From spotting on-chain whale movements to executing deep-dive research, each crypto user has a unique goal. Surf is an AI-powered agent designed to help anyone achieve those goals by unifying the entire onchain workflow into a single, conversational interface.

Markets move in seconds, yet crypto decision-making still crawls. Valuable signals hide beneath a flood of tweets, Discord threads, price charts and half-finished white papers. The typical workflow bounces between dashboards for price, explorers for data, forums for sentiment and bridges for execution.

Context disappears with every tab change, turning even routine trades into multi-window marathons. Information overload slows research cycles; actionable insights fade before a wallet can confirm. Only the most tool-savvy users keep pace, while newcomers stall behind complex interfaces and scattered resources.

Solving this problem of fragmentation and confusion is the core mission of Surf, an artificial intelligence-powered platform designed to unify the entire crypto workflow. The demand for such a solution is clear: after its web app waitlist went live on June 23, it attracted over 300,000 sign-ups in three weeks. Now, Surf is preparing for its early access launch in July 21.

From fragmented feeds to a unified interface

Surf’s design centers on integrating the full crypto workflow — discovery, research and execution — into one conversational experience. The platform surfaces early signals from real-time metrics like decentralized exchange (DEX) volume spikes and smart follower growth, allowing users to identify emerging trends.

Multi-modal outputs, such as charts and scorecards, back every insight with source links so that users can verify data instantly. From there, users can ask questions in plain language to generate in-depth research reports.

This model was first tested in May with the release of Surf Lite, a macOS prototype that demonstrated the capabilities of the underlying signal-detection engine. Even without chat or execution features, it gained strong traction among early adopters.

The full web app, which launched on July 21 for the top 1,000 waitlist users, builds on that foundation. It will introduce natural language chat and expanded research capabilities, with onchain execution tools like swaps and bridging to be rolled out progressively.

You’re watching the future of onchain execution.

No more switching tabs or platforms. With Surf, one prompt gets the job done.

Bridge funds. Complete quests. Move faster.

Sign up now to unlock smarter crypto workflows and early access rewards. pic.twitter.com/qQI8RJPo6w

— Surf (@Surf_Copilot) June 23, 2025

An AI built natively for crypto

Instead of relying on a generic AI model, Surf is powered by Cyber AI, a crypto-specialized model built on a structured knowledge base. It integrates trusted data sources, including CoinGecko Terminal, RootData, curated X feeds and onchain data.

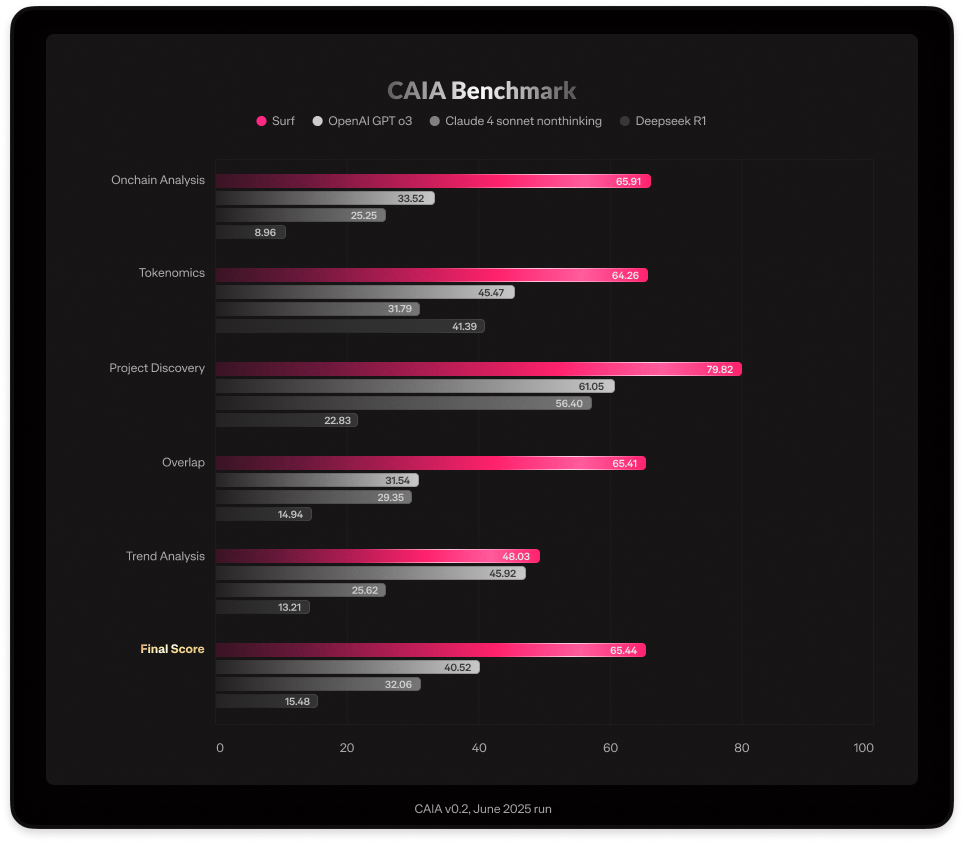

This allows the AI to understand the nuances of tokenomics, onchain activity and project lifecycles with higher accuracy than generalist models. In a recent benchmark for crypto research performance by Crypto AI Agent (CAIA) Benchmark, Surf outperformed other state-of-the-art AI models.

“AI will become the default interface for crypto because it mirrors how people think,” says Ryan Li, co-founder of Cyber AI and Surf. “We’re building an AI product that meets users where they are and unlocks the powerful tools that have so far been limited to experts. When the experience feels intuitive, crypto stops feeling foreign and finally makes sense.”

As Surf transitions from prototype to full web release, its value will be measured by whether a single chat window can genuinely replace the maze of dashboards and tabs that define crypto research today. If users can move from signal to trade without losing context, the platform has the potential to mark a practical step toward making onchain participation less daunting and more efficient for a broader audience.

Learn more about Surf and Cyber AI.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.