Since the beginning of the year, the crypto market has been facing massive downtrends. This left investors questioning the status of the crypto or Bitcoin bull run. Some anticipated it is over amid recent corrections, while others barely remained optimistic. Even after the market began to recover in the last few days, the concerns remain the same. Let’s discuss the recent trends and where BTC stands on the bull cycle.

Is the Crypto & Bitcoin Bull Run Over?

Crypto bull run is the term that describes massive gains in the price of digital assets over a long period. At the beginning of the year, the BTC’s price hit a high of $109.1k but currently stands at just $84.1k, leaving many devastated over its continuous consolidation.

However, the key takeaways from the latest data reveal that the crypto/ Bitcoin bull run is far from over, and many new major breakouts are aligned in the future trajectory.

According to the Colin Talks Crypto, BTC is in the midst of a short-term rally, the peak of which will likely form in mid to late March. This reveals that the rally is still in development and the current consolidation is temporary.

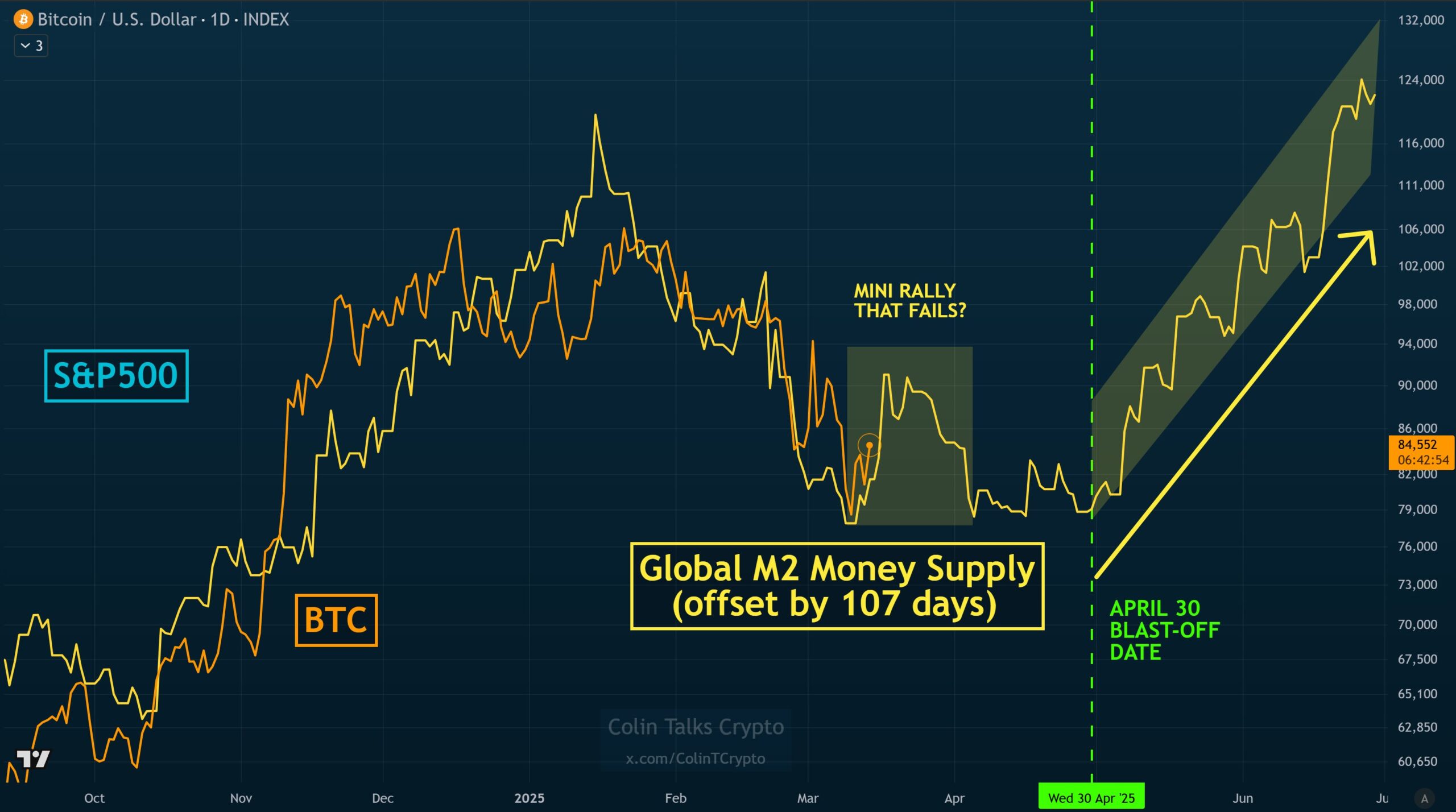

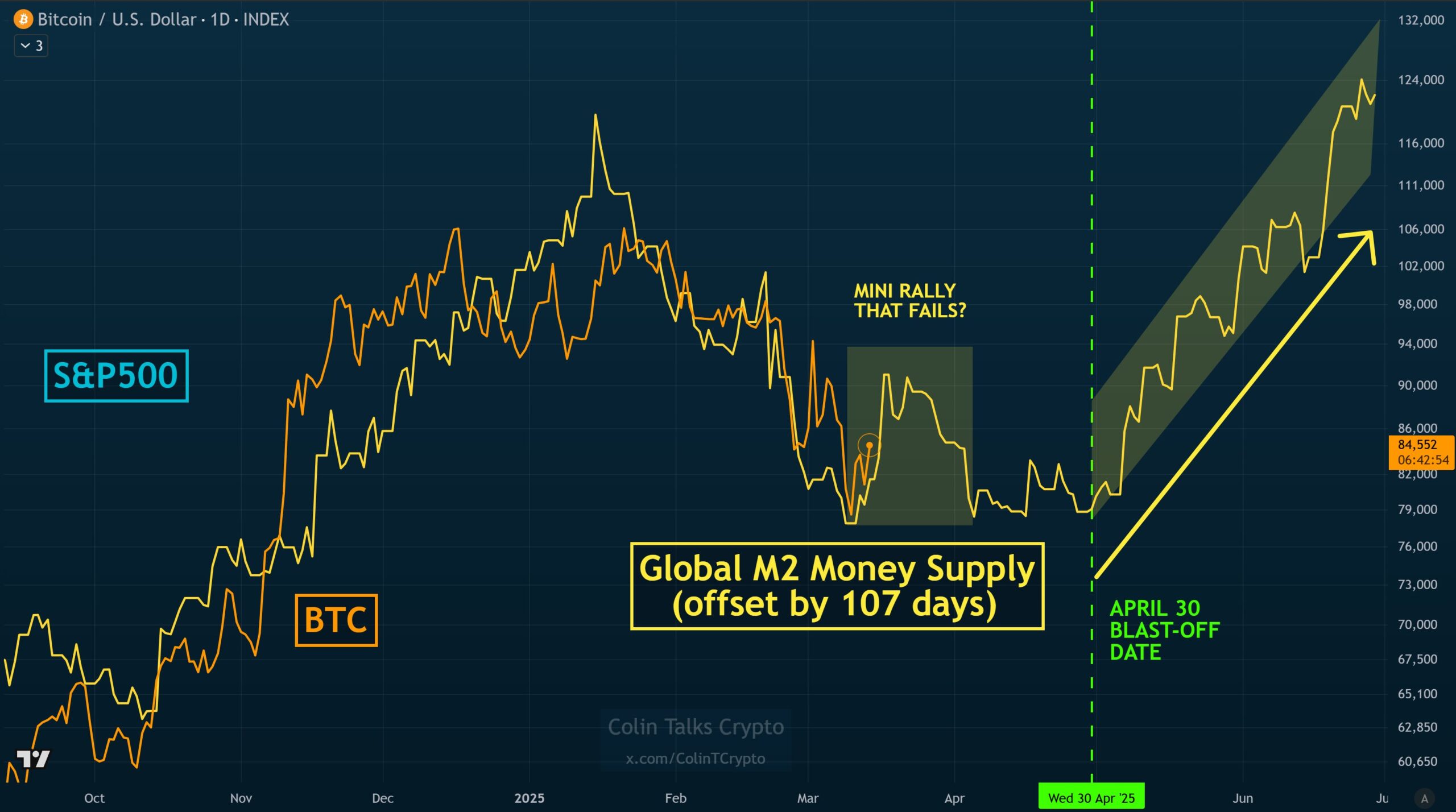

More importantly, the Global M2 Money supply correlation is the best method to analyse the trajectory of this rally as Bitcoin price moves with the M2 data, which is a measure of liquidity.

Based on the stats, there are two possible timelines, both bullish. Scenario 1 (70-day offset) predicts a strong move up around March 2,5, and Scenario 2 (107-day offset) suggests a significant blow-off around April 30 to early May.

What Does This Mean for the Bitcoin Bull Run?

Colin has concluded there are 2-3 more days until the top of this mini rally happens. More importantly, the 107-day offense fits the current situation, so the rally would form around April 30.

It looks to me like BTC has at least three more days until the end of that mini rally. He added that M2 Global supply with a 107-day offset seems to fit best currently. Blast off date estimated around April 30.

Overall, this means that the continuity of the historical pattern may bring short-term volatility, especially once this mini-rally peaks. However, the real acceleration of the crypto & Bitcoin bull run may not occur until April or early May, the same time when global liquidity is expected to rise.

How’s the Crypto Market Performing Today?

After a rough two-month stretch that saw the crypto market lose over $1 trillion, Bitcoin’s price recovery has set a more optimistic tone. With a nearly 9% surge from its month low, BTC currently trades at $84.1k. The rest of the market followed the same, reaching a global market cap of $2.76 trillion.

This bounce happened as the broader financial market, including and stock, rebounded. More importantly, the regulatory clarity from the SEC, as they proposed to classify XRP as a payment asset rather than security, influenced investor sentiments.

Interestingly, the famous crypto analyst Josh Mandel predicted that the BTC price would hit $440k, increasing investor confidence in the asset and the market.

Conclusion: Bull Run Far From Over

Although Bitcoin’s short-term uncertainty remains unchanged, the broader outlook is optimistically bullish. More importantly, analysts believe that BTC is in the mini rally, and the peak is 2-3 days away. However, the biggest breakout or Bitcoin bull run peak is due on April 30 to early May, making the current crypto market ideal for holding.

Amid this bullish Bitcoin price prediction, one claims it could hit $440k soon. Investors must check liquidity trends, market sentiment, and macroeconomic development for better results.

Frequently Asked Questions (FAQs)

According to analysts’ claims, the Bitcoin bull run is not over—instead, a massive rally will form between April 30 and early May.

After reaching a high of $109.1k, the Bitcoin price began to consolidate due to macroeconomic events and bearish investor sentiments.

Crypto analyst Josh Mandel believes BTC could surge to a high of $440k, taking the $84k level as a base.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: