Join Our Telegram channel to stay up to date on breaking news coverage

Capitalizing on bullish market phases demands more than timing. It requires strategic focus on emerging altcoins and meme tokens with strong technical setups or surging investor interest. Yet, identifying such assets can be challenging, particularly when capital continues to flow toward already overextended markets.

This report reviews the recent performance of leading gainers across the crypto market, with a focus on assets that have demonstrated both trading strength and sustained market interest. The aim is to spotlight the next cryptocurrency to explode and inform investors of the evolving narratives behind each project.

Next Cryptocurrency To Explode

Recent market movements have brought several altcoins into focus. Uniswap (UNI) and Dogecoin (DOGE) have seen notable surges, driven by strong liquidity inflows and renewed ecosystem interest. Meanwhile, the presale token Bitcoin Hyper (HYPER) stands out. This scalable Layer-2 built on the Solana Virtual Machine combines Bitcoin security with near-instant transaction speeds. Over $3.5 million already raised, and the HYPER token could become one of the next high-growth crypto assets.

1. Uniswap (UNI)

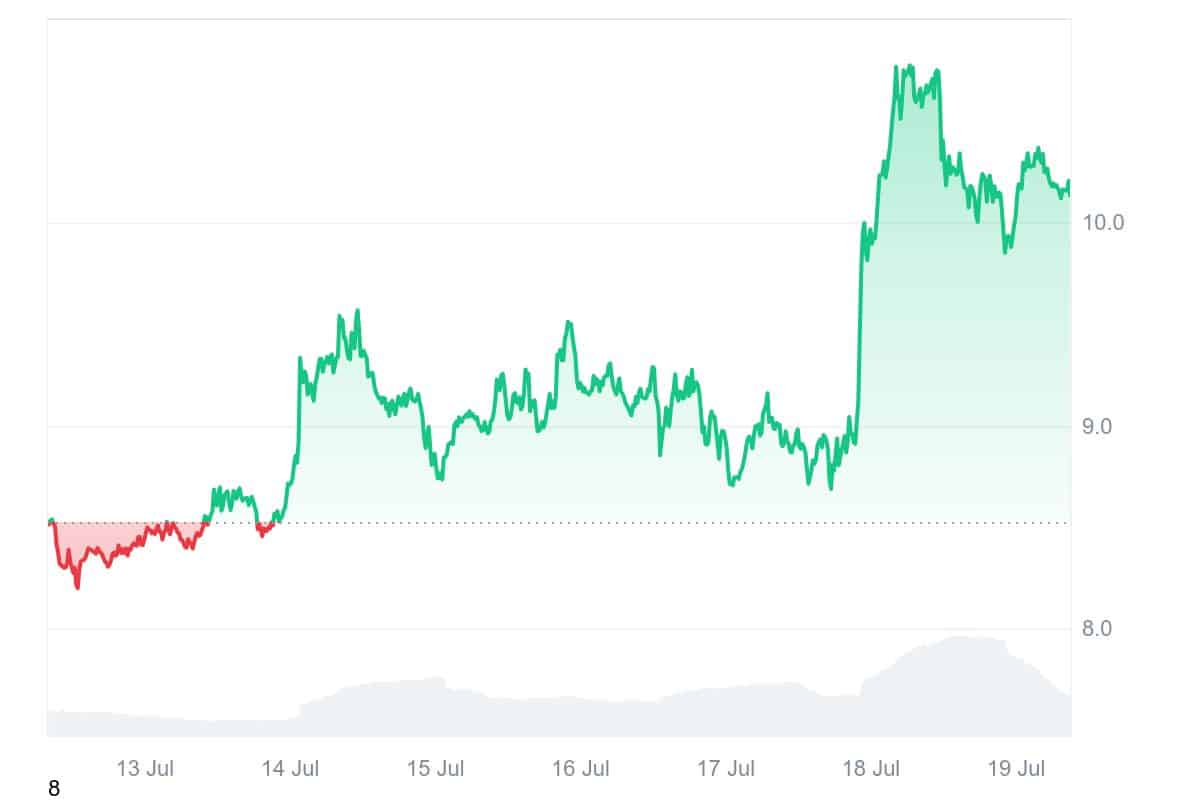

Uniswap is again emerging as a contender for the next cryptocurrency to explode. After consolidating for months between $6.50 and $8.00, UNI has broken past resistance and is now trading at $10.13. This marks a +19.08% increase over the past week and nearly +32% in the last 30 days. Backed by a market cap of $6.37 billion and a 24-hour trading volume of $800.38 million, Uniswap’s momentum appears to be building rapidly.

The move above $9.30 to $9.50 was confirmed with volume, and a daily close above $10.20 could push the price toward $11.50. In case of short-term corrections, strong support remains at $9.40 and $8.85. One of the most bullish indicators comes from on-chain activity. A wallet withdrawal of 2.78 million UNI worth over $25 million signals accumulation, not sell pressure. Historically, such moves from whales suggest conviction in the asset’s upside.

Number of swaps on the Uniswap Protocol

Last year: 670,717,783

This year: 640,881,736

And we’re only 7 months in 🦄 pic.twitter.com/YQLZZSrDy3

— Uniswap Labs 🦄 (@Uniswap) July 16, 2025

Uniswap is also expanding across chains. Deployments on Base, Arbitrum, Optimism, Polygon zkEVM, and Scroll are reducing costs and increasing user accessibility. The integration of UniswapX, a zero-gas aggregator with MEV protection, also strengthens its position. It allows users to access liquidity across multiple decentralized exchanges while ensuring efficient trades. This is an edge that could make Uniswap the dominant player in cross-chain DEX services.

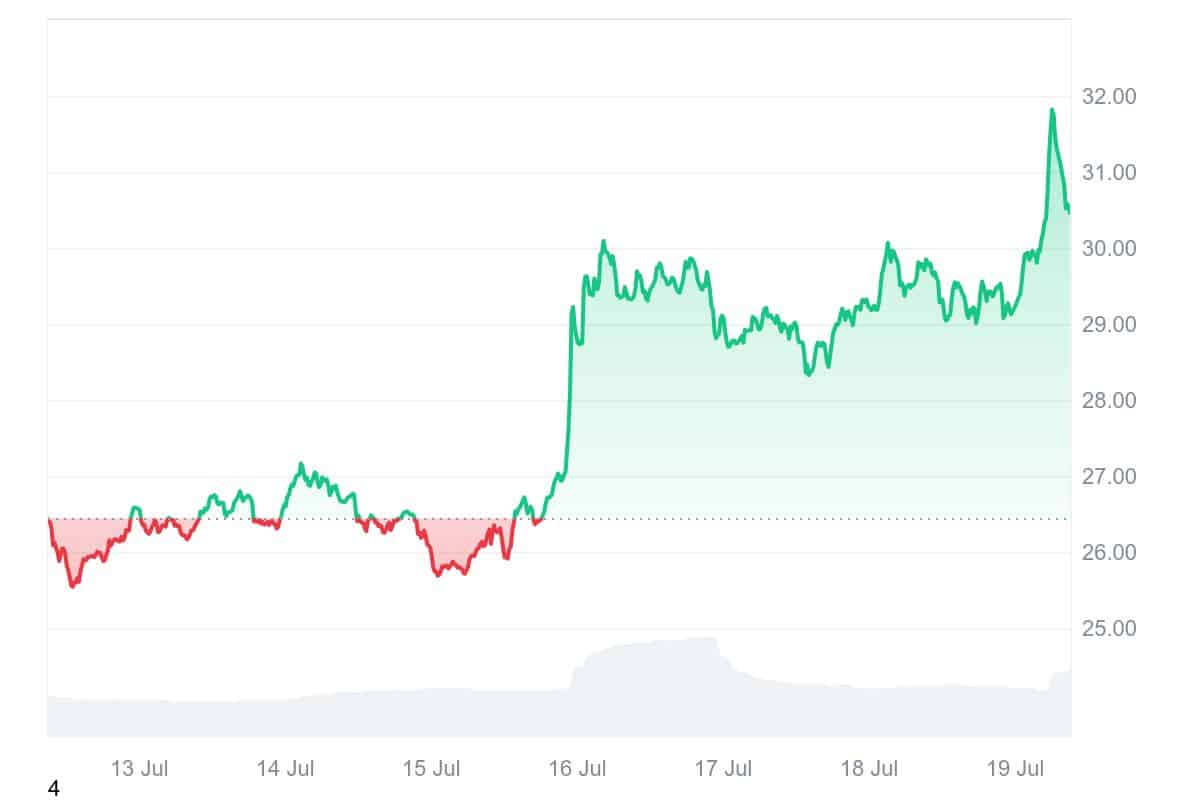

2. Bitcoin SV (BSV)

Bitcoin SV has gained 15.28% over the last seven days, suggesting it may be riding the current wave of investor interest in underappreciated assets. While the 24-hour gain of 2.54% is modest, it fits the broader upward trend. Technical indicators support the bullish setup, with the RSI at 75.17, confirming overbought conditions, and a positive MACD histogram indicating continued momentum.

From a Fibonacci perspective, BSV is sitting just around the 23.6% retracement level at $30.52, right near its current price. This could act as short-term resistance, but breaking through it may open the way for a new uptrend. The rise in BSV may also be partly due to media sentiment, with platforms like CoinGeek actively promoting the project’s original vision of Bitcoin.

Broader market sentiment is another contributing factor. With the Crypto Fear & Greed Index at 69, traders appear more willing to take risks. The Altcoin Season Index is also above 69%, suggesting that altcoins are outperforming Bitcoin. In such conditions, legacy tokens like BSV, with historical relevance and a niche community, can temporarily benefit from speculative capital rotation.

Still, caution is warranted. The asset remains volatile, and without broader adoption or significant development updates, its price may rely more on technical reactions than long-term fundamentals. But in the short term, if positive sentiment continues, BSV could see further upside.

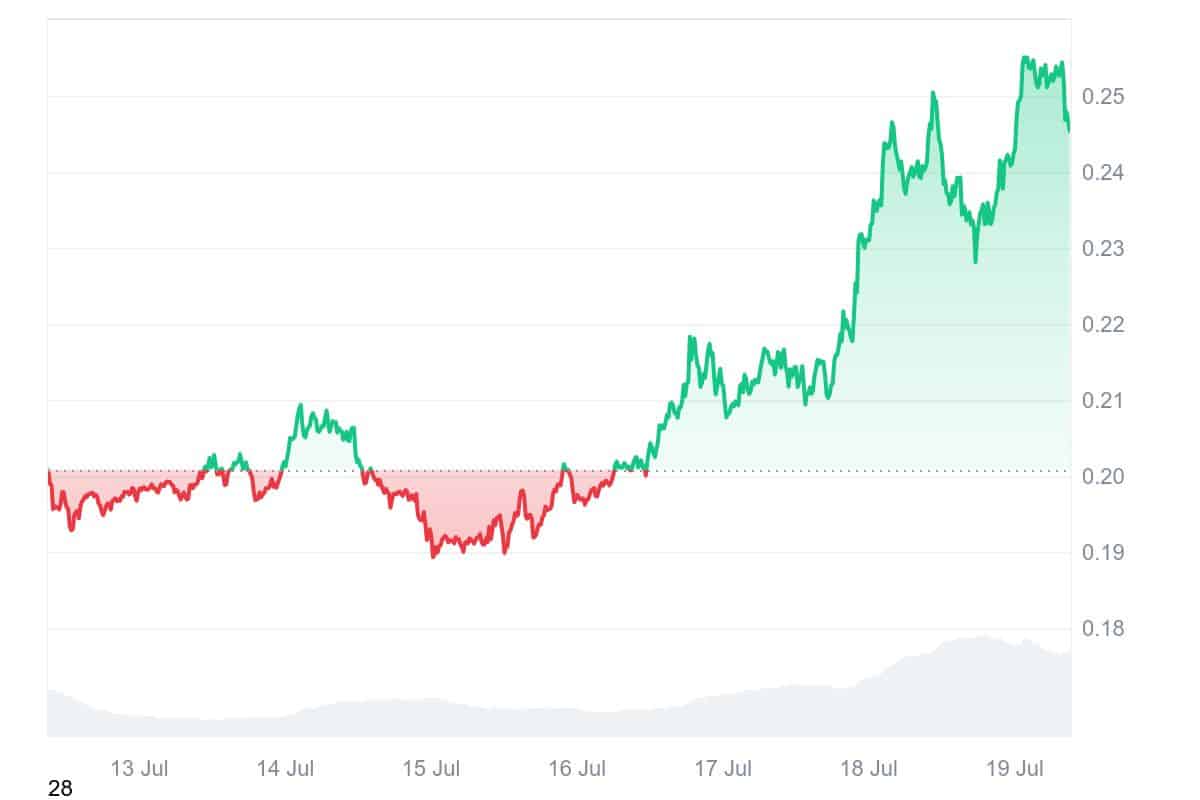

3. Dogecoin (DOGE)

Dogecoin has seen a sharp rebound, rising over 22% in the past week and over 45% over the past month. Supported by intense trading activity and clear technical formations, DOGE’s recent momentum suggests it is gaining strength. The breakout coincided with rising wallet activity and growing open interest, now at $3.98 billion. Trading volume climbed to $6.11 billion, and a long/short ratio of 2.59 on Binance reflects a powerful bullish tilt.

A notable feature supporting the rally is a harmonic pattern on the daily chart, which hints at continued upward movement. On-chain data shows that large DOGE holders have accumulated over 1.08 billion tokens within 48 hours, signaling renewed investor interest. The 2-week chart shows that DOGE broke out from a descending wedge pattern, which was historically a bullish signal.

Moreover, trader sentiment has been further fueled by the asset printing its third bullish engulfing candle on the monthly chart since 2019. Previous instances led to strong rallies, including its 2021 rise to $0.70.

Currently, DOGE is trading near $0.2454. If momentum continues, a further 9% gain is plausible. However, a temporary pullback near $0.2201, the 200-day moving average, cannot be ruled out. The overall structure remains favorable as long as the asset stays above key moving averages and broader market sentiment supports risk-on positioning.

As a meme coin, Dogecoin still lacks clear utility compared to other tokens, but its branding and community strength continue to make it a magnet for retail investors during bullish phases.

4. UNUS SED LEO (LEO)

LEO offers a different value proposition, focusing on token burn mechanisms rather than broad speculative appeal. Currently priced at $8.97, LEO has a market capitalization of $8.28 billion and a circulating supply of around 923 million. While it has dipped slightly over the last 30 days, it remains up over 54% year-on-year. These stats show that LEO is more of a steady performer than a breakout asset, but that doesn’t mean it lacks potential.

Created by iFinex to plug financial gaps following the Crypto Capital issue, LEO has a robust deflationary structure. iFinex continuously buys back tokens from the open market and burns them, reducing the overall supply. So far, about 62 million tokens have been burned from the original 1 billion, which creates positive price pressure when demand holds steady.

LEO’s performance may not mirror volatile meme coins or highly speculative altcoins, but its supply-reduction model gives it a slow but consistent upward bias. The real trigger for a new move could be deeper product integration within Bitfinex or a new incentive model for token holders. As centralized exchanges evolve, tokens like LEO, with strong internal economies and predictable tokenomics, may start to see renewed investor interest.

If Bitfinex introduces features that encourage LEO holders to use their tokens actively rather than passively accumulate, we may see an increase in transaction volume, which could positively affect price. Combined with steady buybacks, such a move might position LEO as the next cryptocurrency to explode not through hype, but through functional utility.

5. Bitcoin Hyper (HYPER)

Bitcoin Hyper has already raised over $3.5 million in its presale, and it’s easy to see why interest is building. The project aims to unlock real Bitcoin utility by combining the security of BTC with the speed and flexibility of the Solana Virtual Machine (SVM).

This novel architecture uses a zero-knowledge, non-custodial bridge to lock native BTC and mint a wrapped version on a Solana-grade Layer-2. The result is an ecosystem where users can trade, stake, launch tokens, or build decentralized apps using Bitcoin, all at near-zero fees and instant speeds.

Other scaling attempts, like the Lightning Network and Stacks, have made strides but remain constrained by technical limits, usability issues, or lack of developer traction. By contrast, Bitcoin Hyper offers a familiar developer experience using Rust-based SDKs and APIs, opening the door to scalable, high-throughput apps without sacrificing Bitcoin’s trustless foundation.

At the protocol level, HYPER functions as the gas token for transactions and unlocks access to staking and premium network features. Ultimately, it complements rather than competes with Bitcoin’s core role as a thoughtful design choice that prioritizes network integrity.

Currently priced at $0.012325, HYPER’s presale enters its next phase in under 30 hours. Buyers can earn up to 259% APY by staking tokens, with 176 million HYPER already locked. To secure tokens before the price rises, visit the official presale page via the link below.

Join the Bitcoin Hyper Presale Here

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage