Priority fees on the Bitcoin network spiked temporarily on June 7, likely due to congestion issues on OKX. Keith Gill, aka Roaring Kitty, aka DeepFuckingValue, is approaching billionaire status as GME stock continues surging. Meanwhile, MicroStrategy stocks have attracted $6.9 billion in institutional short positions despite MTSR stocks rising two-fold in the last six months.

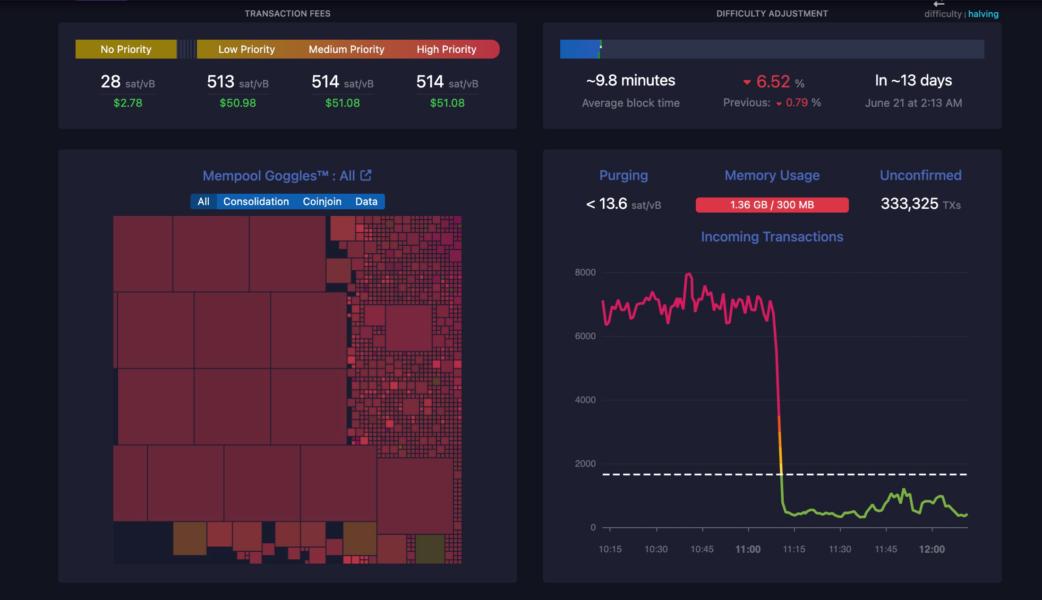

Bitcoin network transaction fees temporarily spike

On June 7, the Bitcoin network experienced a sharp rise in transaction fees, largely driven by 332,000 unconfirmed transactions.

According to blockchain analyst Colin Wu, the processing backlog was caused by crypto exchange OKX, which seemed to have been collecting and sorting through wallets. However, this wasn’t independently confirmed at the time of publication.

At their peak, high-priority transactions cost 514 sats to process, whereas low-priority transactions cost 513 sats. Transaction fees amounted to $50 to $52 in U.S. dollar terms.

The Bitcoin network underwent its fourth halving event in April, reducing the block reward from 6.25 BTC to 3.125 BTC. The halving appears to have put downward pressure on miners, with the likes of Bitfarms reporting a large drop in revenue in May.

GameStop rally sends Roaring Kitty’s shares to $1 billion

Keith Gill, a stock trader known for the GameStop short squeeze in 2021, is on his way to becoming a billionaire as GME shares continue to surge.

Gill, also known by his internet nicknames “Roaring Kitty” and “DeepFuckingValue,” revealed on June 2 that he had started trading GameStop stock again, with $180 million to play with.

The trader posted a $115.7 million position in GameStop shares and $65.7 million in call options on his Reddit account.

The trader’s revelation of another position on GameStop shook the stock market again, causing an uptick in the GameStop stock price. Robinhood’s overnight markets saw GameStop jump by 19% 20 minutes after the post, closing with shares up 38.8% in 2024 so far.

GameStop’s price currently sits at $46.55, a 118% gain since Gill shared his position.

Global capital markets analysts at The Kobeissi Letter believe that Gill is “set to be a billionaire” as GameStop stock catapulted to $67.50 per share in after-hours trading. According to the stock analysts, if it opens at its current levels, Gill’s position will be worth around $1 billion.

The analysts also highlighted that the stock closed 110% higher than June 6 and added $9.5 billion in market capitalization in the previous 12 hours. This puts the company at a $20 billion valuation, making it one of the 400-largest public companies in the United States.

Big shorters are betting $6.9B against MicroStrategy stocks

Several institutions have been holding out for a decline in the stock price of Michael Saylor’s software intelligence firm MicroStrategy, with $6.9 billion in major short positions.

However, short-seller resolve seems to be waning, as the price almost tripled in six months.

As of June 6, MicroStrategy has 18 short positions listed on investment research firm Fintel’s “The Big Shorts” list — which is a list of the largest short positions disclosed by institutions to the SEC.

The largest position, which amounts to approximately $2.4 billion, is also the 27th largest net short position among institutions.

Despite some institutions betting on a MicroStrategy fall, there’s been a marked decrease in short seller confidence.

The short-interest ratio for MicroStrategy’s stock has decreased by nearly 50% over the last six months from 3.1 days to 1.5 days.

Additional reporting by Geraint Price, Sam Bourgi and Felix Ng.