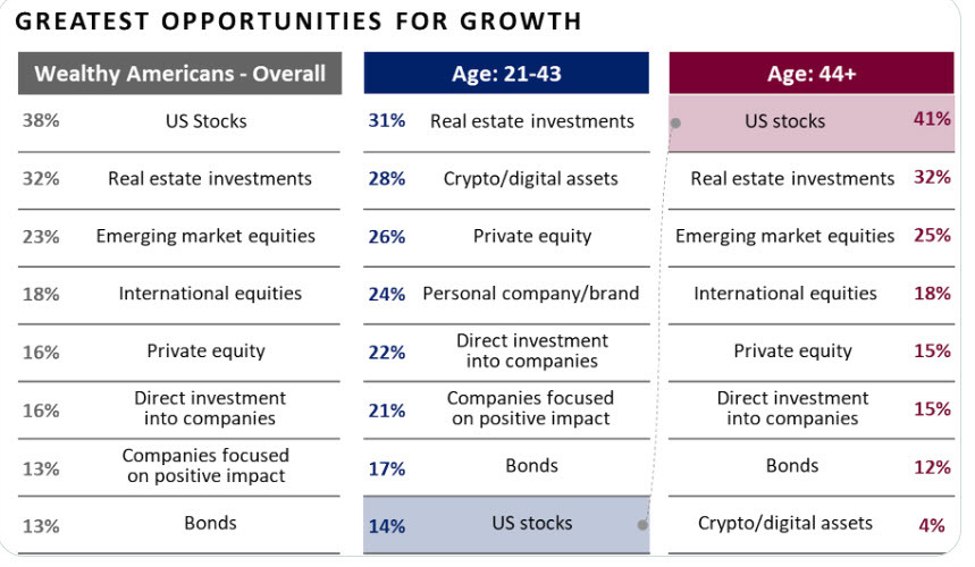

Bank of America is out with a survey of wealthy investors but they divided them into two cohorts: Ages 21-43 and age 44+. The results are shockingly different.

Young investors see real estate and crypto as top opportunities, while U.S. stocks rank lowest. A striking 72% of them believe it’s impossible to achieve above-average returns in traditional stocks and bonds.

I’m not surprised about the divergence in crypto as it as largely young people that profited from the boom, or at least know someone who did. But that’s an incredible divergence in stocks, which you could say are hated.

It only gets wilder from there as young people show high interest in collectibles, which have historically been an awful investment. Antiques are particularly shocking as I don’t know too many young people who have any interest in antiques.

There is very high interest among all

wealthy Americans in building a collection of art, which has been in a bull market for many years. This

is especially true among younger people, with 83%

indicating that they currently own art or would like to.

Finally, young people are more-bullish on the US and global economies despite having similar views on their own personal security. I wonder if that’s just a typical generational rift, due to older people watching Fox News or something else. In any case, a bit of optimism never hurt.

Overall, the report highlights how $84 trillion is expected to pass to younger generations by 2045, That could fuel the bull market in crypto and perhaps in collectibles, or young people could see their investment preferences shift.

Here is the full report.

h/t @kylascan