New research conducted by Protocol Theory, in collaboration with New Zealand’s largest cryptocurrency exchange Easy Crypto, reveals an increasing interest among Kiwis in cryptocurrencies as an alternative means to achieve financial freedom and veer away from the traditional dream of home ownership. According to the findings, nearly half of New Zealanders have either invested in cryptocurrencies or are considering doing so in the future.

The survey highlighted that approximately 50% of New Zealanders either already own cryptocurrency, have previously owned it, or are exploring future investments in this digital asset class. This uptick in interest aligns with the growing disenchantment with conventional financial systems, as 33% of investors reported that the appeal of cryptocurrency lies in minimizing profits for banks and companies. Many respondents identified banks and governments as the primary obstacles to their financial freedom.

Additionally, 60% of those surveyed believe they could incrementally invest small amounts in cryptocurrency, compared to just 16% who think the same about real estate. This sentiment underscores the perceived accessibility of crypto investments relative to the high barriers to entry in the real estate market.

“For many Kiwis, the dream of home ownership is becoming increasingly unattainable,” said Janine Grainger, Co-Founder and CEO of Easy Crypto. “With younger generations facing financial challenges unless they inherit wealth, and older generations looking to bolster their retirement, cryptocurrency is gaining cross-generational appeal.”

The data showed considerable openness to alternative investments. Only 20% of respondents considered government-insured investments as the only safe option, indicating a growing willingness to explore other financial avenues. Interestingly, 26% of Kiwis agreed that crypto enables greater economic equality, surpassing the 23% who felt the same about property investments.

The adoption rate of cryptocurrency in New Zealand is at an all-time high. Of over 1,000 respondents, 14% reported owning or having owned cryptocurrency, an increase from the 10% reported by New Zealand’s Financial Markets Authority in 2022. When including those considering future investments, the adoption rate jumps to 45%, suggesting that Kiwis are early adopters in the global context of crypto uptake.

Despite the rising interest in cryptocurrencies, the industry faces significant barriers to broader adoption. Grainger noted that while digital currencies address many traditional financial system challenges, significant gaps persist between the intent to invest and the actual investment actions. A significant 72% of those who have yet to invest in crypto find the process confusing and challenging to navigate.

The report also reveals that 67% of respondents find cryptocurrency information difficult to understand and feel unsure about whom to consult for guidance. This sentiment was echoed by existing investors, who cited similar barriers. Furthermore, half of the respondents supported the need for regulatory frameworks governing cryptocurrency providers’ operations to foster an environment of ethical and trustworthy practices.

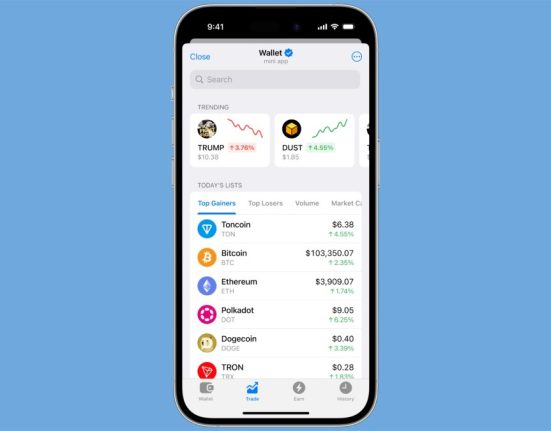

Grainger emphasised the need for the crypto industry to enhance its focus on education and building trust. “To close the gap between recognising crypto as a future financial solution and taking action, we need to simplify the investment process and make it more accessible. This includes offering stablecoins that provide a stable entry into the digital marketplace and user-friendly wallets tailored for beginners.”

She also advocated for a user-centred approach, promoting straightforward communication and enhanced security. “The industry must prioritise investor motivation, opportunity, and trust. By doing so, we can ensure a smoother onramp and greater participation from the general public.”

Grainger concluded that the future of cryptocurrency hinges on demystifying the investment process, equipping users with the necessary tools and resources, and elevating security measures to protect their investments. Only by tackling these crucial areas can the cryptocurrency industry pave the way for broader adoption and mainstream acceptance.