A Connecticut man has been indicted by federal grand jury on a charge of operating an unlicensed money transmitting business, according to federal authorities.

William McNeilly, 55, of New Haven, is charged with one count of operating an unlicensed money transmitting business, which carries a maximum term five years in prison if convicted, and with three counts of making illegal money transactions, which carries a maximum term 10 years in prison on each count, if convicted.

The indictment by a New Haven grand jury was returned on June 5, 2024, and McNeilly was arrested on June 6. He appeared before U.S. Magistrate Judge Maria E. Garcia in New Haven, pleaded not guilty, and is free on a $50,000 bond, according to federal authorities.

Authorities said the indictment alleges that McNeilly owned and operated Global Income Marketplace LLC from a storefront in West Haven and that, according to its Connecticut state registration, GIM was engaged in “website builders programming tech computer repairs and upgrades.”

McNeilly and another individual also operated Global NuMedia LLC, a limited liability company registered in Delaware, authorities said.

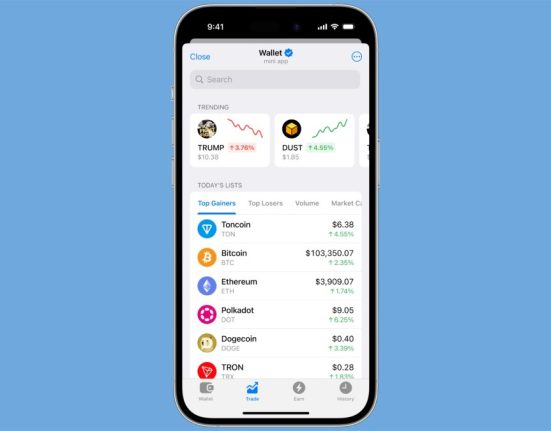

Authorities said McNeilly allegedly never obtained a license from the state Department of Banking “to engage in the business of money transmission,” but he allegedly “opened up several bank accounts in the names of GIM and GNM, and a cryptocurrency exchange account in the name of GNM, and used the accounts to operate a business through which he exchanged customers’ cash, checks, and money orders for cryptocurrency, charging a fee for the service.”

From about July 2019 to June 2022, McNeilly allegedly exchanged more than $1 million in U.S. currency for cryptocurrency on behalf of customers throughout the U.S., authorities said. “McNeilly knew that some of the funds involved in his illegal business were derived from fraud schemes, and the investigation revealed that cashiers checks from victims of romance fraud schemes were mailed to GIM and deposited into GIM accounts,” authorities said in a statement.

Authorities also alleged that, in February 2021, “McNeilly was contacted by TD Bank and told that a $10,000 wire transfer to GNM was reported as fraudulent, and that he needed a license to operate a money transmission business,” but “despite the warning, and that TD Bank closed the GIM and GNM accounts, McNeilly continued to operate his money transmission business through other GIM and GNM bank accounts.”

The case was investigated by the U.S. Postal Inspection Service.