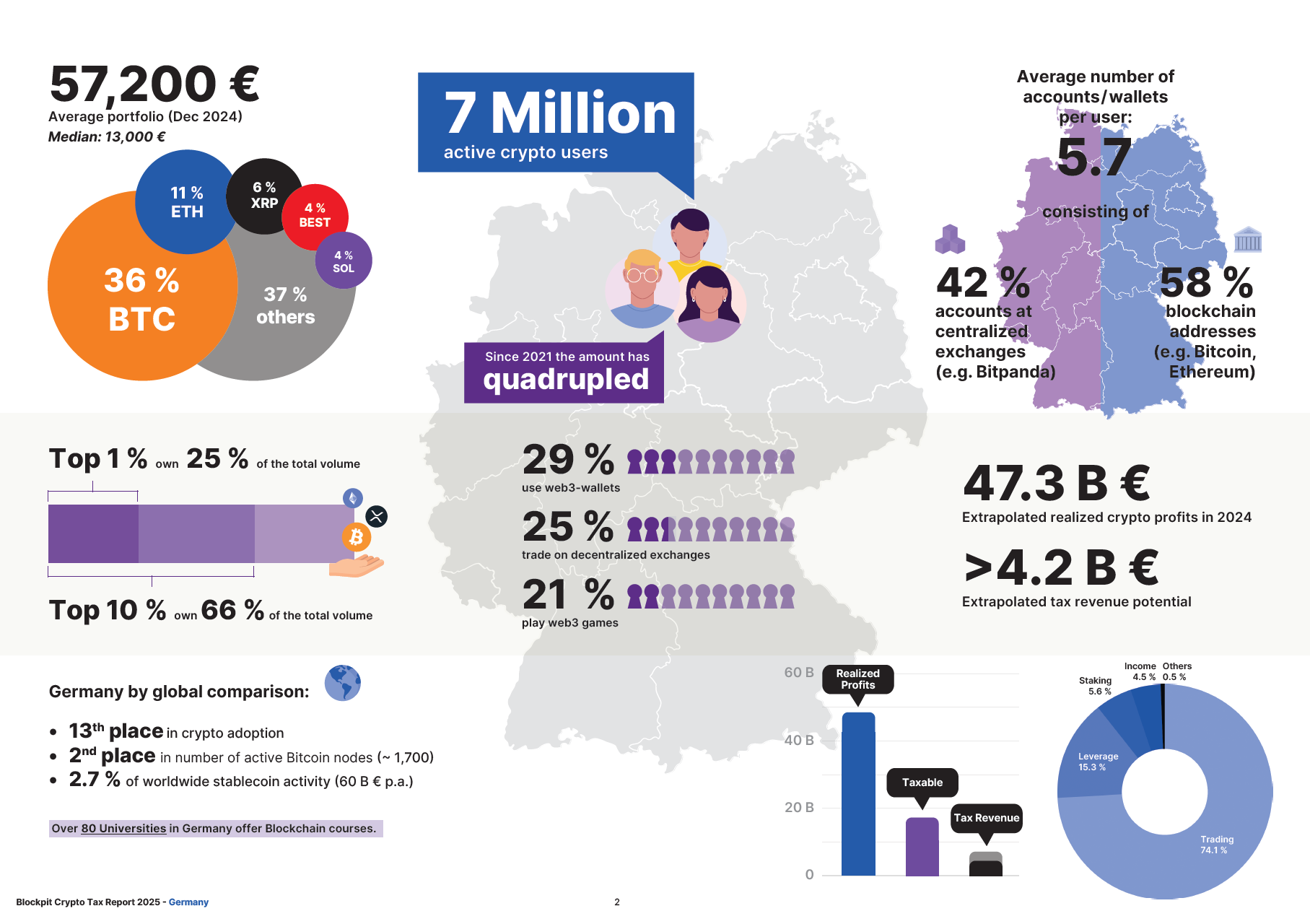

Linz, Austria – March 27, 2025 – Blockpit, Europe’s leading provider of crypto tax solutions, has released its “Crypto Tax Report 2025” for Germany. The analysis reveals that German crypto users realized a projected total of €47.3 billion in gains during 2024. Due to Germany’s one-year holding period rule, only around 44.1% of these gains are taxable. This would translate into a projected tax liability of €4.2 to €7.3 billion last year, assuming a progressive income tax rate between 20% and 42%. However, likely only a small fraction of this was actually declared, as estimates suggest that fewer than 3% of crypto users properly file their tax returns. The study also explores behavioral trends, regulatory developments, and structural challenges within Germany’s crypto ecosystem.

According to available data, there are now over 7 million active crypto users in Germany, a fourfold increase since 2021. At its peak toward the end of the year, the average portfolio value reached € 57,200, with the median at € 13,000. Still, tax compliance remains a major hurdle: a large proportion of investors are either unaware of their tax obligations or struggle to maintain the necessary documentation.

“Tax and regulatory requirements in the crypto space are becoming increasingly complex. With the Crypto-Asset Reporting Framework (CARF) taking effect in 2026, crypto exchanges will be required for the first time to automatically report personal data and transaction histories to authorities,” explains Florian Wimmer, CEO of Blockpit. “Our study shows that education and digital tools are essential to closing the current compliance gap.”

Another key finding of the study is the heavy concentration of crypto wealth: the richest 1% of German investors hold 25% of total assets, while the top 10% control 66%. The study also provides insights into investor strategies over the past four years, with a special focus on staking and leveraged trading.

The full report is available here: https://blockp.it/ctr25de

About Blockpit

Blockpit is Europe’s leading provider of crypto tax software. For over seven years, the company has delivered software solutions that help individuals, businesses, and authorities fulfill their tax obligations in the digital asset space. Just recently Elevator Ventures, the investment arm of the major European banking group Raiffeisenbank International, invested several million euros in the scale-up.

This publication is provided by the client. Cointelegraph does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. Cointelegraph is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the press release.