market witnessed sharp upside on Monday. However, the market today faced some pullback despite a strong upside in US stocks on Monday.

Yesterday, the S&P 500 ended 3.26% up at 5,844.19, reviving hope of greater economic recovery in the market. The Kobeissi Letter stated that the S&P 500 has officially entered a new bull market, closing more than 20% above its April low. The index has gained an impressive 1,000 points over the past month, marking a significant turnaround in market sentiment.

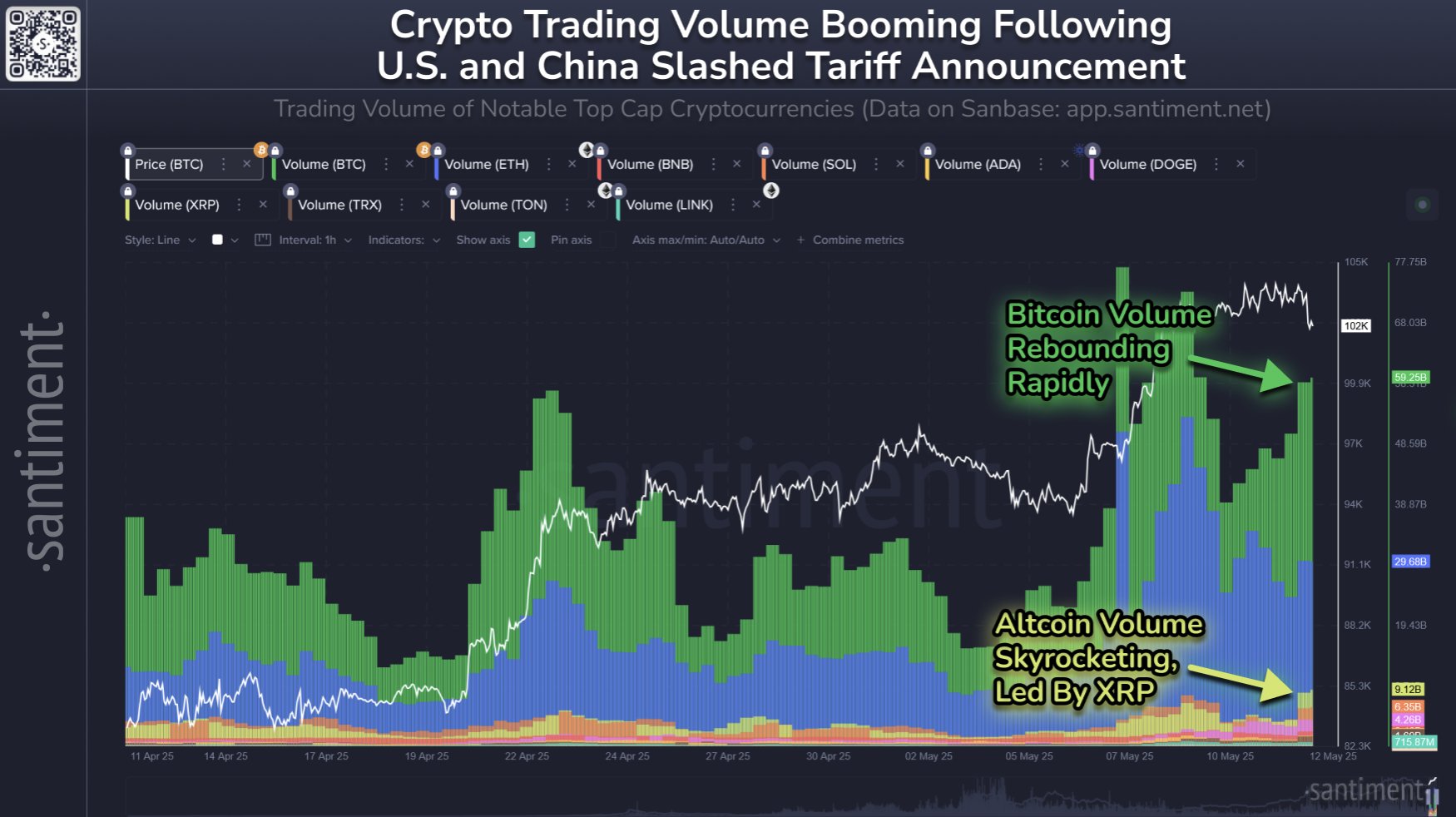

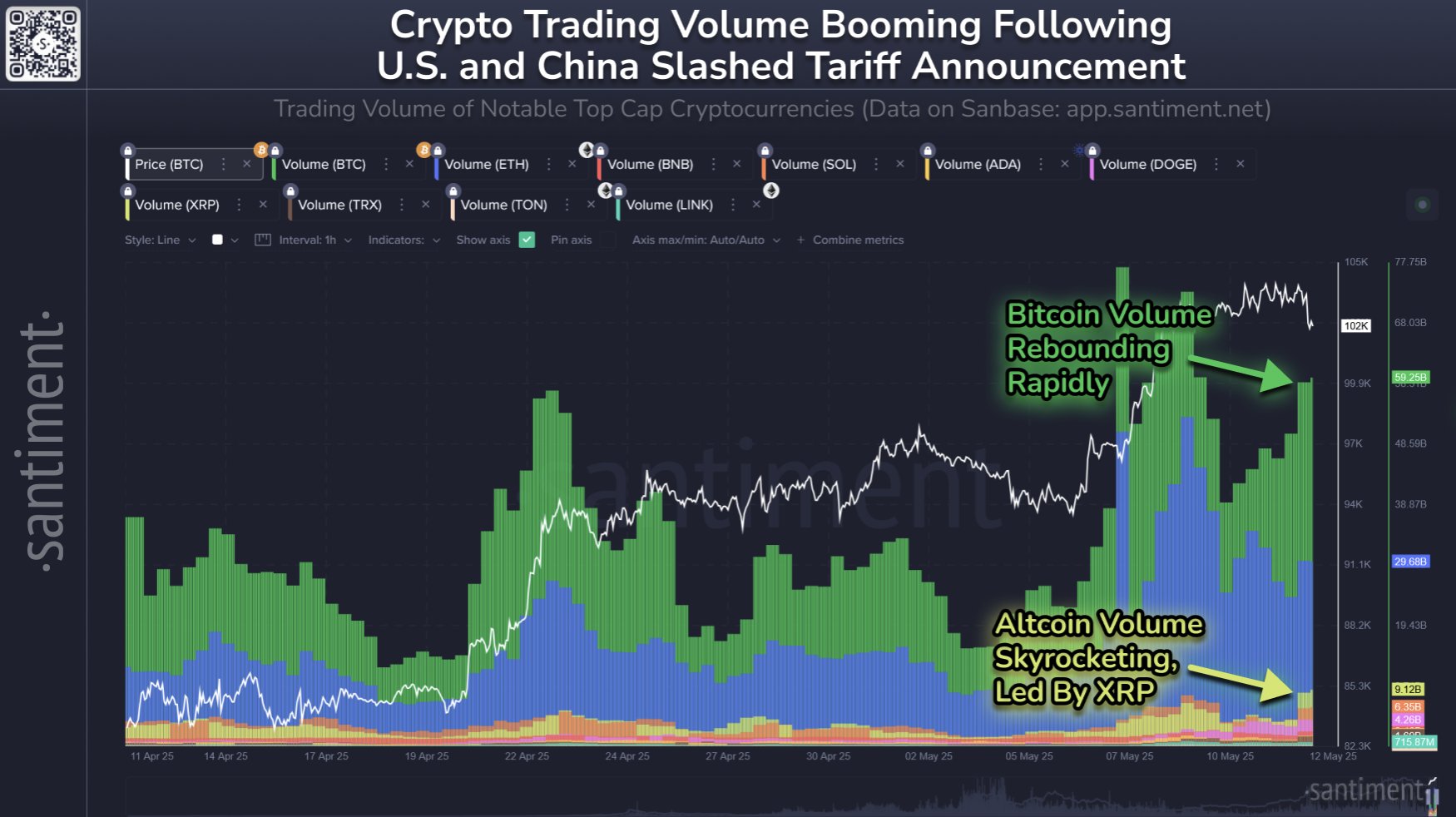

Although the crypto market is lagging to the gains in the US stock indices, analysts remain hopeful for a rally ahead. Blockchain analytics platform noted that the crypto trading volumes have shot up, highlighting strong investor sentiment in the market, amid the US-China trade deal to drop tariffs by 90 days.

Santiment stated that the crypto market could catch up soon to the gains of S&P 500. The blockchain analytics firm noted:

“Prices have been lagging a bit compared to the massive +3.1% S&P 500 reaction to the news. But don’t be surprised if cryptocurrency plays a bit of catch-up with rising volumes and institutional investors planning their next moves”.

Bitcoin and Ethereum Could See Brief Consolidation

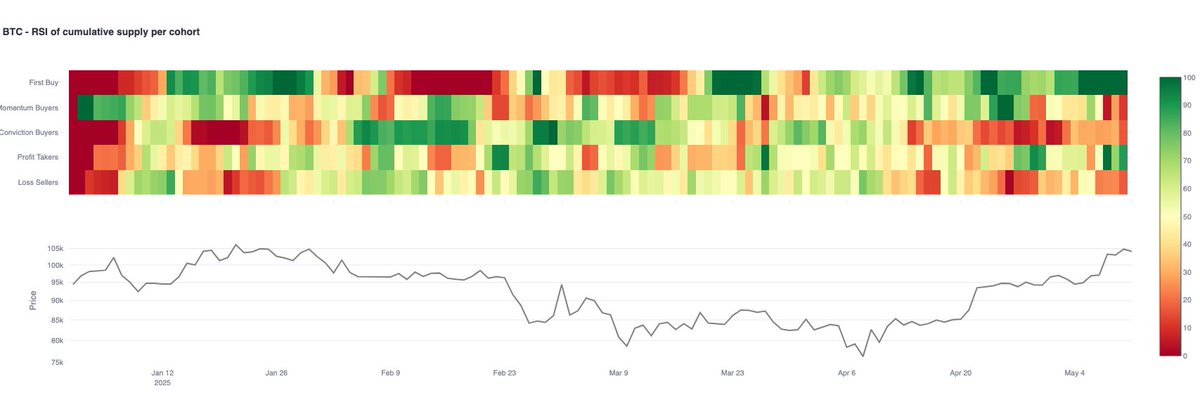

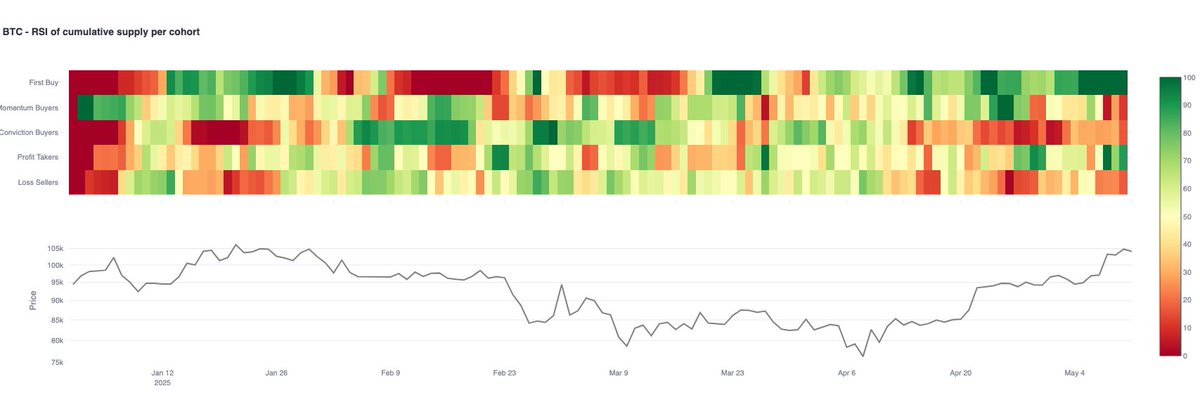

Glassnode’s latest analysis highlights sustained demand for Bitcoin (BTC), with First-Time Buyers’ RSI holding steady at 100 throughout the week. However, Momentum Buyers remain subdued with an RSI of approximately 11, while Profit Takers are on the rise. Analysts caution that if fresh inflows dwindle, Bitcoin could face a period of consolidation. As per the CoinGape report, Bitcoin price risks losing $100K as liquidations in the cryptocurrency market hit $714 million.

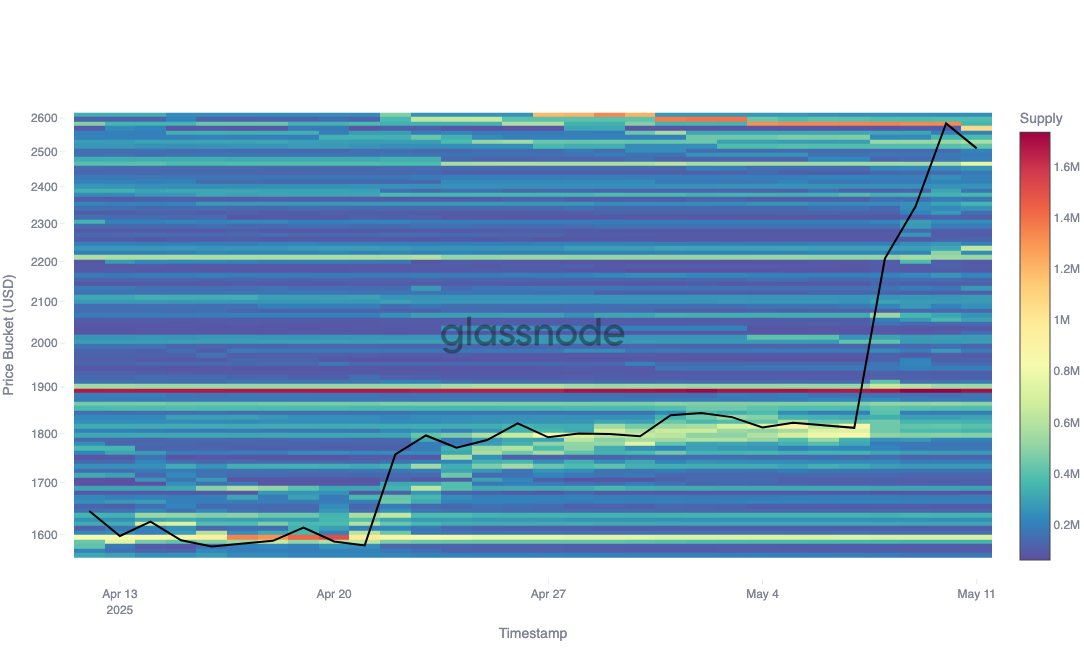

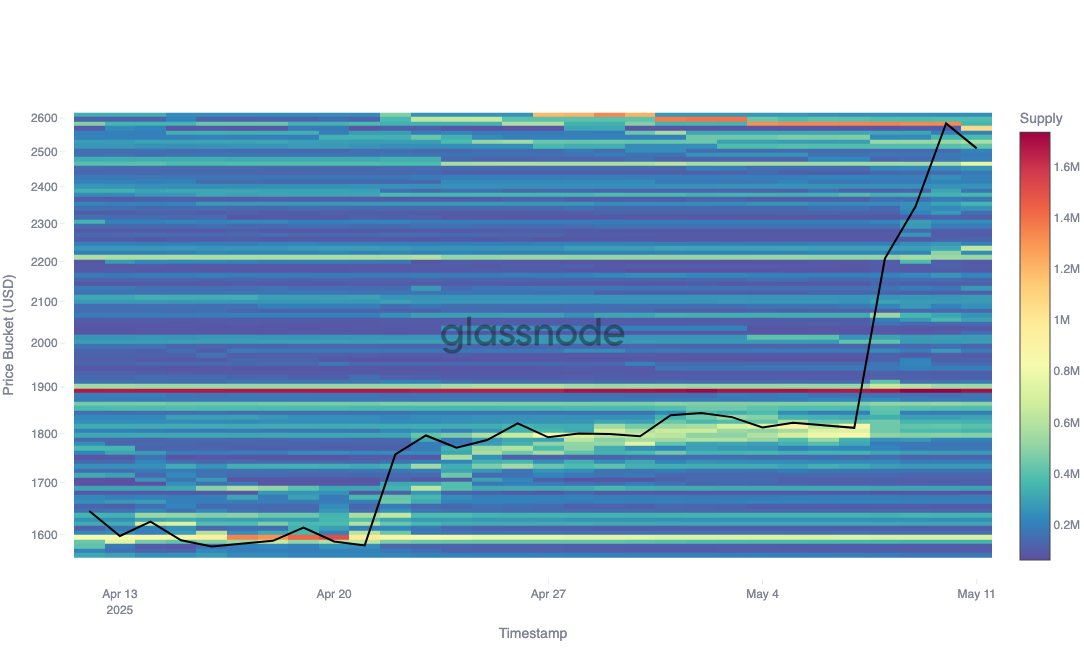

Similarly, the Glassnode report shows that the Ethereum price surge from $1,800 to $2,500 was facilitated by low supply concentration within this range. The rally, however, stalled near $2,580, where 1.3 million ETH was held. This supply has since declined to 1 million, signaling profit-taking as holders exited near their cost basis.

Last week, Wall Street inflows into the crypto market continued as digital asset funds recorded $882 million in inflows last week, marking the fourth consecutive week of positive investments. Year-to-date inflows have now reached $6.7 billion, with Bitcoin leading the charge, contributing $867 million to the total.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: