As the crypto market turmoil continues amid the increasing geopolitical tension, the debate on whether crypto ETF (Solana vs Litecoin) will receive the SEC’s approval continues. The US Securities and Exchange Commission is reviewing nearly 100 ETF filings. Due to constant delays, they have yet to decide on one or more within this year. Who will win? Let’s discuss.

Why Solana vs Litecoin ETF Approval Hype?

Up to now, only two spot crypto ETFs have been launched, Bitcoin and Ethereum, and both are rising with inflows. The impact of this is also visible in their price. So investors wish the same for Solana and Litecoin spot ETF to get the benefits of the asset’s price.

Other than the monetary decision (profits), both are prominent altcoins in the market. The community anticipates their ETF approval to witness a higher adoption rate and demand catering to the network’s developments.

Notably, Ripple token is also in demand, especially after Canada launched 3 Spot XRP ETFs in June. However, the token still lacks regulatory clarity and is stuck in the Ripple vs SEC legal battle, so the focus is on the other two with high approval odds.

Solana, XRP, Litecoin Approval Odds Hit 95%

Crypto ETFs have been in demand for years now, but the hype is at its peak these days. Recently, Bloomberg analysts raised ETF approval odds for these assets to 95% each, stating, “Engagement from the SEC is a very positive sign in our opinion,” hence high approval odds.

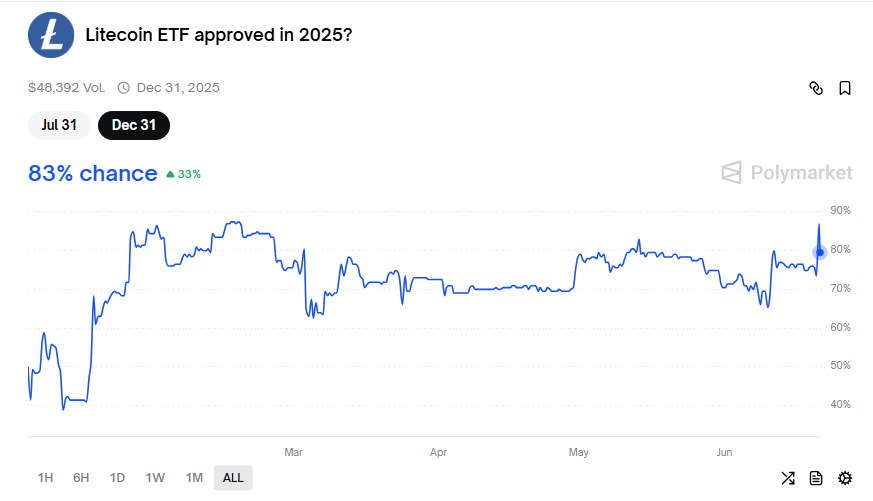

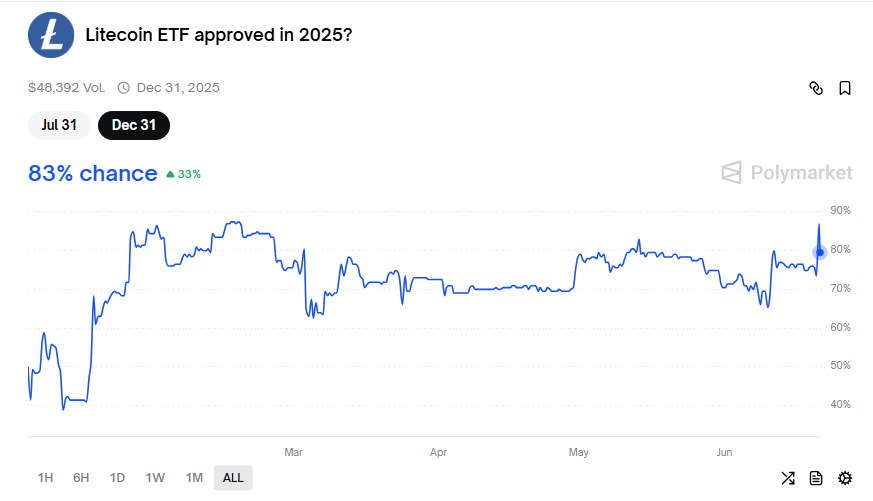

Besides, the social media and community trends also indicate high optimism for the same. Although Bloomberg analysts’ prediction is of high value, Polymarket presents a gap between their demand and supply.

SOL ETF odds have maintained 90%+ mark for days, but Litecoin began gaining traction yesterday after a Bloomberg analyst’s comment. Litecoin ETF approval odds are at 83%, lower than those of its competitors. Besides, its market demand and adoption also lack at some level.

Which Crypto ETF Will Be Approved Next – Solana or Litecoin?

Since Gary Gensler’s resignation, the SEC’s activity signals a more favorable regulatory climate for the crypto industry. This includes approving more crypto exchange-traded funds this year, especially as the Solana and Litecoin ETF odds are skyrocketing.

The Solana proposal includes a staking proposal, which is a structural shift. Some even anticipate SOL ETF approval with staking features. The important metric in the Solana vs Litecoin ETF comparison is the trust’s performance.

Grayscale Solana Trust has small exposure as it only carries 0.1% of the supply. It has no discount history, which explains the low market disruption. On the other hand, Litecoin trust holds 2.65% of the supply and trades at a discount. It points to a higher risk of selling pressure post-ETF launch.

This could shape the SEC’s decision to approve. Additionally, SOL has more filings compared to the LTC, so the chances play in Solana’s favor. Not to forget, their regulatory clarity and market demand would also play a critical role.

What use is there for a Litecoin ETF if the volume in minimal on the ETF and it is surrounding a $6b market cap coin. I’d have a little more enthusiasm if the coin was worth $100b+

— Panda (@DragonWarriiorr) May 4, 2025

Considering these factors, both have significant chances of approval in 2025. However, there’s high uncertainty about who will be first. Investors must await the SEC’s decision, as it is more about their decision than the odds.

Frequently Asked Questions (FAQs)

The Bloomberg analysts’ approval odds are at 95%, whereas the Polymarket odds are 83% for Litecoin and 91% for Solana.

Solana has high ETF filings, strong community, market demand, and even an ETF proposal with staking, which gives it an edge.

Both the assets have their individual features and characters and the same is true for the ETFs, so which is better depends on user demand.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: