Join Our Telegram channel to stay up to date on breaking news coverage

Spotting high-return opportunities in a dynamic crypto market often requires looking beyond overbought assets and turning to emerging or underappreciated tokens with strong fundamentals. While meme coins can offer speculative gains, many investors now focus on assets with real use cases, active development, and institutional interest.

This analysis reviews Pi, Convex Finance, Just, and Pax Gold, which have displayed upward momentum over the past day and week, driven by ecosystem growth, whale activity, and macro alignment. Each token offers distinct strengths, giving each of them the potential to be the next cryptocurrency to explode.

Next Cryptocurrency to Explode

Attention is also shifting toward new projects in presale stages with strong potential. One such token is Best Wallet Token (BEST), which aims to provide secure, user-focused wallet solutions with integrated staking features. With investor interest building and the presale gaining traction, BEST joins the candidates showing early signs of becoming the next cryptocurrency to explode.

1. Pi (PI)

Pi’s latest moves in the crypto space have caught the attention of retail investors and market whales. A key driver behind the recent rally is Pi Network’s new “Buy” feature, which allows users to purchase PI directly with fiat through the native wallet.

This addition, launched on July 22, 2025, could attract more users, making access easier and increasing market demand. On the same day, Pi’s price jumped 7% to $0.4842, before settling at $0.4807. The improved accessibility removes friction and positions Pi as a more user-friendly digital currency.

In addition to fiat integration, Pi Network launched its App Studio, which has led to the development of over 8,000 applications. Since its release on Pi2Day 2025, over 7,600 chatbot apps and more than 14,000 custom apps have been created. This activity is a sign of strong developer interest and real ecosystem expansion. If this momentum continues, it could be a buffer against inflation risks from upcoming token unlocks expected in Q3 2025.

Since the launch of Pi App Studio on Pi2Day 2025, over 7,600 Chatbot apps and 14,100 Custom apps have been created and published by Pioneers! Learn more https://t.co/zWbpIIhOjS pic.twitter.com/Qw2BqKyu56

— Pi Network (@PiCoreTeam) July 20, 2025

One more factor that strengthens Pi’s outlook is the recent whale accumulation. A large investor acquired over 331 million PI coins, reducing the circulating supply and signaling long-term confidence. Such activity often boosts investor sentiment and can limit immediate sell pressure. However, the sustainability of this trend will depend on whether app ecosystem growth and technical resilience can counterbalance the increase in token supply.

2. Convex Finance (CVX)

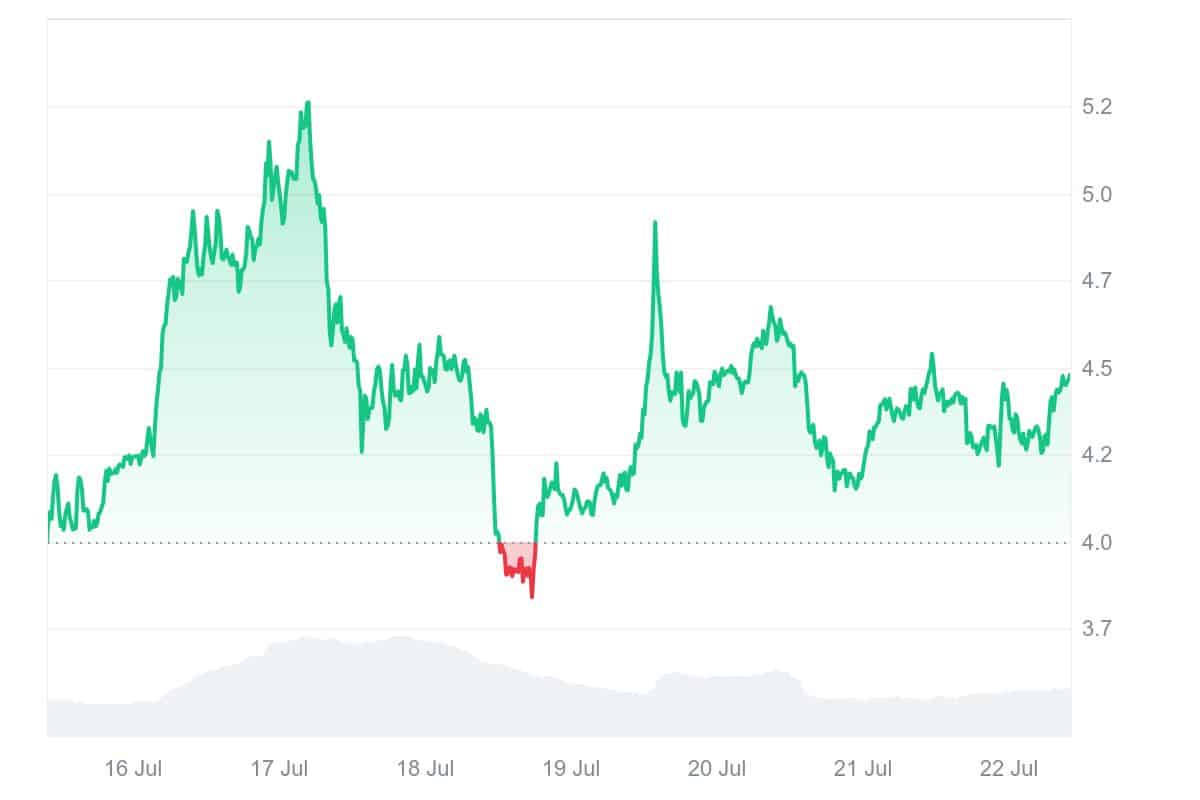

Convex Finance is another name showing signs of growth as it rides a clear bullish wave. CVX has gained over 89% in the last 30 days and 57% over 90 days, with its current market cap at around $441 million. Circulating supply is at 98.5 million, and its turnover ratio of 0.119 suggests moderate liquidity. On-chain data reveals that whales control over 72% of CVX, indicating potential volatility and solid holder conviction. The rise in wallet addresses, up 3.38% in 30 days, suggests retail interest is growing.

From a technical perspective, all short and long-term moving averages are positioned below the current trading price of $4.48. This aligns with upward momentum as confirmed by a bullish MACD crossover and a mid-60s RSI, which is close to overbought but not overheated. The Fibonacci retracement levels put resistance at $4.54 and support near $4.08, giving CVX a clear path upward if Bitcoin dominance remains below 60%.

Convex continues to benefit from its integrations and presence in the DeFi space, including previous collaborations with Frax Finance. Even though some partnerships date back to 2021, continued updates or new features could renew investor interest. With CVX on watchlists and whale support apparent, it has the fundamentals to be the next cryptocurrency to explode, especially if DeFi market conditions remain favorable.

3. Best Wallet Token (BEST)

Best Wallet (BEST) is catching serious momentum, with over $14 million already raised in its presale. This figure proves that smart investors are betting on what could become one of Web3’s top wallet platforms. As altseason gains steam and traders rotate funds from Bitcoin into high-upside altcoins, the arrival of a user-first multichain wallet like Best Wallet is perfect timing.

What sets Best Wallet apart is how much it packs into one clean interface. It supports over 60 blockchains, integrates with 330+ DEXs and 30 cross-chain bridges, and makes token swaps fast, seamless, and cost-efficient. Best Wallet is more than a simple wallet; it’s also a smart aggregator that automatically finds the best trade rates across networks. It’s also non-custodial, giving users complete control over their assets, backed by advanced MPC-CMP encryption for unmatched security.

Altcoin buzz is rising as Bitcoin dominance just hit a 4-month low, and Ethereum, XRP, and others are rallying. That’s pushing more users toward secure, multichain wallets like Best Wallet, especially as its monthly active users soar past 250,000. The platform’s built-in Upcoming Tokens tracker is another standout. This tool alerts users to promising altcoin projects before they hit major exchanges, giving holders of the BEST token a valuable edge during altseason.

The BEST token unlocks extra perks like discounted trading fees, staking yields up to 97% APY, and governance rights. At the time of writing, BEST is still available at $0.025365, but that price will climb in less than 6 hours as the presale enters a new stage. Timing is key here.

Buy BEST tokens NOW before the next price increase and lock in early access to one of the most powerful wallets in the Web3 space.

4. JUST (JST)

Just (JST) has recently undergone some protocol adjustments that could shift its role in the TRON-based DeFi space. The JUST DAO reduced the collateral ratio for USDJ to zero and raised reserves to 100%, which is intended to make borrowing easier. However, the move could bring stability risks if reserve management fails. The upside is that this change might increase usage of the JST governance token as more users participate in decision-making processes within the ecosystem.

JST is also benefiting from broader growth in DeFi activity. Weekly updates show that JustLendDAO’s total value locked (TVL) has reached $7.64 billion, with $4.75 billion supplied and $183.52 million borrowed. Daily rewards now exceed $42,000, reflecting high user engagement and reward potential for liquidity providers. These figures reinforce JST’s importance in its ecosystem, even as competition from JD.com’s stablecoin and TRON’s broader DeFi offerings challenge JST’s growth.

📊Weekly check-in with #JustLendDAO

💥TVL just hit $7.64B

💸Supply stands at $4.75B

🔄Borrowed amount $183.52M

💰Daily rewards over $42KDeFi keeps growing — are you part of it yet? 👀

🔍Explore the latest: https://t.co/voEsVCnWpG

🧠Which market are you farming in right now? pic.twitter.com/MmdMy517aC

— JUST DAO (@DeFi_JUST) July 22, 2025

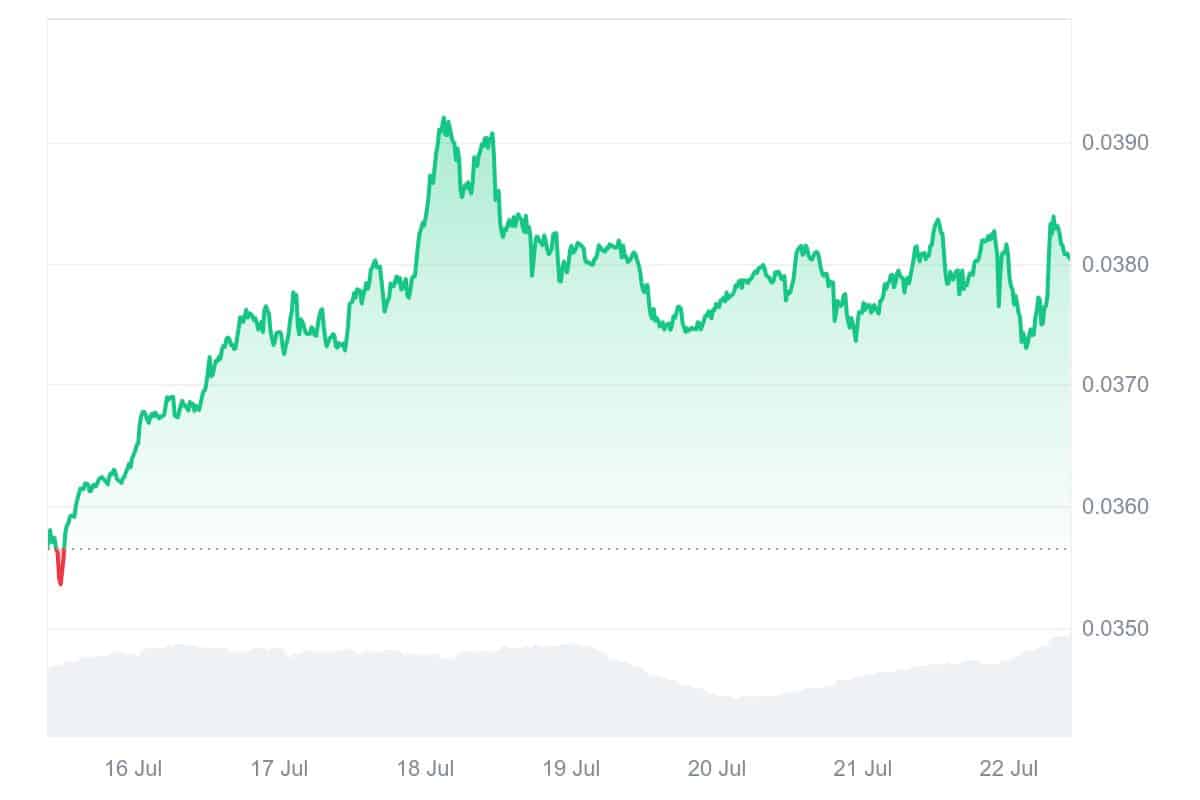

From a technical standpoint, JST is above the 7-day and 30-day simple moving averages, suggesting bullish momentum. The 7-day RSI is 74.03, indicating that the token is overbought and could see a short-term pullback. However, the MACD remains positive, and Fibonacci levels show that resistance is near $0.041 and support at $0.0336. Futures offerings with high leverage, like the 75x option on Binance, could bring further volatility and interest from speculative traders.

JST’s trajectory will depend on how well the ecosystem balances DeFi participation with systemic risk. If partnerships like DWF Labs boost liquidity and TRON’s regulatory challenges in markets like Thailand remain contained, JST could gain more traction. Investors will be watching closely to see if JST’s role in Asian DeFi strengthens or becomes a pressure point.

5. Pax Gold (PAXG)

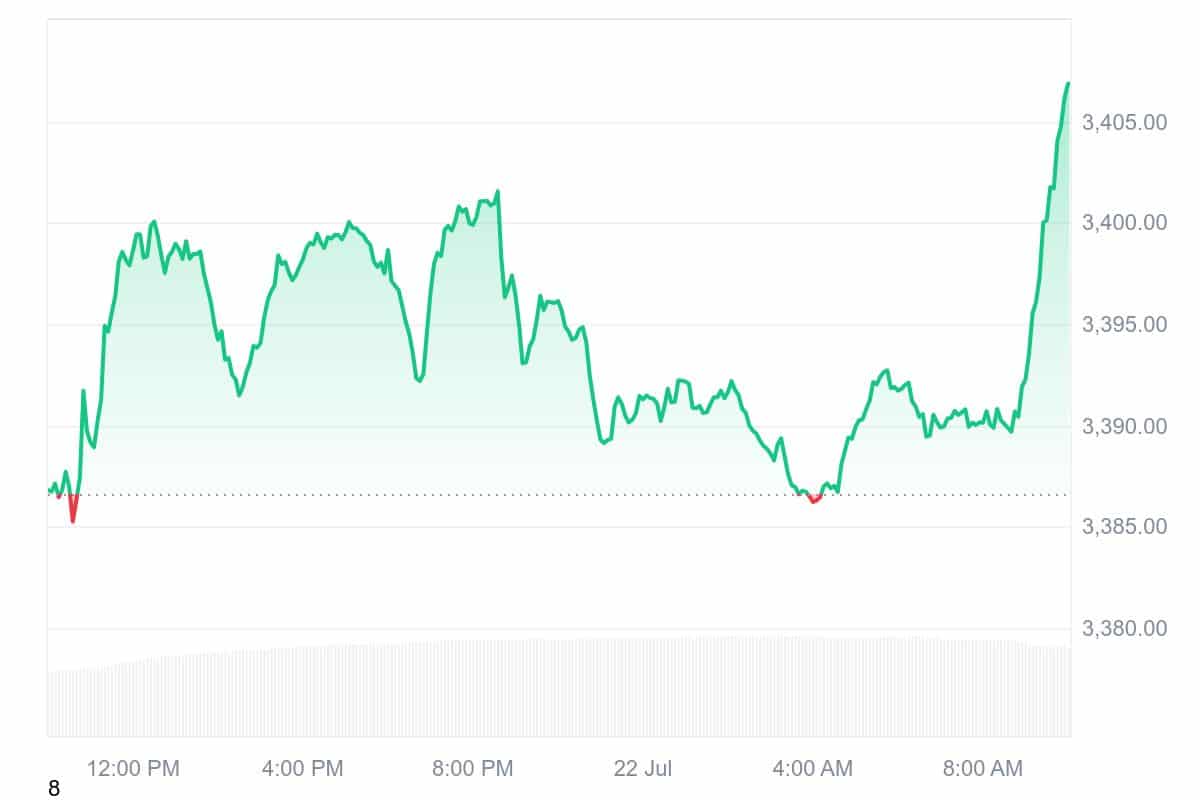

Pax Gold (PAXG) offers a unique hybrid of traditional assets and crypto innovation. Each token is backed by physical gold held in vaults, providing intrinsic value that many other digital assets lack. Although its price generally follows gold, crypto market factors and new project developments can influence its valuation. PAXG is trading near key Fibonacci levels, and the MACD histogram remains positive. RSI is at 62, a neutral range that still leaves room for upward moves.

The token’s bullish outlook is further supported by its position above major moving averages. Resistance is being tested at around $3,413, which could lead to further gains if broken. That said, shorter timeframes show an overbought RSI, which might result in pullbacks.

The GENIUS Act is officially signed.

Thank you to @POTUS, @DavidSacks, @BoHines, @SenatorHagerty, @SenLummis, @SenatorTimScott, @SenGillibrand, @Sen_Alsobrooks, @RepFrenchHill, @RepBryanSteil, @GOPMajorityWhip, @RepRitchie and many others for their leadership on stablecoins. pic.twitter.com/rt2lK6OCsQ

— Paxos (@Paxos) July 18, 2025

On the fundamental side, Paxos is expanding its offerings by introducing USDG, a new stablecoin aimed at the EU market. If USDG secures MiCA compliance, it could improve user trust in Paxos’ full suite of products, including PAXG. Meanwhile, competition is rising. Tether Gold (XAUT) remains a dominant force, and new projects like AYNI are entering the space, increasing market pressure. The Q2 2025 RWA report points to the growing role of tokenized real-world assets, and PAXG’s leadership here will be tested.

Investor interest in tokenized assets is increasing, particularly among institutions looking to hedge with real-world assets. If PAXG improves on-chain liquidity and adds more use cases, it could start challenging traditional gold ETFs in both convenience and appeal. For now, it stands out as one of the more stable and asset-backed plays that could still be considered part of the next cryptocurrency to explode narrative, especially as real-world asset tokenization accelerates.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage