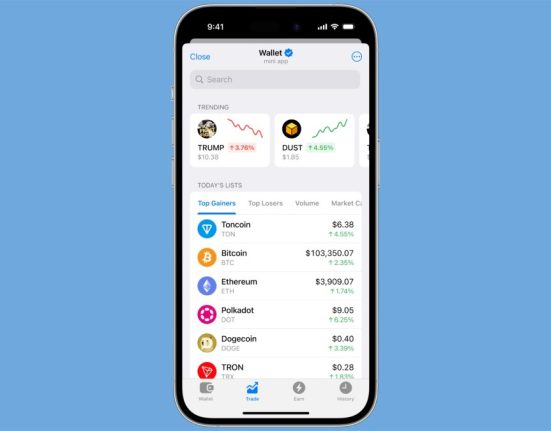

Bitcoin is down slightly, many altcoins have seen major losses and the largest cryptocurrency continues to face rejections at the $70k level. While Bitcoin and Ethereum experienced losses of 5-7%, many altcoins bled double digits. BNB, Solana, and Dogecoin saw losses ranging from 12-15%. Shiba Inu, Avalanche, Polkadot, Chainlink and NEAR Protocol also suffered double digit losses.

The Consumer Price Index (CPI) report is coming out, which historically influences crypto markets. Anticipation of this report may be causing some market hesitation. The Federal Open Market Committee (FOMC) meeting is also taking place, with a summary of economic projections being discussed.

Although no rate changes will be announced, this meeting still impacts market sentiment. Officials are expected to keep interest rates steady regardless. However, the new inflation figures might influence their predictions on the number of rate cuts for the year, as policymakers can revise their forecasts based on this data.

Despite the downturn, institutions and companies are still interested in crypto, influenced by the success of Bitcoin spot ETFs. This interest extends to all major cryptocurrencies, including Ethereum and other blue chips.

What to expect from Bitcoin price?

When discussing Bitcoin’s price, analyst Crypto Rus noted that before Bitcoin surged from $1,000 to $20,000 in 2017, there was a period of choppiness and consolidation, similar to the current 15-week period. He suggested that once a breakout occurs, significant upward movement could follow, potentially reaching $300,000 to $400,000.

He said that despite ETH recently dropping from $3,900 to $3,500, it is forming a bull flag. With Ethereum ETFs on the horizon, significant investment is expected, which could drive ETH prices higher. The influx of liquidity will benefit not just ETH but the entire market.