Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor’s Strategy posted $14.05 billion of unrealized gains, boosting confidence in new crypto listings significantly. The company’s massive Bitcoin holdings demonstrate an institutional commitment that influences emerging token market dynamics. Strategic accounting changes now reflect real-time asset valuations, affecting investor sentiment toward cryptocurrency investments.

Strategy’s 3,300% stock surge since 2020 showcases Bitcoin’s transformative potential for corporate treasuries. The $65 billion Bitcoin position establishes a precedent for institutional adoption across digital asset markets. Corporate Bitcoin strategies continue driving mainstream acceptance and encouraging broader cryptocurrency investment participation.

New Cryptocurrency Releases, Listings, & Presales Today

$BTCBULL rallies Bitcoin enthusiasts with meme energy and community strength. $8.4M presale and claim process boost its bullish market potential.

1. Nexgent AI ($NEXGENT)

Nexgent AI empowers investors with customizable AI agents that analyze on-chain and off-chain data for crypto research and strategy testing. By processing liquidity, contracts, and sentiment, agents deliver real-time insights without coding expertise. Moreover, the replica ledger allows safe strategy testing using real market data. For instance, customizable signals integrate with tools like Telegram, enhancing user workflows. Additionally, public APIs enable developers to embed insights into custom dashboards. Therefore, Nexgent’s automation and flexibility make it a top portfolio pick. Its innovative approach captivates investors seeking data-driven decisions.

The crypto market’s complexity overwhelms investors, with fragmented data across liquidity, contracts, and sentiment requiring extensive analysis. Nexgent’s AI agents consolidate these metrics, delivering actionable insights instantly. Furthermore, Solana’s high token launch volume demands rapid evaluation, which Nexgent automates effectively. For example, agents flag risks like rug pulls, protecting capital. Moreover, manual research is time-intensive, but Nexgent streamlines workflows for efficiency. Hence, it addresses critical investor challenges, boosting portfolio potential. Its robust tools position it as a must-have for savvy traders.

🚀 INTRODUCING: TRUSTED DEX 🔒

The community asked. We delivered…in under 24 hours.

Nexgent agents can now monitor only the DEXs you trust, giving you sharper control over strategy and exposure.

💡 Shoutout to the Nexgent community for this idea – you’re building the future… pic.twitter.com/bZQS8vvdYe

— Nexgent.AI (@NexgentAI) July 7, 2025

Recently, Nexgent introduced Trusted DEX, allowing agents to monitor user-selected decentralized exchanges. This feature enhances strategy precision and risk management for investors. Moreover, it was developed in under 24 hours, showcasing rapid innovation.

Nexgent’s use cases, like real-time signal delivery and strategy testing, empower users to navigate volatile markets confidently. The integrated tool suite eliminates reliance on multiple apps, enhancing efficiency. Additionally, transparent workflows build trust by showing data provenance clearly. For instance, APIs allow seamless integration with external systems, broadening utility. Also, partnerships with MessierM87 enhance DeFi capabilities, increasing credibility. Therefore, Nexgent’s innovative features and alliances make it a compelling investment. Its focus on actionable insights drives investor enthusiasm.

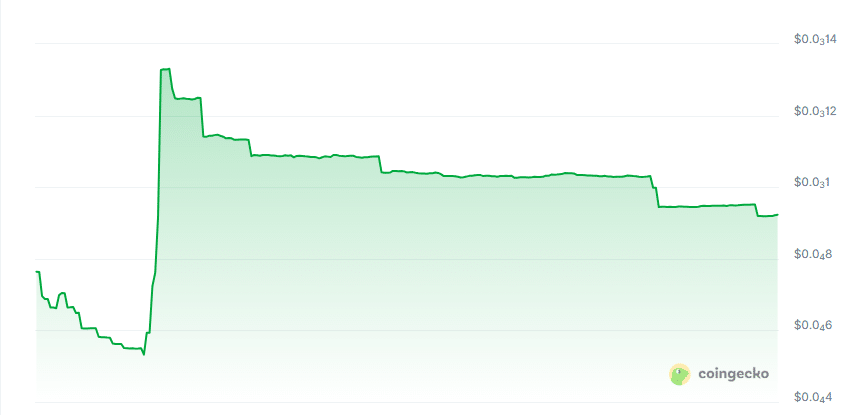

2. BTC Bull Token ($BTCBULL)

BTC Bull Token rallies a passionate community to celebrate Bitcoin’s projected surge to $250,000 and beyond. Its military-style branding embodies resilience against market and regulatory challenges. Moreover, it fosters engagement by celebrating Bitcoin’s milestones, encouraging long-term loyalty. For instance, the presale raised $8,449,206.95, reflecting strong investor confidence. Additionally, its meme-driven approach amplifies Bitcoin’s bullish narrative. Therefore, $BTCBULL’s vibrant community and market alignment make it a top portfolio contender. Its infectious optimism inspires investors to join the bull run.

Meme coins often lack sustained engagement, but $BTCBULL builds a dedicated community around Bitcoin’s growth potential. Market uncertainties like regulations can disrupt momentum, yet $BTCBULL’s branding counters these effectively. Furthermore, standing out among numerous tokens requires a unique theme, which $BTCBULL delivers. For example, its bullish narrative resonates with Bitcoin enthusiasts globally. Also, the lack of tangible rewards in other projects is addressed through community-driven incentives. Hence, $BTCBULL tackles key meme coin challenges, enhancing its appeal. Its alignment with Bitcoin’s trajectory positions it for growth.

$BTCBULL’s solution leverages meme culture to fuel excitement for Bitcoin’s price surge. Its military-strength imagery signals defiance against market obstacles, inspiring confidence. Moreover, celebrating milestones fosters a sense of shared success among holders. For instance, the presale’s success underscores strong market traction and investor trust. Therefore, $BTCBULL’s unique blend of hype and strategy makes it a portfolio standout. Its community-driven momentum captivates bullish investors.

Recently, $BTCBULL’s claim process for staked tokens went live, with a seven-day lock period. Investors are warned against imposters and fake links for safety. Moreover, the bull community emphasizes secure engagement practices.

The presale, raising $8,449,206.95, highlights $BTCBULL’s alignment with Bitcoin’s bullish cycle, attracting dedicated investors. Its community-driven rewards ensure long-term engagement and loyalty. Moreover, the token’s visibility in new crypto listings boosts its market presence. For example, funds support initiatives amplifying Bitcoin’s growth narrative. Hence, $BTCBULL’s presale success and branding make it a high-potential investment. Its ability to unite investors around Bitcoin’s rise fuels excitement.

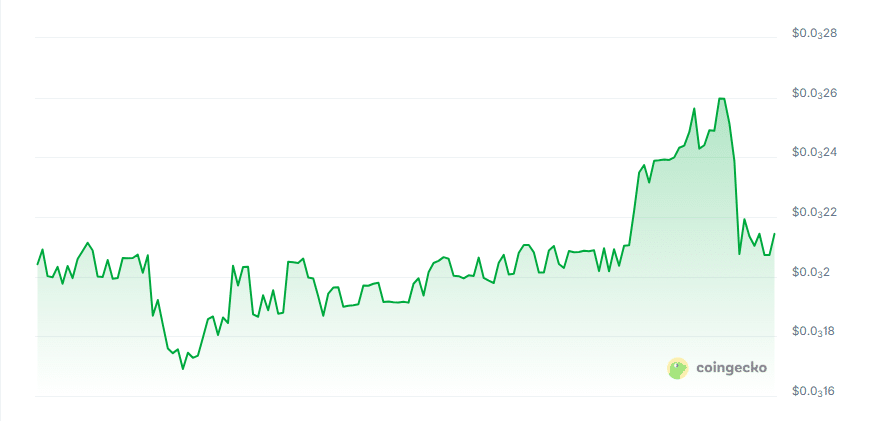

3. eS1M ($ES1M)

eS1M integrates eSIM services with crypto wallets, enabling seamless internet and on-chain transactions for token holders. Its lifetime validity eliminates SIM renewals, enhancing convenience. Moreover, blockchain ensures secure, private digital identities, reducing fraud risks. For instance, it supports Ethereum payments, streamlining crypto use. Its eco-friendly approach cuts plastic waste from physical SIMs. Therefore, eS1M’s innovative integration makes it a strong portfolio addition. Its unique utility inspires investors seeking sustainable solutions.

Traditional internet and crypto services lack integration, forcing users to manage separate systems, reducing efficiency. eS1M’s unified eSIM and wallet solution simplifies digital transactions. Furthermore, traditional SIMs’ short validity disrupts continuity for users and businesses. For example, eS1M’s lifetime validity ensures stable digital identities, boosting productivity. Additionally, physical SIMs generate 20,000 tons of plastic waste annually, which eS1M eliminates. Hence, eS1M addresses critical connectivity and environmental challenges. Its transformative approach enhances its investment potential significantly.

Security vulnerabilities in traditional SIM systems, like number reassignment, expose users to identity theft risks. eS1M’s one-wallet-one-number model ties eSIMs to crypto wallets, enhancing privacy. Moreover, its blockchain records ensure transparent, secure transactions for users and businesses. For instance, OTP services improve security for social media and corporate use. Therefore, eS1M’s secure, integrated solution positions it as a top investment. Its focus on privacy and efficiency captivates forward-thinking investors.

eS1M Development Update

small update on our side

we’ve been focused on stitching the OTP logic and wallet-linked flow together

still a few edge cases to iron out before we feel confident putting it liveinfra’s coming along, but launching too early just means more patching… pic.twitter.com/rv10ssQBUJ

— eS1M (@useEs1m) July 4, 2025

Recently, eS1M updated its OTP logic and wallet-linked flow integration. The team is refining edge cases to ensure a robust launch. Moreover, delaying the launch prioritizes long-term reliability.

eS1M’s use cases span personal, business, and community needs, offering seamless connectivity and secure transactions. Its partnership with MessierM87 enhances DeFi capabilities, boosting credibility. Moreover, lifetime eSIMs and blockchain transparency build trust among users and organizations. For example, corporate OTP APIs streamline client interactions, improving efficiency. Its environmental focus also aligns with sustainability trends, attracting eco-conscious investors. Hence, eS1M’s versatile applications and alliances make it a portfolio must-have. Its innovative vision drives investor excitement.

4. YieldFlow ($YFLOW)

YieldFlow delivers secure, anonymous DeFi solutions for staking, lending, and liquidity mining, managed by smart contracts. Its preselected investments minimize risk while maximizing returns. Moreover, it removes technical complexity, making DeFi accessible to all users. For instance, real-time yield calculations optimize portfolio growth effortlessly. Therefore, YieldFlow’s decentralized approach makes it a top portfolio pick. Its focus on profitability and security inspires investor confidence.

Centralized services dominate crypto, but security breaches and bankruptcies cost billions, eroding trust. YieldFlow’s smart contracts ensure decentralized, transparent asset management. Furthermore, centralized systems mimic traditional finance, introducing human errors and high fees. For example, YieldFlow’s automation eliminates these risks, prioritizing user control. Additionally, its collateralized lending model, requiring over 120% backing, protects investors. Hence, YieldFlow addresses centralized flaws, enhancing its investment appeal. Its commitment to decentralization positions it for long-term success.

Recently, YieldFlow launched YTrade, a 100% on-chain futures grid bot with GMX. This pioneering tool enhances decentralized trading, boosting profitability. Moreover, it reinforces YieldFlow’s commitment to secure, user-controlled earnings.

YieldFlow’s staking offers stable cash flow, forming a solid portfolio foundation for risk-averse investors. Its lending model uses secure collateral, including NFTs, ensuring safety. Moreover, DeFi liquidity mining, managed by smart contracts, balances high returns with risk control. For instance, its unique contract-based management outperforms competitors in profitability. Also, the GMX partnership enables advanced on-chain trading strategies. Therefore, YieldFlow’s diverse, secure offerings make it a compelling investment. Its innovative automation captivates DeFi enthusiasts.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage