Crypto traders are notoriously quick to adapt — especially when the ground starts shifting under them. With increased regulatory scrutiny in the West and mounting pressure on centralized exchanges, most assumed that crypto trading activity in 2025 would either slow down or consolidate under the most compliant, mainstream platforms.

But the reality tells a different story.

If you’re expecting North America or Europe to be the epicenter of global crypto engagement this year, you may be looking in the wrong direction.

The Traditional Powerhouses Are Losing Momentum

The U.S. and EU have historically dominated crypto adoption and trading volume. But with tightening KYC policies, regulatory ambiguity, and lawsuits against major platforms, many traders — particularly those engaging with margin or derivatives — are feeling the squeeze.

Even the public narrative has shifted. Following scandals like FTX and Terra Luna, many headlines asked whether crypto was dead. Bitcoin dipped below key psychological levels, and altcoins collapsed by more than 90%. But as a recent industry outlet noted, “Crypto isn’t dead; it’s just not making a lot of noise.”

Instead of fading, the industry is evolving. Traders are moving, quietly — and in large numbers — to platforms that better match the new reality.

Asia-Pacific Takes the Lead — Quietly but Rapidly

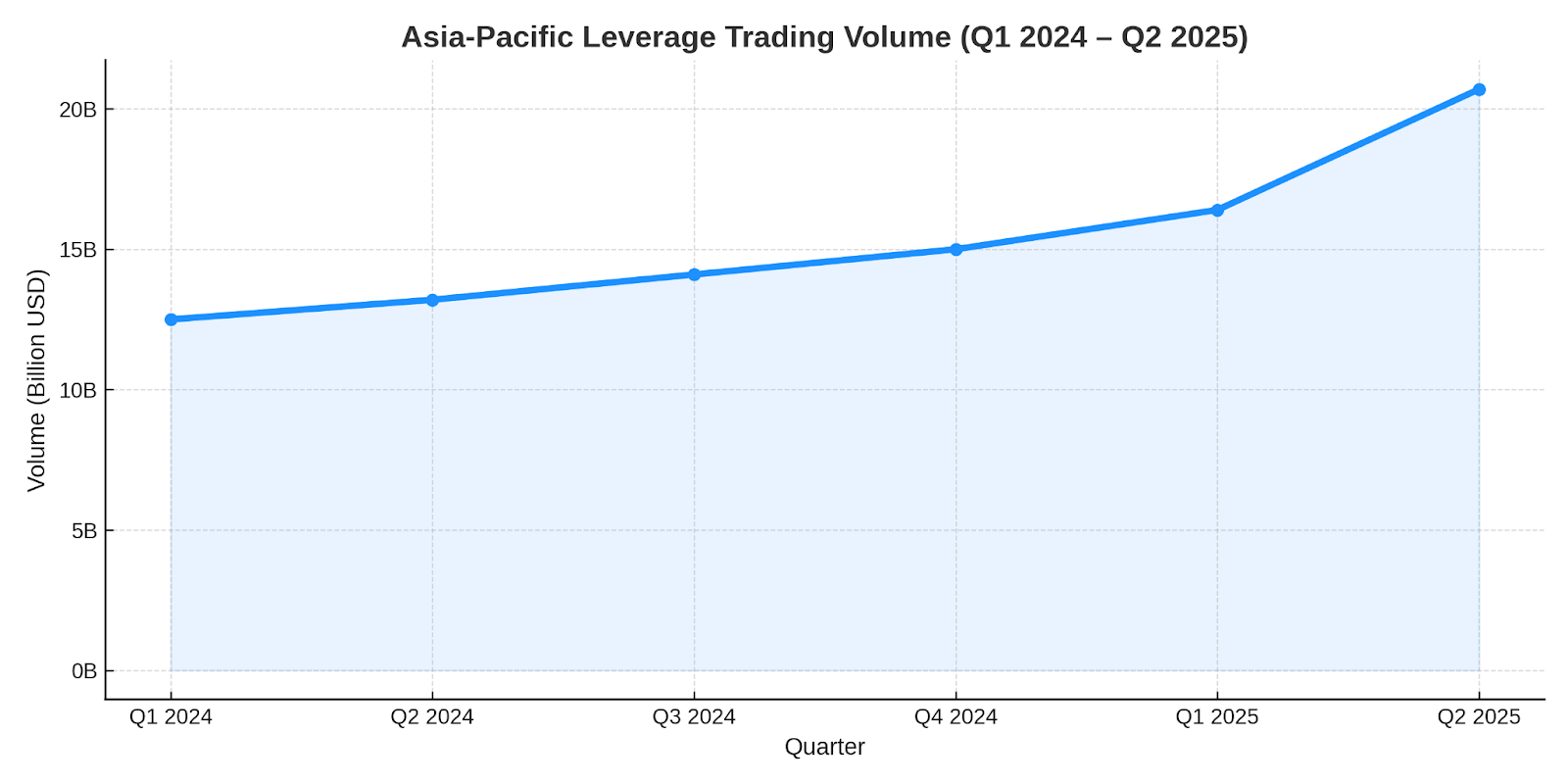

The Asia-Pacific region quietly became a hub for leverage-heavy trading in 2025. Based on behavioral signals and traffic flows tracked by Leverage.Trading, demand for crypto leverage trading platforms in APAC grew sharply over the past year, highlighting shifting regional dynamics. Traders there increasingly preferred platforms offering flexible margin settings and aggressive leverage tiers — a shift that underscores how trading preferences vary dramatically across geographies.

This trend coincides with the maturing of the global crypto user base. According to recent insights, the current investor profile has changed — people are no longer chasing hype-driven coins. They’re looking for platforms and assets that offer structure, predictability, and purposeful features. In APAC, that means fast onboarding, adjustable leverage, and minimal KYC for qualified users — all wrapped in mobile-first experiences.

Why APAC Traders Are Choosing High-Leverage Platforms

There are several reasons this region is gaining dominance:

- Mobile-first culture: Traders in APAC tend to manage their entire trading journey from mobile — a major shift that heavily favors mobile-optimized platforms.

- Higher risk tolerance: Cultural and generational dynamics in APAC normalize high-frequency speculation, and many traders have prior exposure to traditional leverage products in forex or commodities.

- Regulatory gray zones: Some local governments remain neutral, allowing innovation to flourish without immediate suppression.

- Strategic mindset shifts: Traders aren’t just chasing volatility. They’re seeking features — like isolated margin — that let them manage risk more precisely.

This aligns with a broader trend: serious traders are adopting smarter tools, while the era of “hype coins” quietly fades away. As that same industry outlet put it, “People want projects that have a purpose, good teams, and goals.” That same logic is driving platform selection.

The Tools and Features That Matter Most in 2025

Today’s crypto trader cares more about execution than emotion. They want:

- Customizable leverage settings

- Fast deposits without excessive onboarding friction

- Transparent fees and funding rates

- Responsiveness across devices

At the same time, they’re leaning into tools that help them trade with intent — from position size calculators to comparison pages that evaluate margin modes, contract types, and platform-specific risks. These tools are no longer optional — they’re becoming foundational to smarter decision-making.

How Global Traders Are Responding to Regional Trends

What happens in Asia-Pacific doesn’t stay there. Traders from the U.S., UK, and Europe are watching closely — and many are adapting.

With rising interest in projects that offer real utility, even Western traders are expanding beyond “safe names” like Coinbase. The growing demand for platforms that support cross-margin, derivatives contracts, and isolated risk control — often found on APAC-native exchanges — is bleeding across borders.

Market sentiment is shifting, too. As reported recently, search trends like “crypto with use case” and “blockchain in healthcare” are rising, while interest in meme coins and hype tokens fades. Even when traders seek offshore exchanges, they want ones that support long-term use cases — not just short-term speculation.

The Future of Crypto Trading Might Not Be Where You’re Looking

Crypto isn’t dead — it’s becoming selective.

While the hype cycle may be over, innovation isn’t. Across the Asia-Pacific region, traders are quietly setting new norms, platforms are evolving faster, and trading behavior is becoming more methodical. Meanwhile, Western markets face friction that many traders no longer have the patience for.

The result? A silent but significant global migration.

If 2021–2023 was defined by viral coins and celebrity tweets, 2025 is about tools, trust, and tactical execution. And increasingly, that future is being shaped far from Silicon Valley or London.

So the next time you wonder where crypto is headed, don’t just ask which tokens are pumping. Ask who’s trading, where they’re trading, and how those platforms are shaping strategy.

Because chances are, the real action isn’t where you thought it would be.