Join Our Telegram channel to stay up to date on breaking news coverage

The Federal Reserve’s unchanged interest rates and upcoming US-China trade talks have positively influenced cryptocurrency market conditions. Bitcoin prices surged briefly to $97,000 following the potential thawing of international trade tensions. New crypto listings continue attracting investor attention despite market uncertainty from the Fed’s cautious, data-dependent economic approach.

New Hampshire’s historic Bitcoin Strategic Reserve bill marks significant institutional adoption of cryptocurrency as a legitimate investment. Ethereum’s Pectra upgrade enhances blockchain functionality while ETF developments signal growing mainstream financial integration of digital assets. Despite short-term volatility, these developments fuel optimistic market sentiment, encouraging strategic long-term cryptocurrency investment decisions.

New Cryptocurrency Releases, Listings, & Presales Today

BTC Bull Token harnesses Bitcoin’s rising momentum through meme culture, uniting enthusiasts for long-term bullish engagement. Its presale success and branding strategy amplify visibility, securing investor attention amid market-wide meme coin saturation.

1. BTC Bull Token ($BTCBULL)

BTC Bull Token is a meme coin rallying Bitcoin’s surge to $250,000, uniting a passionate community for the 2025 bull cycle. Its unique selling point is championing Bitcoin’s rise above gold, fostering an unyielding bullish mindset among supporters. By rejecting a $150,000 Bitcoin as too conservative, $BTCBULL ignites enthusiasm for unprecedented growth. The token thrives on meme-driven hype, ensuring it stands out among new crypto listings in a crowded market. Furthermore, it rewards long-term holders, aligning with Bitcoin’s potential to dominate global assets. This vibrant community approach blends humour with serious market opportunity, promising an exhilarating ride. In essence, $BTCBULL captures the spirit of Bitcoin’s ultimate bull run, rallying millions.

Meme coins often struggle to capture Bitcoin’s bull run due to a lack of engagement and market uncertainties. Many projects fail to sustain active communities or offer tangible rewards, leading to fading interest. Regulatory hurdles and shifting sentiments can disrupt bullish momentum, derailing initiatives. Additionally, visibility is challenging in a saturated token landscape, requiring a unique narrative. $BTCBULL overcomes these by fostering a dynamic community united by Bitcoin’s growth. Moreover, its meme-driven focus ensures sustained engagement, while its bullish theme tackles visibility issues. By aligning with Bitcoin’s trajectory, $BTCBULL addresses market uncertainties effectively.

The $BTCBULL presale has raised $5,540,873.7 of $6,272,266 and is priced at $0.002505, reflecting strong investor interest. This success signals $BTCBULL’s growing appeal in the crypto market.

2. Silo Finance ($SILO)

Silo Finance is a non-custodial lending primitive creating programmable, risk-isolated markets called silos for decentralised borrowing and lending. Its unique selling point is enabling users to deploy two-sided markets with a wallet, ensuring overcollateralised security. Each silo’s identical architecture with variable modules promotes interoperability with decentralised applications. By offering risk isolation, $SILO enhances user confidence in volatile markets, distinguishing itself in DeFi. This flexible, secure approach empowers users with control and accessibility. Furthermore, its scalable lending model positions $SILO as a DeFi leader. Ultimately, $SILO redefines lending through innovation and user-centric design.

Decentralised lending faces systemic risks and limited interoperability, exposing users to losses during market swings. Many protocols struggle with complex interfaces, reducing user engagement and adoption. Additionally, scalability is hindered by poor integration with other decentralised applications, limiting growth. $SILO addresses these by introducing risk-isolated silos, containing risks within markets. Its modular design ensures seamless dApp integration, enhancing utility. Moreover, user-friendly features boost engagement, tackling accessibility barriers. By prioritising security and scalability, $SILO fosters a robust lending environment.

$SILO’s solution centers on a peer-to-pool, overcollateralised model for efficient, secure lending. Users deposit tokens into silos or managed vaults to earn interest, with silos supporting borrowing. Managed vaults optimise yield by shifting deposits across markets, managed professionally. Borrowers use tokens as collateral, with loans as non-transferrable ERC-20 tokens accruing interest. Flexible repayments allow partial or complete settlement, burning debt tokens to clear balances. Additionally, interoperability amplifies $SILO’s reach in DeFi. This approach balances risk and reward, making $SILO a cornerstone for lending.

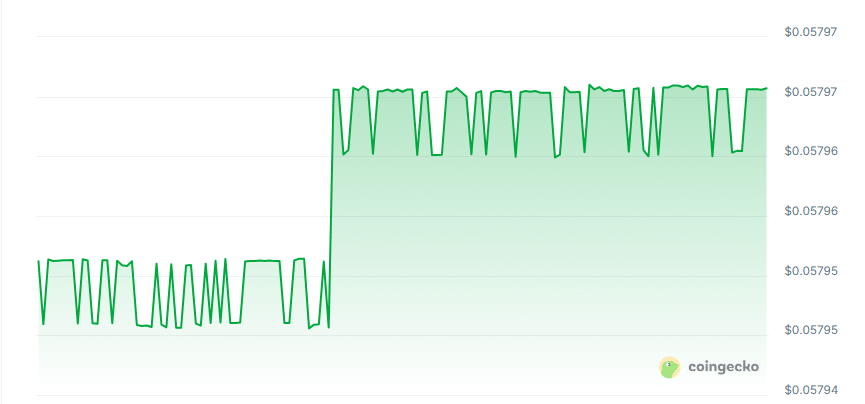

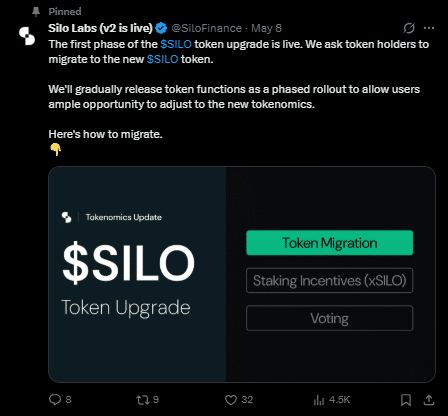

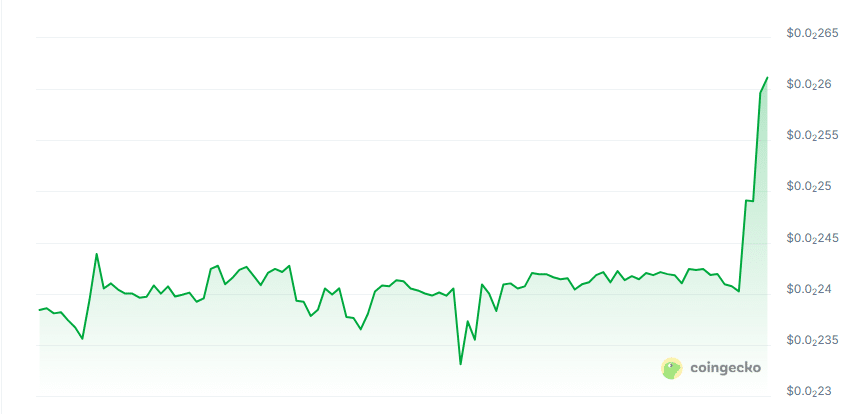

The $SILO token upgrade’s first phase is live, urging holders to migrate. Functions will roll out gradually, easing users into new tokenomics. This ensures a smooth transition for the community. $SILO partners with Pendle, a major yield trading platform, and Beefy, a yield optimiser. These collaborations enhance $SILO’s visibility and utility in DeFi. By aligning with key players, $SILO strengthens its market position.

3. aZen ($AZEN)

aZen is a decentralised infrastructure network for AI-driven Web3 ecosystems, using Proof of Contribution to tokenise computing and AI services. Its unique selling point is integrating AI with decentralised applications, creating a scalable, transparent infrastructure. The aZen Protocol ensures trustless, interoperable environments for AI and computing nodes, optimising resources. By prioritising privacy-preserving AI data processing, aZen builds user trust, setting it apart in Web3. This innovative approach unlocks value for developers and enterprises, driving Web3 evolution. Furthermore, its AI-native framework positions aZen as a pioneer in decentralised computing. Ultimately, aZen redefines infrastructure with efficiency and innovation.

Web3 lacks scalable, AI-native infrastructure, with inefficient resource allocation and privacy concerns limiting growth. Many networks face high costs and latency, hindering performance. Interoperability issues restrict integration across ecosystems, stunting adoption. aZen tackles these with dynamic fractional NFTs, optimising computing and AI resources. Its AI-powered security, using zero-knowledge proofs, ensures secure data processing. Moreover, a decentralised marketplace enhances scalability, addressing cost and latency challenges. By fostering interoperability, aZen drives Web3 innovation forward.

aZen’s solution optimises AI computing and data through a decentralised, self-governing protocol. Dynamic fractional NFTs enable fractional ownership and leasing of resources, enhancing flexibility. Smart contracts automate resource allocation, using AI to reduce inefficiencies. Cloud-to-edge computing reduces latency for real-time applications, improving performance. A decentralised marketplace monetises computing and AI services via trustless contracts. Additionally, privacy-preserving machine learning secures AI training, boosting confidence. This holistic approach delivers scalable, secure Web3 infrastructure.

aZen’s DePIN and ZenHive products tokenise computing resources and provide decentralised hardware for AI computing. Rewards are based on Proof of Contribution, which evaluates resource quality and duration. ZenHive supports industries like gaming and social media with high-performance solutions.

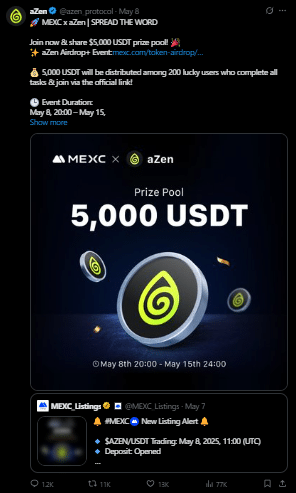

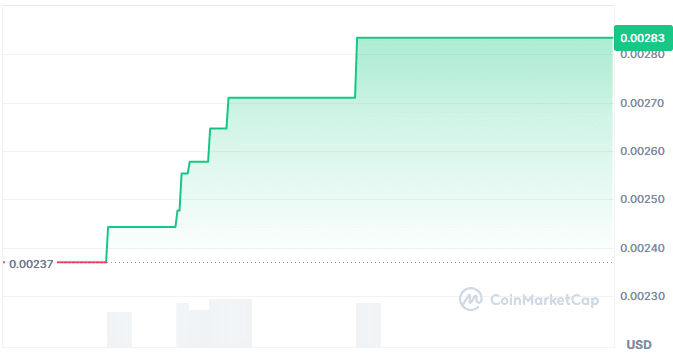

An aZen airdrop event with MEXC offers a $5,000 USDT prize pool. Running May 8–15, 200 users who complete tasks will share rewards, boosting aZen’s community engagement and visibility. aZen partners with Fireverse for AI-driven music creation and Digitalabs for decentralised compute infrastructure. Friend3AI enhances SocialFi, while InitVerse supports dApp development, strengthening aZen’s ecosystem.

4. Superseed ($SUPR)

Superseed is an Ethereum Layer 2 network offering self-repaying loans, enhancing capital efficiency with 100% protocol revenue returned to users. Its unique selling point is zero-interest loans repaid via fees like sequencer profits, built on the OP stack. Supercollateral and Proof-of-Repayment mechanisms automate loan repayment, stabilising debt. The Superseed Stablecoin, overcollateralised at 150%, ensures stability and accessibility. This open-source, Ethereum-equivalent design supports developers with familiar tooling. Moreover, its optimistic rollup enhances the onchain experience, distinguishing $SUPR in scaling. Ultimately, Superseed redefines financial freedom through user-centric innovation.

Ethereum scaling faces capital inefficiency, with high fees and complex loan structures burdening users. Many Layer 2 solutions lack automated repayment, increasing friction. Accessibility to low-cost loans remains a barrier, limiting financial inclusion. Superseed addresses these with self-repaying loans funded by protocol fees, ensuring zero-interest borrowing. Its open-source design fosters developer adoption, enhancing scalability. Furthermore, user rewards prioritise engagement and tackle adoption challenges. By automating repayment, Superseed overcomes inefficiencies in Ethereum scaling.

$SUPR is now live. pic.twitter.com/cyGX74qR9R

— Superseed (@SuperseedXYZ) May 5, 2025

Superseed’s solution leverages an optimistic rollup and native CDP platform for seamless loan repayment. Supercollateral users borrow without interest, with fees burning debt systematically. The Dynamic Repayment Vault stabilises repayment rates by channelling fees into debt reduction. Proof-of-Repayment distributes tokens daily via auctions, repaying loans with proceeds. The Superseed Stablecoin ensures stability with 150% collateralisation. Additionally, Ethereum-equivalent tooling boosts developer accessibility. This integrated approach positions Superseed as a leader in Layer 2 innovation.

Supersale participants can now claim $SUPR tokens for DeFi applications. Users can trade, earn incentives, and provide liquidity on Superseed, enhancing $SUPR’s utility and adoption. Superseed partners with Velodrome, a leading Optimism trading marketplace, and Fractal Visions, a Superchain creator platform. Stryke supports option traders, strengthening Superseed’s DeFi ecosystem.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage