- Cryptocurrency market capitalization reclaimed the $3 trillion mark on Monday, erasing mild losses from the weekend.

- Bitcoin price broke above $95,000 as markets anticipate crypto updates in Trump’s 100-day speech.

- Monero price jumps 50% on bullish tailwinds following a controversial $333 million transaction.

- XMR has emerged as the most-searched token on Coingecko, indicating increased investor interest.

Cryptocurrency markets experienced a mild uptick on Monday, reclaiming the $3.1 trillion mark, according to Coingecko’s aggregate data. United States (US) President Donald Trump is expected to deliver a speech to Congress commemorating his 100th day in office on Monday.

It remains to be seen whether Trump’s speech will form a sell-the-news event or if further directives on crypto regulations and Bitcoin strategic reserve will propel markets further.

Bitcoin market update:

Bitcoin price broke above $95,000 as markets anticipate potential crypto updates in President Trump’s upcoming 100-day speech.

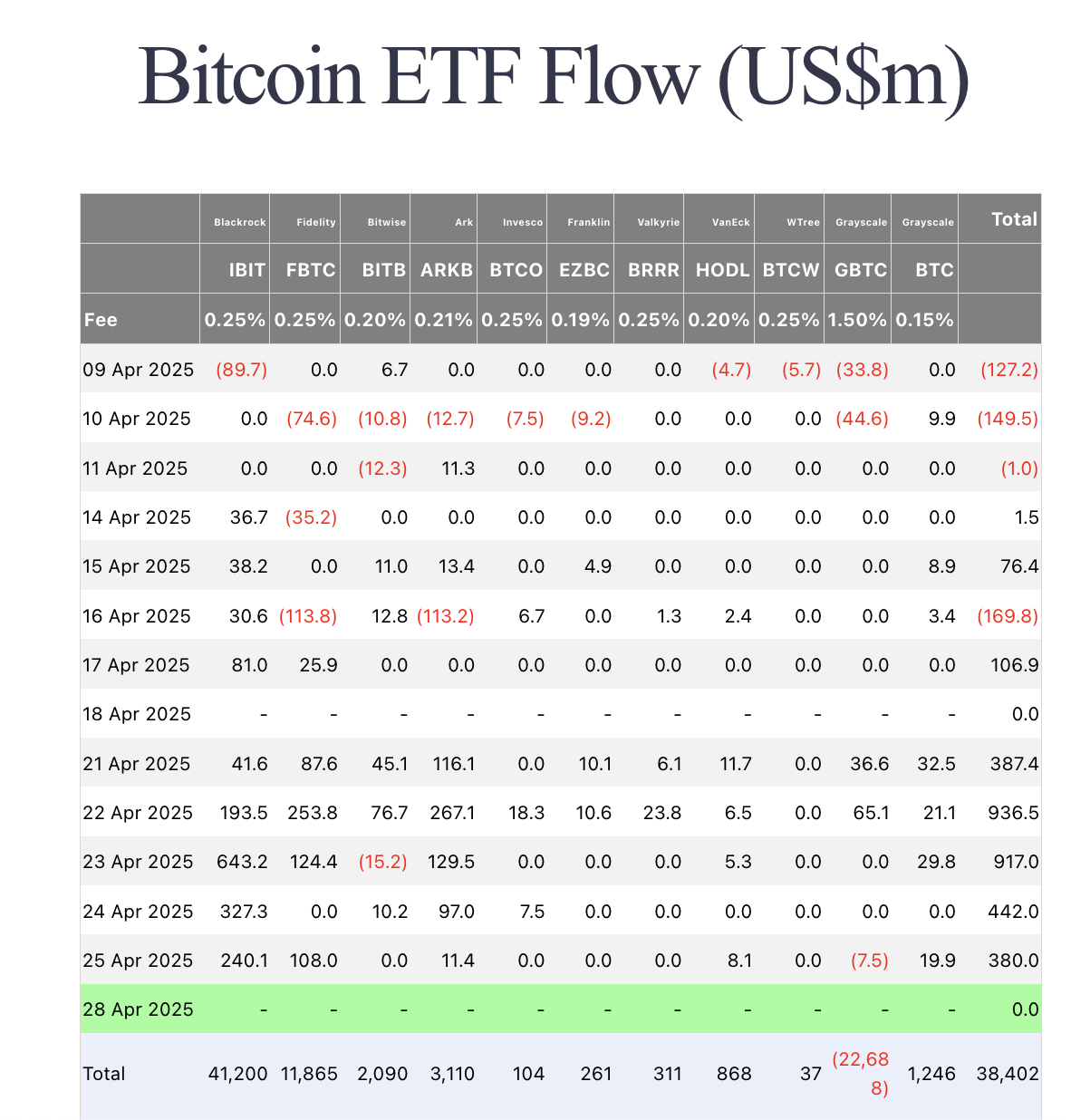

Chart of the Day: BTC ETFs gobble up $3.2 billion in six-day buying spree

Bitcoin ETFs entered record-breaking inflows last week. The unusual BTC ETF demand was linked to Trump’s criticism of Federal Reserve (Fed) Chair Jerome Powell in controversial calls for rate cuts, prompting institutional players to rotate funds out of US-denominated assets.

Bitcoin ETFs Flows | Source: Farside

The chart above shows how Bitcoin ETFs have recorded positive flows in the last six days of trading, acquiring a total $3.16 billion worth of BTC during that period.

Meanwhile, CME group’s FedWatch tool currently reads only an 8.9% chance of a rate cut despite Trump’s controversial calls last week. Without further crypto updates in Trump’s 100-day speech Bitcoin ETF demand could taper off this week.

Altcoin market updates: Monero emerges top trending token, as SUI and XRP pull volumes

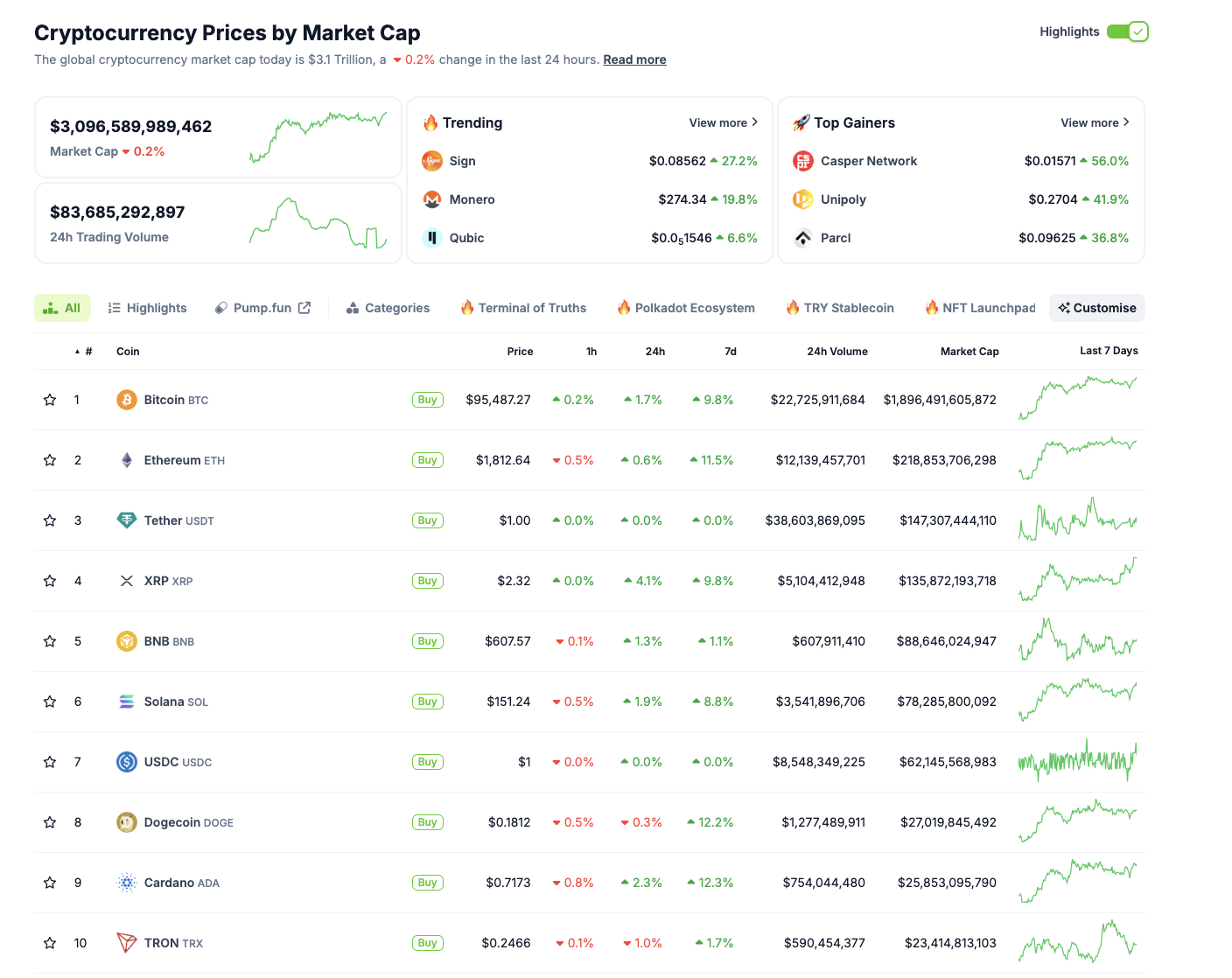

The global cryptocurrency market cap rose marginally to $3.1 trillion today, reflecting a 0.2% increase over the last 24 hours, according to CoinGecko.

Trading volumes remained healthy at $83.6 billion, suggesting steady market participation despite the cautious broader sentiment.

Monero (XMR) captured headlines as the top trending token after its price surged over 15% to $274.34.

The rally follows bullish momentum sparked by news of a controversial $333 million transaction traced to Monero, further highlighting its appeal as a privacy-focused network.

Monero also emerged as the most-searched token on Coingecko, indication strong investor interest.

Cryptocurrency market performance | Coingecko

Meanwhile, Sui (SUI) continued its impressive performance, advancing 2.3% over the past 24 hours to $3.80.

SUI’s trading volume crossed $850 million, fuelled by strong ecosystem developments and increasing DeFi adoption. Similarly, XRP climbed 3.3% to $2.32, benefitting from renewed optimism surrounding Trump’s 100-day speech.

Top gainers today included Casper Network (CSPR), Unipoly (UNIPOLY), and Parcl (PRCL), each recording 65%, 41% and 29% gains respectively.

Altcoin sentiment remains broadly bullish, although many tokens like TRUMP, Solana and Dogecoin are starting to encounter profit-taking pressure after recent strong rallies.

Crypto news updates

ProShares prepares to launch leveraged and short XRP futures ETFs

ProShares may launch three futures-based ETFs tied to XRP as early as April 30, according to a post-effective amended prospectus filed on April 15.

The proposed products include the Short XRP ETF, the Ultra XRP ETF, and the UltraShort XRP ETF, offering investors exposure to both leveraged gains and declines in XRP’s price.

The SEC has not raised objections to the filings, allowing the funds to proceed to market without further review.

However, while the products may become effective on April 30, actual trading could be delayed depending on exchange readiness and operational logistics.

ProShares’ XRP futures ETFs would join offerings from Teucrium Investment Advisors, the first manager to launch a US-listed XRP ETF.

Bitget initiates legal action over alleged VOXEL futures manipulation

Bitget has taken legal action against eight account holders accused of manipulating the VOXEL/USDT perpetual futures market on April 20.

The exchange reported that the suspected manipulation resulted in over $20 million in illicit gains.

Following an internal investigation, Bitget reversed the irregular trades and restored the affected accounts to normal status.

The platform stated it would return 100% of the recovered funds to impacted users through airdrops. An official incident report is expected to be released soon as Bitget continues its investigation. The exchange emphasized its commitment to maintaining fair trading practices and ensuring market integrity across its platform.