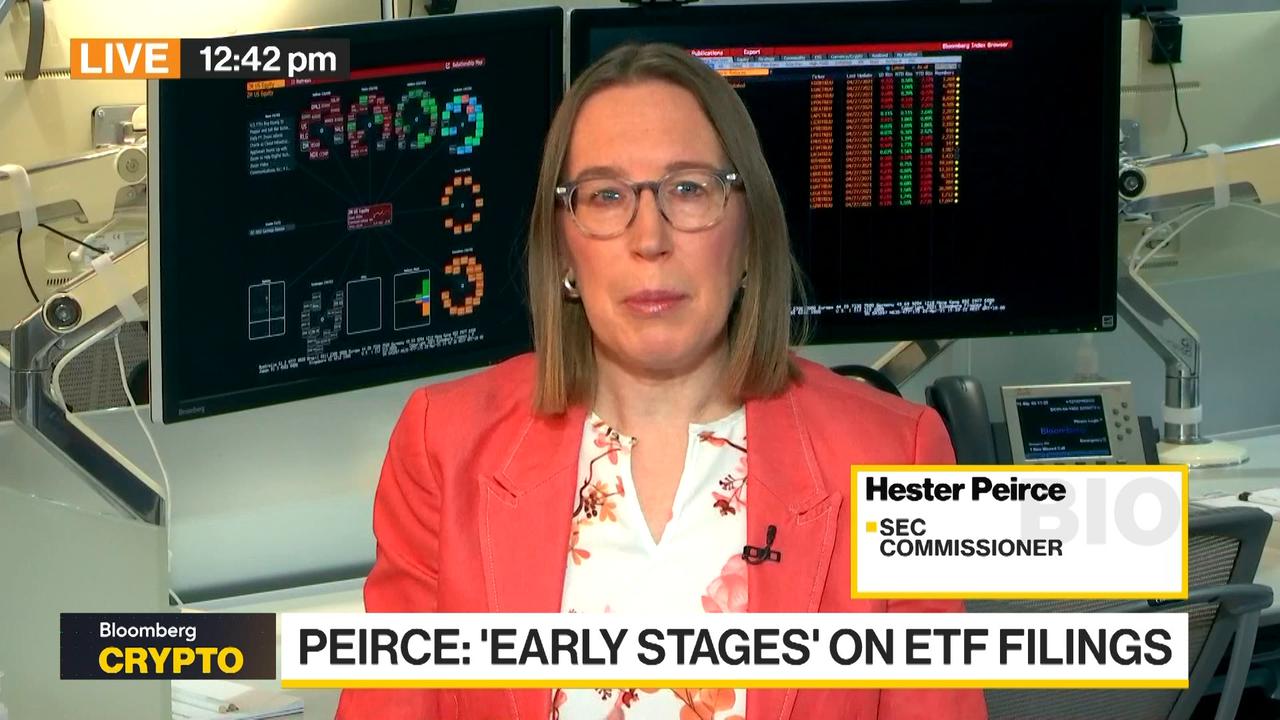

Most meme coins not under SEC jurisdiction: Peirce

Head of the SEC Crypto Task Force and SEC Commissioner Hester Peirce gives her take on meme coins and says the SEC will look at the facts and circumstances, but says most meme coins probably don’t have a home in the current set of regulations.

Bloomberg

Digital assets transactions from Bitcoin, XRP, other cryptocurrencies and non-fungible tokens (NFTs) must be reported on taxpayer’s tax returns. The Internal Revenue Service says that income from digital assets like Bitcoin and other tokens is taxable.

Millions of Americans use cryptocurrency. About 17% of U.S. adults say they have ever invested in, traded or used a cryptocurrency, according to 2024 findings from the Pew Research Center.

As tax season nears its end, here’s what to know about reporting report crypto such as Bitcoin to the IRS.

You may have to report cryptocurrency and NFTs on your tax return

The IRS says that individuals who sold crypto, received it as payment, or had other digital asset transactions must accurately report it on their tax return.

This includes convertible virtual currency and cryptocurrency, stablecoins, and non-fungible tokens (NFTs). For tax purposes, the agency treats digital assets as property, not currency.

All taxpayers must answer this digital assets question on your tax return

The “Yes” or “No” digital assets question listed on federal income tax returns must be answered correctly:

“At any time during the tax year, did you: (a) receive (as a reward, award or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

According to an IRS, you answer “yes” if you received digital assets (crypto, Bitcoin, NFTs) as payment for property or services, from a reward or award, from mining, staking and similar activities, and more criteria.

If you’re unsure how to respond to the digital assets question, the IRS provides a questionnaire to help determine how to answer it. Generally, if you had any digital asset transactions, you check “yes,” but if not, you check “no.”

Which federal forms have the digital asset question?

Everyone who files must answer the digital asset question that appears at the top of these forms:

How to report digital asset income

Taxpayers must report all income related to their digital asset transactions, the IRS notes, regardless of whether they result in a taxable gain or loss. Here’s what the agency recommends when reporting crypto and other digital asset transactions.

- Keep records and documentation of any purchases, receipts, sales and exchanges, among other things.

- Calculate the gain or loss of a digital asset and its transaction.

- Determine the basis of a digital asset (typically the cost in U.S. dollars).

- Report it on the correct form, which depends on the type of transaction.

When is the tax filing deadline?

The general deadline to file a federal return with the IRS is just days away, on April 15, 2025. For state taxes, the deadline in Ohio is also April 15, with an extension filing deadline of October 15, 2025.