03/19 update below. This post was originally published on March 18

Bitcoin has been stuck in holding pattern in recent weeks, struggling to regain momentum after “panic selling” raised fears of a major bitcoin price crash.

The bitcoin price has dropped from its all-time high of almost $110,000 per bitcoin, plummeting to around $80,000 despite a leak revealing Russia is quietly leaning into bitcoin and crypto.

Now, as traders speculate Donald Trump’s White House could be gearing up to buy as much bitcoin as possible, closely-watched crypto trader Arthur Hayes has predicted the Federal Reserve is about to step in to stabilize markets, potentially triggering a bitcoin price boom.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

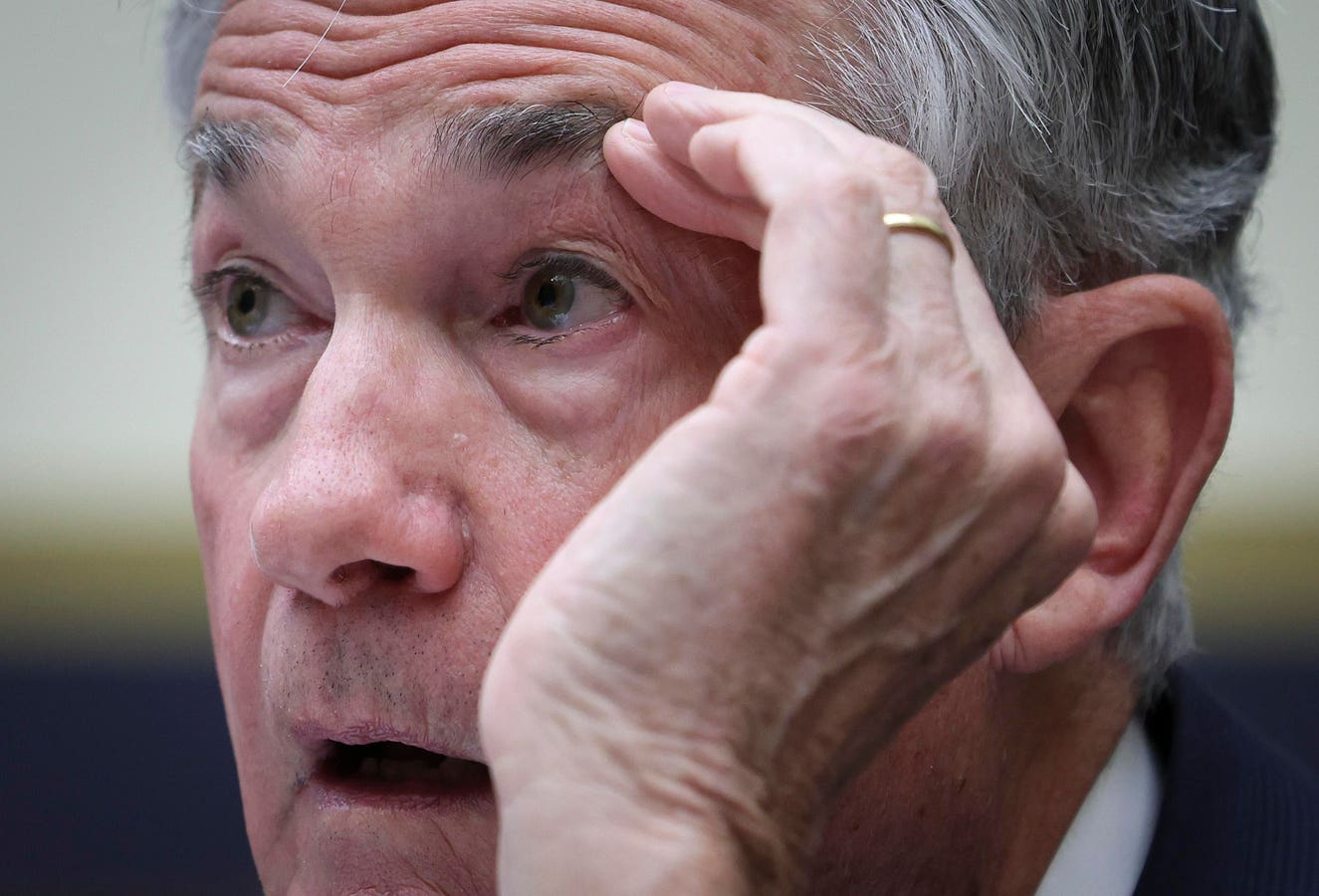

Federal Reserve chair Jerome Powell could step in to support markets, including the bitcoin price … [+]

“When there’s financial distress, they always print money. It doesn’t matter the political leanings,” Hayes, the cofounder of crypto deivatives pioneer BitMex who went onto launch the Maelstrom investment company, said in a wide-ranging interview with Bitcoin News.

The bitcoin price and wider crypto market has followed stock markets lower in recent weeks as traders react to U.S. president Donald Trump’s on again-off again international trade tariffs and the rising risk of recession.

03/19 update: Federal Reserve chair Jerome Powell is “between a rock and a hard place,” Wells Fargo’s chief economist has told the Wall Street Journal, with the Fed likely to hold rates steady today as it grapples with the prospect of Donald Trump’s trade war fueling an inflation bump but also dampening economic growth.

Traders are whispering that Powell could announce an end to the Fed’s balance sheet runoff program, known as quantitative tightening, which could boost the bitcoin price, crypto and stock markets.

“Our rates strategists expect the statement to indicate that the Fed is pausing quantitative tightening until the debt ceiling is resolved, as suggested in the January meeting minutes,” Bank of America analysts wrote in a note seen by Coindesk. “They do not expect to restart after the debt ceiling is addressed, but the announcement won’t be made until later this year.”

The Fed will announce its interest rate decision at 2pm ET, followed by Powell’s 2:30pm ET press conference.

“Late last year, Fed chair Powell hinted that the end of [quantitative tightening] was coming in 2025. If he mentions it in [today’s statement or press conference (I imagine someone will ask him), that would end up signalling that we’re in a new monetary regime, and that the Fed stands ready to resume additional debt purchases should [quantitative easing] become necessary again,” Noelle Acheson, editor of the Crypto Is Macro Now newsletter, wrote in an emailed note.

“While renewed [quantitative easing] is unlikely any time soon, the additional liquidity from a large buyer (the Fed) coming back into the market to replace maturing holdings would be good news,” Acheson wrote, adding the Treasury market is facing $9 trillion in debt maturity this year that quantitative tightening could disrupt.

“When the floodgates open, it’s go time,” Hayes said, referring to the return of liquidity to the market, and predicting “they’re going to reflate and print more money than anyone’s ever printed before.”

The last bitcoin price boom that saw the bitcoin price climb to around $70,000 in late 2021 came in the aftermath of huge Covid-era government stimulus spending and money-printing.

“We are experiencing a low in liquidity fiat money generation,” Hayes said.

Hayes has predicted the bitcoin price will reach $250,000 by the end of the year as the Fed is forced to flip dovish and move to prop up the economy and asset prices.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has dropped back from its recent highs of around $110,000 per bitcoin, dragging … [+]

“All eyes are on the Federal Reserve policy meeting this week,” BlackRock analysts wrote in a note.

The Federal Reserve today begins its two-day policy meeting, with the Fed’s latest interest rate decision due tomorrow—expected to see interest rates left unchanged despite president Trump’s campaign to see them brought down.

Traders are pricing in two or three rate cuts later this year but that could change with Fed chair Jerome Powell’s all-important, post-decision press conference.