New details about the Bullish IPO have emerged, with the Peter Thiel-backed crypto exchange revealing how many common shares it intends to sell as part of its public offering. The exchange also revealed its projected IPO price, which indicates that it plans to raise up to $629 million at a $4.2 billion valuation.

Bullish IPO Price And Number of Available Shares

In an SEC filing, the crypto exchange revealed that it is offering a total of 20.3 million ordinary shares, with a nominal value of $0.02 per share. The company anticipates that the initial public offering price would be between $28 and $31 per ordinary share. This amounts to up to $629 million in gross proceeds at an IPO price of $31.

Meanwhile, in line with an earlier CoinGape report, the crypto exchange has applied to list its ordinary shares on the New York Stock Exchange (NYSE). The exchange will trade under the ticker “BLSH” following the Bullish IPO.

Furthermore, the latest filing revealed that certain funds managed by BlackRock and Ark Invest’s subsidiaries and their affiliated entities have indicated an interest in the IPO. These funds are interested in purchasing up to $200 million worth of the ordinary shares available.

However, there is no agreement in place, and the underwriters could determine to sell more, fewer, or no shares to these potential purchasers. J.P. Morgan, Jefferies, and Citigroup are the lead underwriters for this Bullish IPO.

Plans For Proceeds Of The IPO

The crypto exchange revealed in the SEC filing that it intends to convert a significant portion of the net proceeds from the IPO into U.S.-dollar-denominated stablecoins. The company plans to use the proceeds for general corporate and working capital purposes, including funding potential future acquisitions.

The Bullish IPO filing alluded to how the passage of the GENIUS Act and a regulatory-friendly environment under the Trump administration could help boost the exchange’s business in the U.S. The company expects to expand its liquidity services to stablecoin and crypto issuers following the listing.

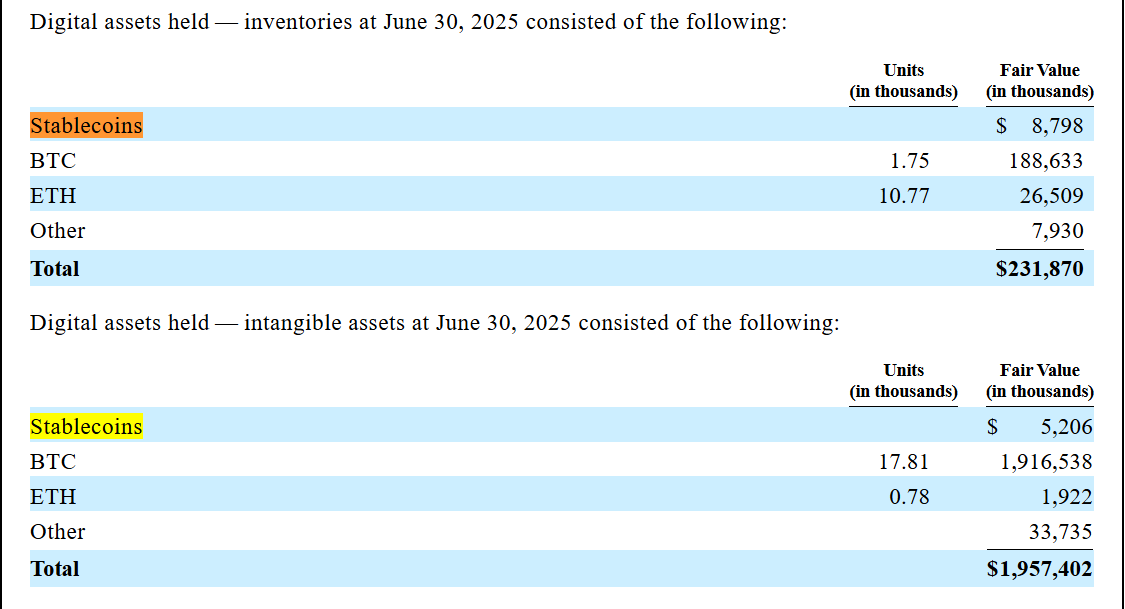

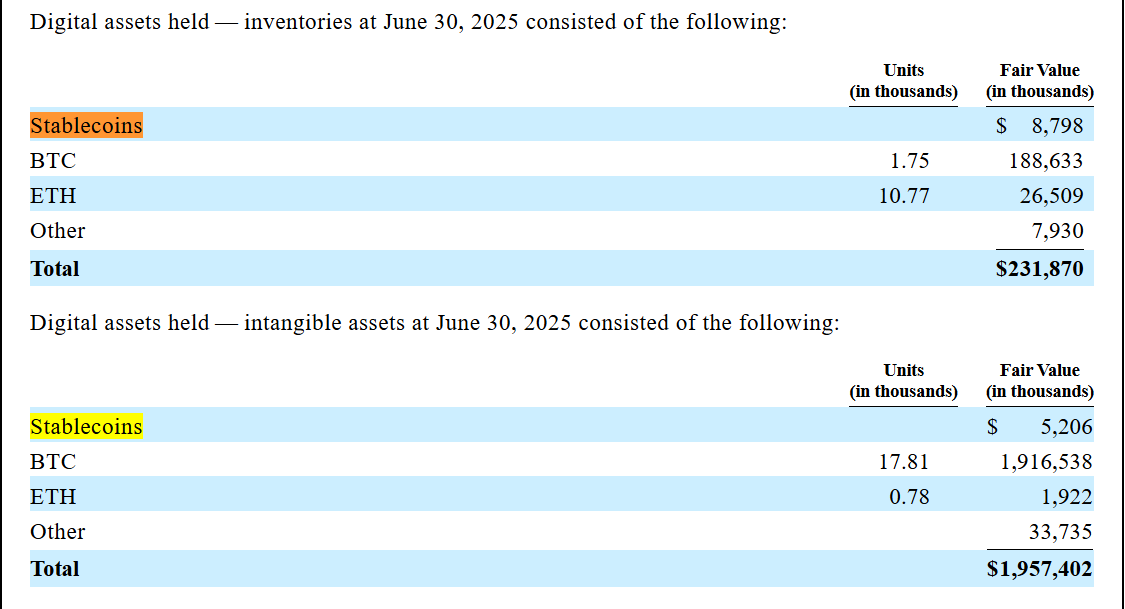

Meanwhile, Bullish also revealed its crypto holdings as of June 30, 2025. As part of its inventories, the crypto exchange holds stablecoins, Bitcoin, and Ethereum worth $231,870. Its intangible assets also include stablecoins, BTC, and ETH worth just over $1.9 million.

It is worth mentioning that, besides the Bullish IPO, other crypto firms such as fellow crypto exchanges Kraken and Gemini are also looking to go public in the U.S. Grayscale and crypto custodian BitGo have also filed for a U.S. IPO.

These firms are looking to enjoy a similar success that stablecoin issuer Circle recorded when it went public in June earlier this year. The stablecoin issuer raised $1.05 billion from its public offering and saw its CRCL stock record a gain of around 167% on the first day of trading. The stock went on to reach an all-time high (ATH) of almost $300 from its IPO price of $31.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: