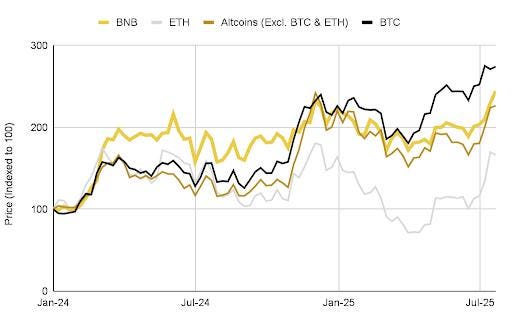

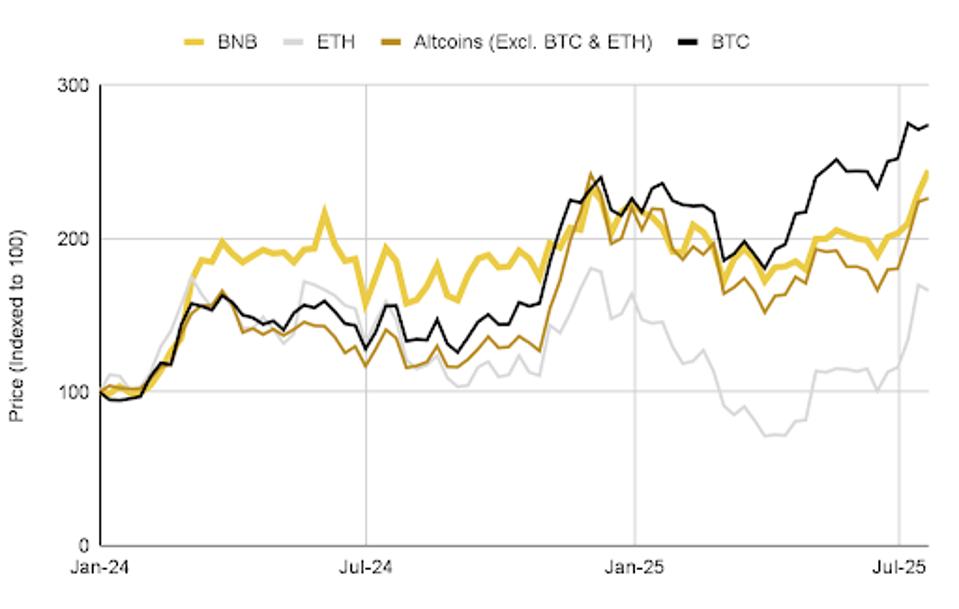

In a significant market development, BNB has shattered its previous all-time high of US$794, decisively breaking the key psychological barrier of US$800 to establish a new peak. This pushed the token’s total market capitalization to US$112B, making it the world’s third-largest cryptocurrency.

BNB’s outperformance amid positive macro backdrop. Source: Tradingview, Binance Research, as of July … More

This milestone distinguishes BNB as the only major cryptocurrency, aside from Bitcoin, to hit new highs this cycle among the top 100 digital assets with over two years of trading history. The powerful, five-week rally underscores a market consensus that increasingly views BNB as more of a blue-chip asset, second only to Bitcoin in the current bull cycle.

Beyond The Hype: Real Utility in a Speculative Market

Although BNB’s price has shown strong performance, sophisticated investors focus on more than just price performance and chasing returns – they analyze the broader risk-reward profile. Over the past five years, BNB has delivered a Sharpe ratio of 2.5, meaning for every dollar of risk taken, investors earned 2.5 dollars. BNB outperforms traditional market indices and other large-cap cryptocurrencies in terms of risk-return balance, highlighting BNB’s potential for strong returns alongside a comparatively stable risk profile.

BNB leads in risk-reward performance among major assets in a 5-year window. Source: Tradingview, … More

This rally was built on a healthy foundation, not short-term speculation, as Open Interest (OI) in BNB futures has not seen a commensurate spike. The primary driver of the price increase is new, real capital entering the spot market to establish long-term positions, reflecting genuine investor conviction rather than leveraged bets.

BNB’s value isn’t merely speculative; it’s anchored by a self-reinforcing “utility flywheel” that spans both centralized and decentralized ecosystems. This creates a virtuous cycle where utility drives demand, which in turn enhances the asset’s value and encourages further ecosystem development.

- Centralized Utility (Binance Exchange): Binance users holding BNB may have access to direct economic incentives such as trading fee discounts, participation in exclusive token sales, and yield-earning opportunities. Binance also offers a suite of financial products, allowing users to earn yield by staking their BNB.

- Decentralized Utility (BNB Chain): As the native gas token, BNB is indispensable as the “gas” that powers a vibrant ecosystem of over 1,300 decentralized applications (dApps), similar to Ethereum’s ETH. BNB also serves as a primary liquidity and collateral asset across the network’s diverse DeFi landscape.

Nearly one-third of BNB’s total supply has been permanently burned. Source: bnbburn.info, Binance … More

- Token Burn: Unlike most cryptocurrencies that continuously unlock or issue more tokens, leading to a de facto increase in circulating supply, BNB has permanently removed 31% of its total supply over seven years, supporting its scarcity and creating a fundamental supply-and-demand imbalance that supports higher valuations.

- Real-World Adoption: BNB’s utility is gradually expanding into the real world by purchasing goods and services through Binance Pay or booking travel products on platforms like Travala.com. Although still in its early stages, this shows its ambition to connect the digital and physical economies.

More than theoretical, BNB Chain leads all blockchain networks in decentralized exchange volume for most of 2025, processing over US$108B in weekly volume at its peak, outpacing Ethereum, Solana and other major chains. When institutions see these numbers, they see real economic activity over speculative trading.

The New Frontier: Corporate Treasury Adoption

Publicly Announced Corporate BNB Treasury Adoption Strategies

Following the path forged by Bitcoin, a new wave of “BNB Treasury” strategies appears to be emerging among publicly traded companies, marking BNB’s transition from a primarily retail asset to an institutional-grade one. According to Binance founder CZ, at least 30 companies are actively exploring this strategy, with several already making public announcements totaling over US$1.2B in potential buying pressure.

For context, while the total amount of ETH currently held in public company treasuries is US$3.7B, representing only 0.83% of ETH’s total market cap, a US$1.2B reserve for BNB means that at least 1% of the supply has been recognized by public companies — surpassing ETH.

The long-term impact of this trend may be profound. Most directly, it creates a new, structural source of demand for BNB that is less correlated with retail sentiment or daily trading activity. These corporate treasuries are likely to become long-term holders, effectively removing supply from the liquid market. This could create a “demand floor” for the price and potentially reduce volatility in the long run. Furthermore, this trend greatly enhances BNB’s legitimacy, positioning it as a viable, institutional-grade reserve asset alongside Bitcoin.

Future Vision: Web2-Level Simplicity, Web3-Level Control

The official BNB Chain roadmap reveals its grand strategic focus, aiming to win the next stage of competition through achievable improvements in performance, developer support, and user experience: match or exceed transaction speeds of TradFi networks like NASDAQ; next-gen L1 architecture with native privacy features and enhanced processing power; and facilitate partner integrations to tokenize US equities, ETFs and funds to enhance liquidity from traditional markets.

With this vision, the BNB Chain’s team addresses the main barrier preventing mainstream crypto adoption: complexity. If they can deliver on these promises, BNB could become the primary infrastructure that finally brings blockchain technology to everyday businesses.

The Bottom Line

BNB isn’t riding a speculative wave; it’s showing a fundamental shift in how institutions view digital assets. Companies choosing BNB for their treasuries are betting on utility, not hype, and choosing an asset that powers real economic activity today while positioning for the blockchain-integrated economy of tomorrow. It reveals the best investment strategy isn’t always chasing the next big thing, but recognizing value in assets already delivering results. BNB simply works.

The quiet revolution is no longer quiet: Corporate America is speaking, and it’s saying utility matters more than speculation. Smart investors should listen.