Needham Bank is heading north with a $212 million cash-and-stock deal to acquire the parent company of BankProv, an Amesbury-based bank that struggled after making an ill-fated bet on the cryptocurrency sector several years ago.

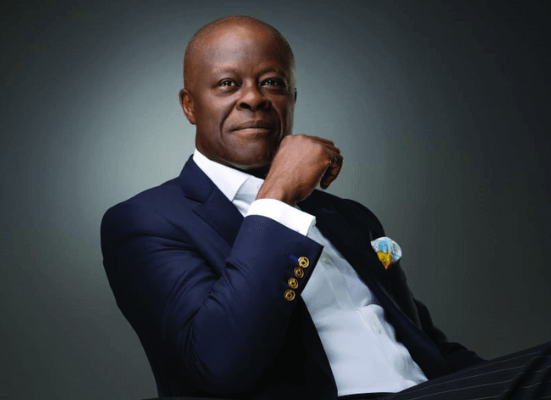

The acquisition of Provident Bancorp is the first for Needham and chief executive Joe Campanelli since Needham’s holding company, NB Bancorp, raised around $400 million through an initial public offering at the end of 2023. Needham’s footprint is in Greater Boston and the western suburbs, while BankProv’s seven branches are in the Merrimack Valley and in southern New Hampshire.

Needham, perhaps best known for its lending to builders and developers, will rebrand the BankProv branches under its own name after the deal closes at the end of the year. The deal represents an 8 percent premium over Provident Bancorp’s closing price on Wednesday.

Together, the combined organization will have 18 branches, and $7.1 billion in assets, and will be the sixth largest Massachusetts-based bank in the Boston metro area. “It’s really a great opportunity,” Campanelli said. “There are very few independent publicly traded banks left [in the market].”

BankProv chief executive Joe Reilly, founder of Centrix Bank (now part of Eastern Bank), will join Needham’s board of directors. Reilly, then a BankProv board member, became co-chief executive of BankProv in late 2022 at a time when the bank had been losing money because of its unusual venture into loans backed by crypto mining equipment — the bank stopped making those loans around that time — and he became the sole CEO two years later.

Campanelli said he plans to cut about 35 percent of BankProv’s operating costs; the deal will add to Needham’s earnings in the first year. BankProv employs around 160 people, though it’s unclear how many of them will join Needham’s 375-person team. Campanelli said he has slowed hiring at Needham recently and hopes that he may be able to find other jobs for any displaced BankProv workers, though the exact size of the new workforce has not yet been determined.

He said Needham already has around $350 million worth of business in the BankProv footprint, primarily through business loans. He’s looking forward to growing that amount.

BankProv is around the same size that Needham was when Campanelli joined the bank as its chief executive in early 2017. As Needham grows, Campanelli vows to ensure it still has the feel of a small-town bank. Toward that end, he makes a point of making his cell phone number public, for all to see, on the company website.

“People still want to pick up the phone and talk to somebody,” Campanelli said. “We always say, ‘We get big by staying small.’”

Jon Chesto can be reached at jon.chesto@globe.com. Follow him @jonchesto.