Bitcoin has rocketed to an all-time high this year, with its latest boom enticing a new wave of surprising and controversial new cryptocurrencies.

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price has topped $124,000 in the last few weeks, lifting ethereum, Ripple’s XRP and the wider crypto market to over $4 trillion for the first time as Tesla billionaire Elon Musk quietly confirms his “only” crypto.

Now, as Kanye West suddenly joins the crypto craze, Harvard economist Kenneth Rogoff has admitted he got bitcoin and crypto wrong ten years ago, warning a coming dollar “crisis” could propel crypto higher and joining some of the most bullish bitcoin price forecasters in sounding the alarm over the $37 trillion debt pile.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

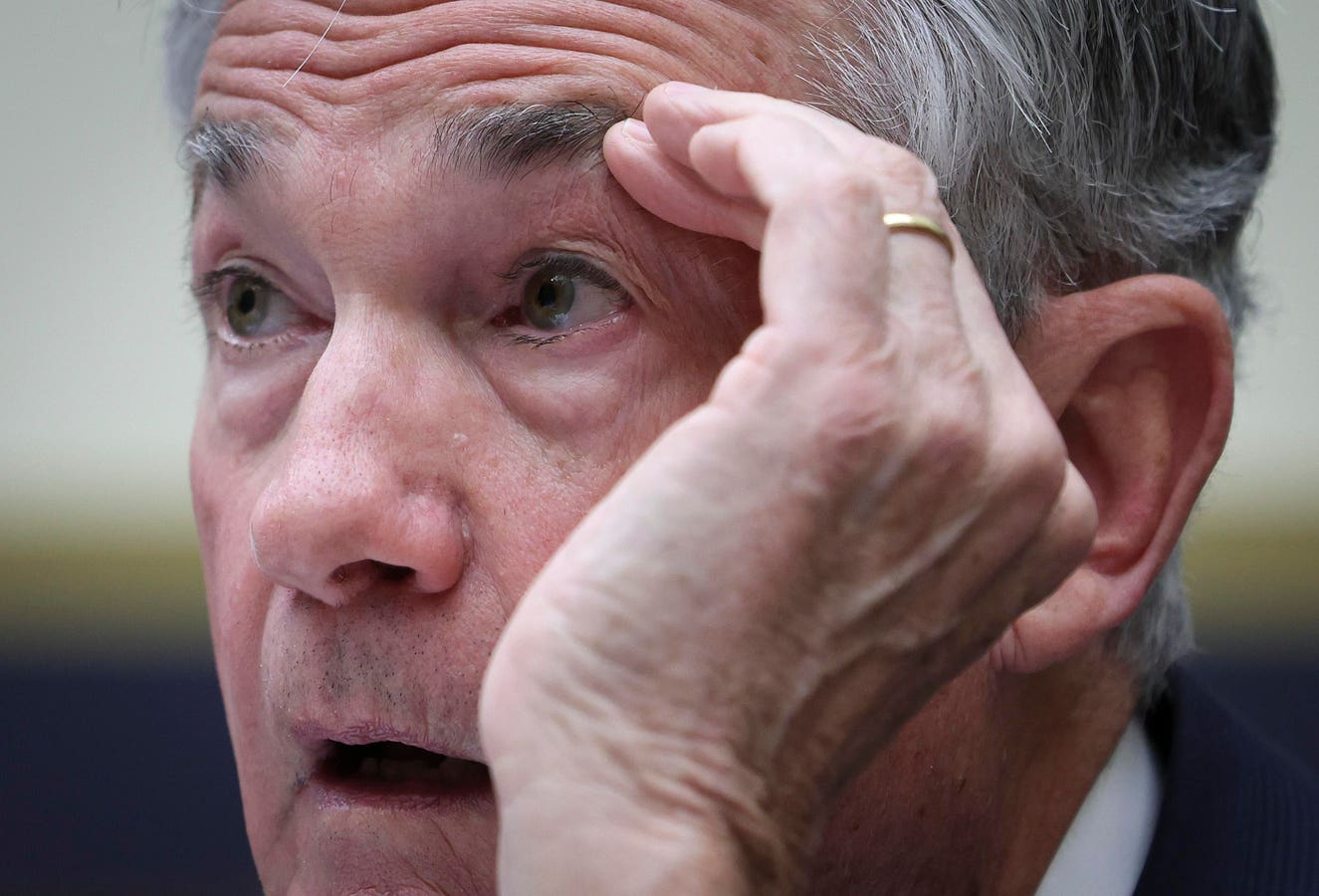

Federal Reserve chair Jerome Powell is battling stubborn inflation as higher interest rates add to the spiraling $37 trillion U.S. debt pile—predicted to spur the bitcoin price, ethereum, XRP and crypto higher.

Getty Images

“Almost a decade ago I was the Harvard economist that said that bitcoin was more likely to be worth $100 than 100,000,” Rogoff posted to X. “What did I miss?”

Rogoff, who was also the International Monetary Fund’s chief economist and has a new book coming out warning over the future of the U.S. dollar, pointed to a lack of “sensible cryptocurrency regulation,” bitcoin’s appeal to the “global underground economy,” and U.S. president Donald Trump’s embrace of crypto as spurring the bitcoin price higher.

However, Rogoff has also predicted the growing U.S. debt pile, which has ballooned to over $37 trillion this year, has raised “doubts about the U.S. dollar.”

“Over the medium and longer term, the dollar could lose market share to the Chinese yuan, the euro, and even cryptocurrency,” Rogoff wrote in a piece for Foreign Affairs.

“In the long term, a severe debt or, more likely, an inflationary spiral could send the economy into a lost decade, drastically weakening the dollar’s position as the dominant global currency and undermining American power,” Rogoff wrote in the piece headlined, “America’s Coming Crash: Will Washington’s Debt Addiction Spark the Next Global Crisis?”

This week, minutes from the latest Federal Reserve interest rate-setting meeting showed officials remain concerned about price pressures, though Fed chair Jerome Powell opened the door to cutting interest rates in September at his closely-watched Jackson Hole Economic Symposium speech, sending the bitcoin price—and other major cryptocurrencies including ethereum and XRP—higher while torpedoing the U.S. dollar.

“This is bullish for the front end of the yield curve and risk assets, where bitcoin is a fast horse in the race,” Jessy Gilger, investment advisor at bitcoin financial services company Unchained, said in emailed comments.

“A dovish tilt could supercharge bitcoin’s narrative as a hedge against fiat uncertainty, accelerating institutional accumulation and liquidity. While the mid and long end of the curve remain uncertain, bitcoin’s sensitivity to macro signals means it’s poised to ride any wave of optimism from rate cut expectations.”

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price has surged over the last 12 months, lifting the price of ethereum, XRP and other cryptocurrencies as Wall Street and U.S. president Donald Trump embrace crypto.

Forbes Digital Assets

Meanwhile, the most bullish bitcoin price voices in the crypto space have pointed to the growing U.S. debt pile as potential catalyst to send bitcoin sharply higher.

“I think we’ll see $1 million per bitcoin by 2030,” Brian Armstrong, the chief executive at bitcoin and crypto exchange Coinbase, posted to X.

Armstrong named increasing regulatory clarity, the president Donald Trump’s bitcoin strategic reserve, and Wall Street adoption among other factors that include the U.S. debt‑to‑GDP ratio.

“The debt‑to‑GDP ratios are the thing to watch usually, I think,” Armstrong said in a conversation posted to YouTube with payments giant Stripe cofounder John Collison.

“I forget where we’re at now—150 or 170 or something—but if you look historically, maybe when the British lost it or the Dutch, they were in the 200–250 range. So we’re within sight of a pretty dangerous threshold, historically. It’s hard to see where the political will is going to come from to do that, and I hope that bitcoin could be part of that solution.”