Join Our Telegram channel to stay up to date on breaking news coverage

XRP’s institutional utility through Ripple’s ODL system creates continuous demand versus Shiba Inu’s entertainment-based appeal. The $37.7 million institutional inflows demonstrate real financial infrastructure adoption affecting new crypto listings evaluation. Fiat-backed stablecoins and tokenized Treasury trading establish sustainable value creation beyond speculative market movements.

Institutional investors favor XRP’s regulatory clarity and banking partnerships over meme coin volatility risks. Pending XRP ETF applications signal mainstream financial adoption that influences overall cryptocurrency market sentiment. Shiba Inu’s lack of utility and revenue generation limits long-term investment appeal significantly.

New Cryptocurrency Releases, Listings, & Presales Today

$HYPER transforms Bitcoin with fast, scalable Layer-2 transactions and smart contracts. $3M presale and CoinTelegraph partnerships signal strong market traction and adoption.

1. Hybrid ($HYB)

Hybrid delivers a unified infrastructure for crafting, deploying, and scaling AI agents in Web3, streamlining development with its modular architecture. Its Agent Builder SDK empowers developers with tools to create AI agents using templates, reducing complexity. Furthermore, access to on-chain and off-chain data ensures agents leverage live market insights effectively. Decentralized storage via Filecoin secures training datasets with privacy-focused solutions. Also, the Hybrid L2 Chain minimizes latency and gas costs for AI workloads. Hence, Hybrid’s cohesive approach positions it as a top portfolio contender. Its innovative tools inspire investors seeking Web3 AI growth.

Fragmented Web3 AI development tools hinder innovation, requiring developers to navigate multiple disjointed systems for data, storage, and blockchain integration. Hybrid consolidates these elements, offering a seamless framework for building AI agents efficiently. For instance, its pre-configured on-chain functionality simplifies decentralized interactions for developers. Furthermore, accessing diverse datasets reduces errors in live applications, enhancing reliability. Also, the lack of a unified infrastructure slows Web3 AI progress, which Hybrid addresses comprehensively. Therefore, Hybrid’s solution accelerates innovation, making it a compelling investment. Its scalability and developer focus attract forward-thinking portfolios.

Atlas, Hybrid’s Web3 Copilot, simplifies blockchain interactions by managing assets, transactions, and governance in one intuitive interface. It bridges user complexity with real-time insights, enhancing Web3 accessibility for all experience levels. Furthermore, Atlas integrates seamlessly with Hybrid’s framework, ensuring smooth engagement with decentralized networks. For example, it helps users discover new opportunities, boosting adoption. Also, its ability to track assets and provide governance tools empowers users. Hence, Atlas enhances Hybrid’s value, making it a standout investment. The project’s innovative AI integration drives investor enthusiasm.

Staking $HYB is now live at:https://t.co/1Epn0CgEgT

Options available:

• 365d – 13.31% APY

• 180d – 8.33% APY

• 90d – 3.98% APY

• 30d – 1.01% APYChoose a pool that fits and start earning.

— Hybrid (@BuildOnHybrid) July 16, 2025

Recently, Hybrid launched staking for $HYB with options offering up to 13.31% APY. Flexible pools ranging from 30 to 365 days encourage user participation. This incentivizes long-term commitment, boosting investor confidence.

Hybrid’s partnerships with Magic Eden and Mon Protocol expand its reach in the NFT and gaming markets, boosting credibility. The Agent Builder SDK and L2 Chain enable scalable AI applications, appealing to developers. Furthermore, Atlas’s user-friendly interface attracts a broad user base, enhancing adoption potential. For instance, staking rewards up to 13.31% APY incentivize long-term holding, drawing investors. Also, Hybrid’s focus on simplifying Web3 AI development positions it for growth. Therefore, its robust features and alliances make it a must-consider for portfolios. Its visionary approach captivates investors seeking high-growth opportunities.

2. Bitcoin Hyper ($HYPER)

Bitcoin Hyper is revolutionizing the crypto world as Bitcoin’s first high-speed Layer-2 network. By integrating the Solana Virtual Machine (SVM), it enables fast, scalable smart contracts for Bitcoin. This breakthrough unlocks Bitcoin for payments, meme coins, and decentralized applications (dApps). Unlike Bitcoin’s slow, costly transactions, Bitcoin Hyper offers near-instant finality with minimal fees. The decentralized Canonical Bridge ensures secure transfers between Bitcoin’s base layer and the Layer-2. In 2025, $HYPER is poised to redefine Bitcoin’s role in DeFi and beyond.

The project addresses Bitcoin’s core limitations, such as slow speeds, high costs, and lack of programmability. While Bitcoin’s blockchain is unmatched in security, it struggles with modern dApp demands. Bitcoin Hyper processes transactions off-chain using SVM, slashing latency and fees dramatically. This makes Bitcoin viable for everyday payments and complex smart contract applications. Recent coverage in CoinTelegraph, Bitcoin.com, Cryptonews, and BinanceSquare highlights its growing hype. Investors are buzzing about its potential to transform the Bitcoin ecosystem.

The $HYPER presale is live, raising over $3 million of its $3.33 million target. Priced at $0.012275, tokens offer early investors a chance at significant returns. Staking rewards are a staggering 297% APY, with over 105 million tokens already staked. This high yield attracts speculative traders seeking massive gains in 2025.

Bitcoin Hyper is making waves as the fastest Layer-2 in Bitcoin’s history. Its ability to combine Bitcoin’s security with Solana’s speed sets it apart. The project’s modular architecture and partnerships with top crypto platforms signal strong credibility. Hence, Bitcoin Hyper’s ability to redefine Bitcoin’s utility captivates investors. Its forward-thinking vision ensures long-term portfolio value.

3. Echo Protocol ($ECHO)

Echo Protocol unifies Bitcoin liquidity across native, liquid staking, and wrapped BTC, simplifying DeFi integration with high-yield solutions. Its Vault solution aggregates BTC standards, enabling seamless interaction with MoveVM, EVM, and SVM ecosystems. Also, Proof-of-Reserve ensures transparency and security for all BTC assets. For instance, unified BTC minimizes depegging risks, enhancing trust. Furthermore, partnerships with Chainlink and Redstone strengthen its infrastructure. Hence, Echo’s innovative liquidity model makes it a top portfolio contender. Its yield optimization captivates DeFi-focused investors.

Fragmented BTC standards, like native, LSTs, and wrapped tokens, complicate DeFi integration and reduce liquidity efficiency. Echo’s aggregation layer unifies these assets, enabling seamless DeFi participation. Furthermore, the lack of trustless bridges hinders secure cross-chain transfers, but Echo’s Vault solution addresses this. For example, strict due diligence and real-time Proof-of-Reserve ensure asset safety. Also, depegging risks in LSTs creates bad debt, which Echo mitigates with transparent backing. Therefore, Echo enhances BTC’s DeFi utility, boosting investment appeal. Its focus on transparency makes it a strong portfolio choice.

Echo’s eMSTR strategy offers 2.5x leverage on BTC without liquidation risks, appealing to high-risk investors. Its CeDeFi solution leverages Ceffu’s custody for secure, delta-neutral trading, maximizing yields. Also, Echo Strategy automates yield optimization across DeFi protocols, enhancing returns. For instance, integration with Babylon and Eigenlayer boosts staking efficiency. Furthermore, partnerships with Chainlink and Redstone ensure reliable oracles and due diligence. Hence, Echo’s yield-focused infrastructure drives investor interest. Its innovative financial engineering positions it for portfolio growth.

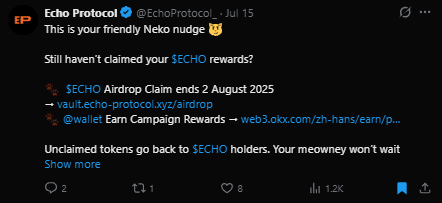

In recent news, Echo’s $ECHO airdrop claim ends August 2, 2025, urging users to act quickly. Unclaimed tokens return to holders, incentivizing participation. Partnerships with Chainlink and Redstone enhance transparency and reliability.

Echo’s Vault solutions across Aptos, Solana, and Morph enable users to stake BTC and earn boosted yields in DeFi. Its real-time Proof-of-Reserve feed ensures unified BTC is fully backed, reducing risks. Also, strict asset criteria and due diligence enhance security and trust. For example, eMSTR’s convertible notes lower capital costs, attracting diverse investors. Furthermore, CeDeFi’s dual earning capability appeals to conservative and speculative investors. Therefore, Echo’s robust yield solutions make it a top investment choice. Its transparent, scalable model inspires investor confidence.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage