WASHINGTON — A vote to advance a major crypto regulation bill in the Senate failed Thursday, with Democrats uniting to block the measure after bipartisan negotiations stalled.

The vote on the GENIUS Act — which would create the first U.S. regulatory framework for issuers of stablecoins, or digital tokens pegged to currencies like the dollar — was 48-49. Sens. Josh Hawley, R-Mo., and Rand Paul, R-Ky., joined all Democrats present in opposing the procedural vote. Senate Majority Leader John Thune, R-S.D., also voted “no” so he could more easily bring the bill back to the floor at a later date.

The legislation needed 60 votes to advance to final passage in the Senate, where Republicans hold a 53-47 majority.

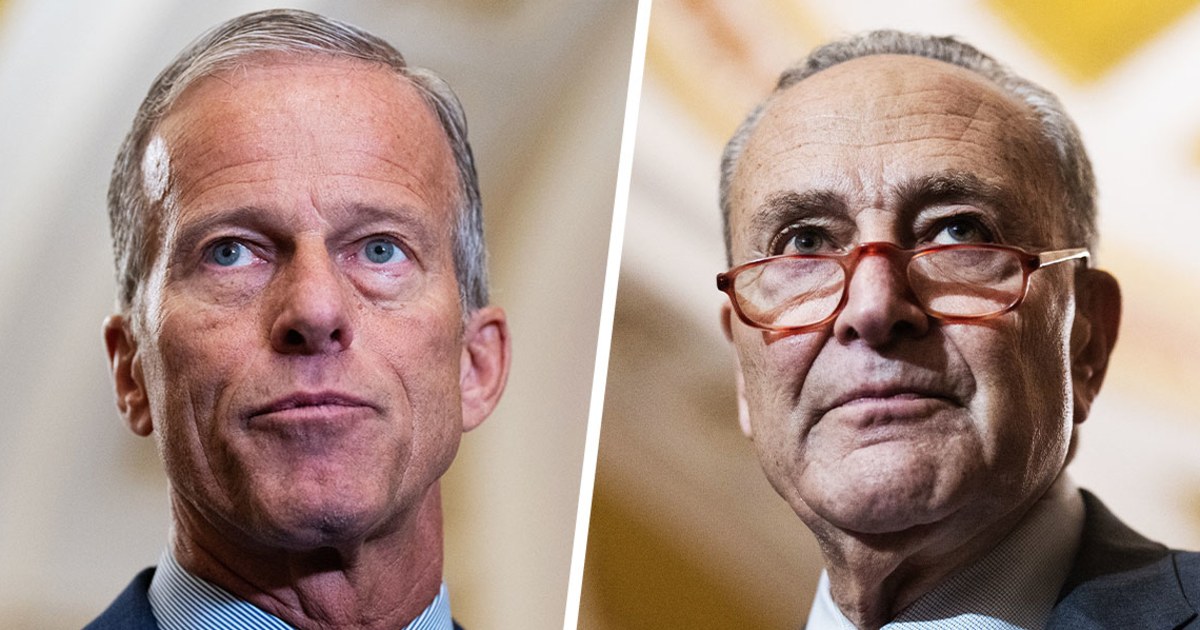

The Senate Banking Committee had passed the GENIUS Act in April with the support of five Democrats. But after Thune said the chamber would swiftly take the measure up, Senate Minority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., the ranking member on the Banking Committee, privately urged Democrats to withhold their vote to extract more concessions from Republicans, according to three people with direct knowledge of their comments.

Democrats were seeking explicit provisions barring members of the executive branch, including President Donald Trump and his family, from owning or trading cryptocurrency and stronger anti-corruption provisions.

Before the vote, Senator Ruben Gallego, D-Ariz., who had been involved in the ongoing negotiations around the legislation, asked for unanimous consent to delay the vote to Monday and skip one of the procedural steps to keep the Senate on track to pass the bill next week.

Warren rejected the request after saying earlier Thursday that she would not vote to advance the bill without receiving updated legislative text that reflects the progress of recent negotiations.

Asked what language needs to be finalized in negotiations, Gallego said that a key Democrat demand, adding a provision to prohibit elected officials from issuing stablecoins, was nixed in negotiations.

“A lot of us had recognized that it made it very difficult for Republicans. … There were questions about the constitutionality of it,” Gallego said of the provision.

Changes were made to the legislation at the request of Democrats after it was reported out of committee, including preserving state regulatory authority for foreign-issued stablecoins and broadening suspicious transaction monitoring and reporting for stablecoin users, according to two people familiar with the process.

After the vote, Thune said there would have been opportunities for Democrats to amend the bill if they had allowed the process to move to the next step on the Senate floor.

“If Democrats were interested in further changes, as they claim, they would have had the chance to make those changes on the floor, all they had to do was vote for cloture,” Thune said. “Not every bill that comes to the floor is a final bill.”

On the Republican side, Hawley had said that without a provison prohibiting tech companies from owning stablecoins, he’s not comfortable supporting the bill.

And Paul said he opposed the legislation due to fears of over-regulation.

“I’m not a real big fan of federal regulations period, much less starting a whole new scheme for a whole new industry that exists and seems to be doing OK without federal regulations.” Paul told reporters Tuesday.

Bipartisan negotiations fail to yield an agreement

Hours of negotiations between a bipartisan group of crypto-focused senators took place this week, starting Wednesday in the office of Banking Committee Chair Tim Scott, R-S.C. The list of attendees included Sens. Bill Hagerty, R-Tenn.; Cynthia Lummis, R-Wyo.; Mark Warner, D-Va.; Kirsten Gillibrand, D-N.Y.; Angela Alsobrooks, D-Md and Gallego, according to three sources familiar with the meeting.

Hagerty led negotiations with the Democrats who voted for the legislation in committee but later backtracked on their support. In a statement, those Democrats cited “numerous issues that must be addressed, including adding stronger provisions on anti-money laundering, foreign issuers, national security, preserving the safety and soundness of our financial system, and accountability for those who don’t meet the act’s requirements.”

The shift in Democratic support comes after an Abu-Dhabi backed investment firm announced last month that it will invest billions of dollars in the Trump family crypto venture, World Liberty Financial. The news of the investment sparked backlash from Senate Democrats, who argued that it is “evidence” that the president is using his office to enrich himself. And it comes after Trump held a $1.5 million-per-plate fundraiser on Monday focused on high-profile crypto investors and tech entrepreneurs.

“The opportunities for grift — in which the Trump Administration offers favors to the UAE or to Binance in exchange for their massive payouts — are mind-boggling,” Sens. Warren and Jeff Merkley, D-Ore., wrote in a Monday letter to Jamieson Greer, the acting director of the Office of Government Ethics. (Binance is a cryptocurrentcy exchange.)

Warren and Gillibrand signed on to legislation from Merkley that would ban presidents, lawmakers and their families from financially benefiting, issuing, endorsing or sponsoring crypto assets, including stablecoins. The End Crypto Corruption Act directly targets Trump and his family’s crypto ventures, including nontraditional cryptocurrency endeavors like Trump’s dinner and private White House tour for the top investors in his meme coin, $TRUMP.

Sen. Chris Murphy, D-Conn., has joined the chorus of Democrats calling for legislation that specifically targets meme coins like $TRUMP, introducing his own broader proposal, along with Rep. Sam Liccardo, D-Calif., to crack down federal officials from using their position to profit off digital assets.

The counter-messaging effort from Senate Democrats would likely fail in the GOP-controlled Senate. But Sen. John Kennedy, R-La., said he would be in favor of barring “all public officials” from using their positions to profit off of cryptocurrency.

The GENIUS Act does not touch meme coins, a different type of cryptocurrency that derives its value from internet culture rather than from an underlying utility or asset. But proponents of the legislation argue that the bill does have protections against money laundering and fraud.

Republicans, meanwhile, heard from tech entrepreneur David Sacks for more than an hour Wednesday, according to multiple senators who attended the briefing.

“Well, we had a good conversation yesterday,” said Sen. Rick Scott, R-Fla., who supports the legislation. “Everybody needs to understand, trading bitcoin is totally different than stablecoin.” (Bitcoin is not pegged to fiat currency, like the U.S. dollar.)

Asked if most members of Congress understand what different digital assets are and how they are used, Sen. Jon Husted, R-Ohio, chuckled.

“That’s a great question. I can’t speak for other people. I know I’ve had to spend a lot of time on it myself to really understand the issue,” he said. “There is no regulatory regime around this right now. It is the Wild Wild West, and we want to start to recognize that we need some security around this.”