Since 2020, federal tax forms have asked about Bitcoin and other cryptocurrency activities. The question that appears at the top of Form 1040 currently reads, “At any time during 2024, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

What do you do if you check the Yes box? How do you enter these transactions as you prepare your income tax return? Below, we answer those questions and explain all that’s relevant to taxes and cryptocurrency.

File Your Taxes for Free (or Very Cheap): These Online Tax Services Save You Money

File Your Taxes for Free (or Very Cheap): These Online Tax Services Save You Money

What Is Cryptocurrency?

Let’s first make sure we’re on the same page when it comes to crypto tax prep. The IRS defines cryptocurrency as a “digital representation of value recorded on a cryptographically secured, distributed ledger (blockchain) or similar technology.” You can’t see it, hold it in your hand, or put it in your (physical) wallet.

Cryptocurrency has been in use for over a decade. It has grown in popularity over the last few years (based on research from Security.org, 28% of American adults own cryptocurrency in the US today, rising from just 15% in 2021). Instead of using a bank to create, transfer, and exchange funds, cryptocurrency employs a distributed and encrypted blockchain network to process transactions. No bank or government authority controls cryptocurrency, but they certainly regulate it (or try to), including by imposing taxes on the profits you gain from it.

The Best Tax Software We’ve Tested

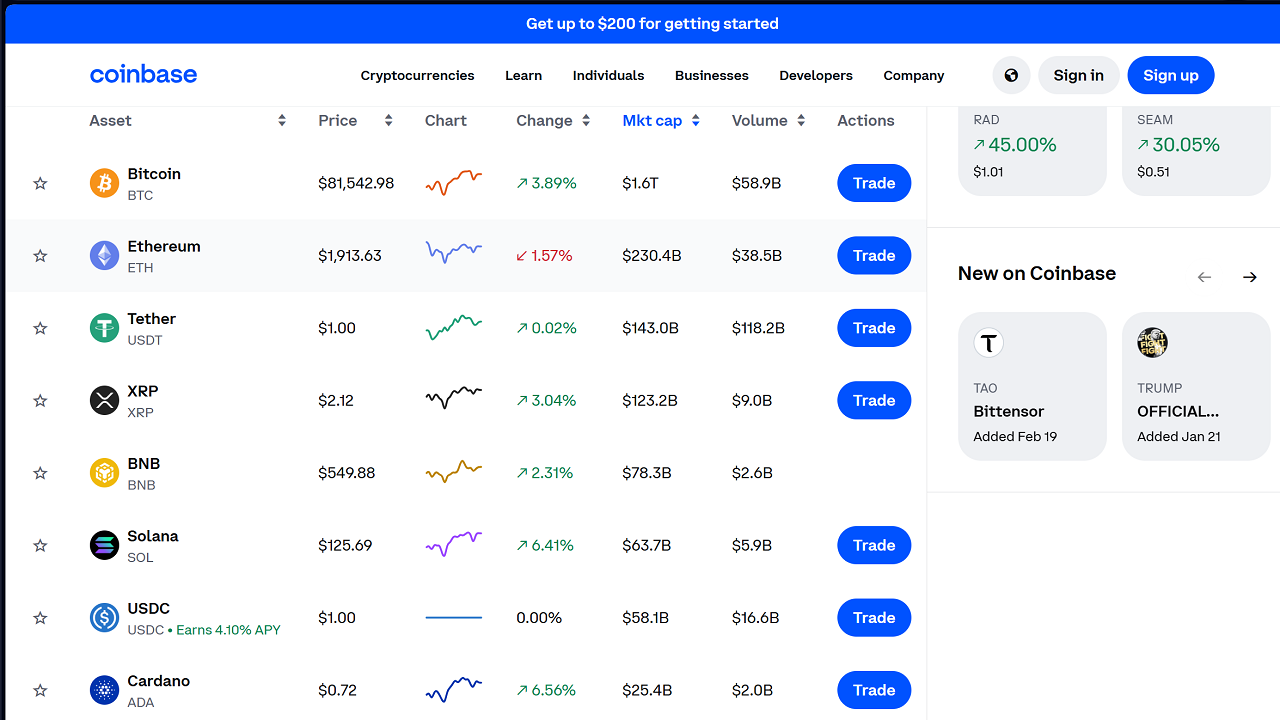

Cryptocurrency units are called coins, even though there aren’t any physical coins. You store coins and fractions of coins in a digital wallet under your control or use a custodial service similar to a financial brokerage. A few of the major exchange and wallet providers are Binance, Coinbase, Kraken, and eToro.

Bitcoin was the first successful cryptocurrency (we have a guide on how to buy, sell, and manage it), and it remains the most popular. It’s so dominant that most other cryptocurrency coins fall under the umbrella of altcoins. Major altcoins include Cardano, Ethereum, Litecoin, Solana, and XRP, among others.

You can use cryptocurrency to pay for goods or services, invest, or simply exchange funds with someone else, whether for other cryptocurrencies or traditional currency. (The latter are also known as fiat currencies because they exist by fiat, or decree, of government authorities, and their supply has no hard limit, unlike Bitcoin and other cryptocurrencies.) Cryptocurrency transactions appear on an anonymized, encrypted blockchain, which you can think of as a digital public ledger.

Crypto asset lists in Coinbase (Credit: Coinbase/PCMag)

For the purpose of your taxes, the IRS treats the dollar value of the cryptocurrency at the time of the transaction as either 1099 income or, in the case you receive it as payment from an employer, W-2 income.

The mechanics of using cryptocurrency are often as simple as scanning a QR code or copying and pasting a long ID. What happens in the background, however, is far more involved than typical bank transactions since many distributed servers (rather than one bank or exchange) have to verify the transaction.

Is Cryptocurrency Property?

If you’re a US taxpayer and have been using cryptocurrency but not paying taxes on any gains from it, you’re not alone. You’re also not compliant with IRS regulations, which could catch up to you someday. The agency might penalize you unless you can prove “reasonable cause.”

Since 2014, the IRS has considered cryptocurrency to be property. Taxpayers are required to report transactions involving virtual currency as US dollars on their tax returns, which means they must determine its fair market value as of the transaction date. You can determine fair market value by converting the virtual currency into US dollars or into another currency first (assuming market supply and demand establish the currency’s exchange rate) as an intermediary step.

In other words, you need to do some seriously precise bookkeeping if you plan to use cryptocurrency. You can use some general accounting applications like Intuit QuickBooks Online, along with integrated apps or some extra data entry. A good bit of advice is to start keeping detailed records of all your crypto transactions from the start since reconstructing years of transactions could be difficult or even impossible. Keep in mind that custodial services, such as Coinbase, can do most of the legwork for you if you manage everything through them.

Does this mean you could be on the hook for transactions going back to 2014? Yes. In fact, the IRS has sent letters to taxpayers who’ve been involved in cryptocurrency transactions, informing them that they had to file amended returns and pay back taxes.

Capital Assets vs. Ordinary Income

If you sell your home because you’re moving or sell stocks because you want to cash in a profit, the IRS considers those properties capital assets. Virtual currencies are similar. When you sell them and make a profit, you pay capital gains taxes on them, either at the short-term (those you hold for less than a year and taxed as normal income) or long-term rates on Schedule D.

You calculate these amounts just like other capital gains and losses. You take your cost basis (the amount you paid for the currency) and calculate how much it’s gone up or down since that date. Capital gains rates for the 2024 tax year can be 0%, 15%, or 20%, depending on your taxable income.

If you’re selling property as a part of a business or trade, however, the IRS doesn’t consider said property a capital asset and taxes it as ordinary income. The same rule applies to virtual currency sales. The IRS looks at the “character” of the gain or loss—your intent, or why you’re selling.

Other crypto benefits that the IRS considers income rather than capital gains include airdrops, mining rewards, staking rewards, and others.

The IRS’s FAQs on Virtual Currency Transactions offer some clear answers to the most common questions. You can also read the denser IRS Notice 2014-21.

When Do You Have to Report on Cryptocurrency?

Several common situations require you to report on crypto. You must do so, for example, if you:

-

Received crypto as payment for goods or services

-

Received crypto as income, then held and sold it for profit

-

Received new crypto from an airdrop, hard fork, or staking rewards

-

Sold, exchanged, spent, or converted it

As mentioned, you can report your cryptocurrency income on several IRS forms, such as Form 1099-B, Form 1099-K, Form 8949, and Form W-2. Where you report it on your tax return depends on how and why you received it.

Recommended by Our Editors

For example, crypto you received in exchange for services you provided as a self-employed individual would be reported on Schedule C. Investment income could go on Schedule D.

Can You Report Cryptocurrency Using Tax Software?

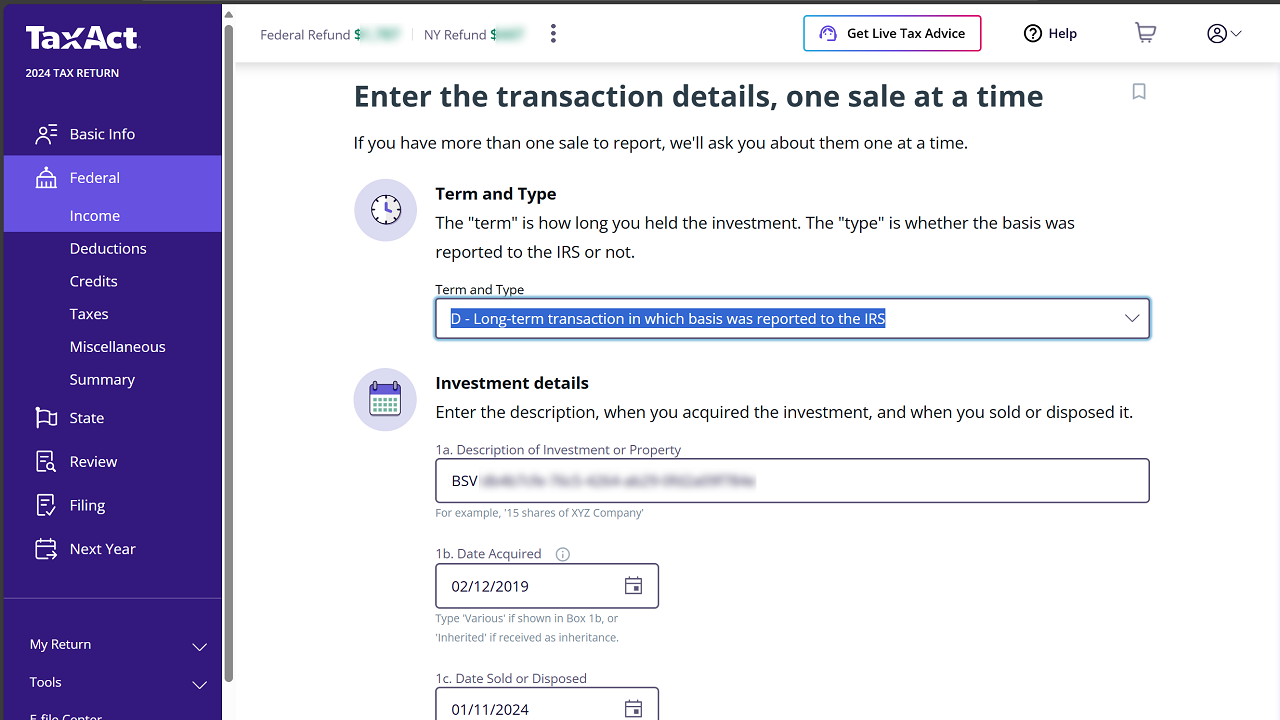

Dedicated cryptocurrency tax software is available (we haven’t tested these applications), but online personal tax services include tools for reporting your tax-related crypto activity. Either way, the advantage of using software is that you won’t need to deal with official forms and schedules. You just answer questions, and the apps deposit your answers in the correct places. All of the tax apps we reviewed let you enter transactions manually. You just need details like the below for each transaction:

Manual entry is fine if you just have a few transactions to record, but it becomes unwieldy if you are heavily involved with crypto.

As such, some tax sites offer additional options. TaxAct, for example, allows you to either enter information from a consolidated Form 8949: Sales and Other Dispositions of Capital Assets (attaching a PDF to your return) or upload a CSV file, which some exchanges make available. The app provides instructions on how to create and import transactions the latter way if yours doesn’t. You need TaxAct Premier for this task (currently $84.99 for federal returns and $59.99 per state).

Cryptocurrency transactions in TaxAct (Credit: TaxAct/PCMag)

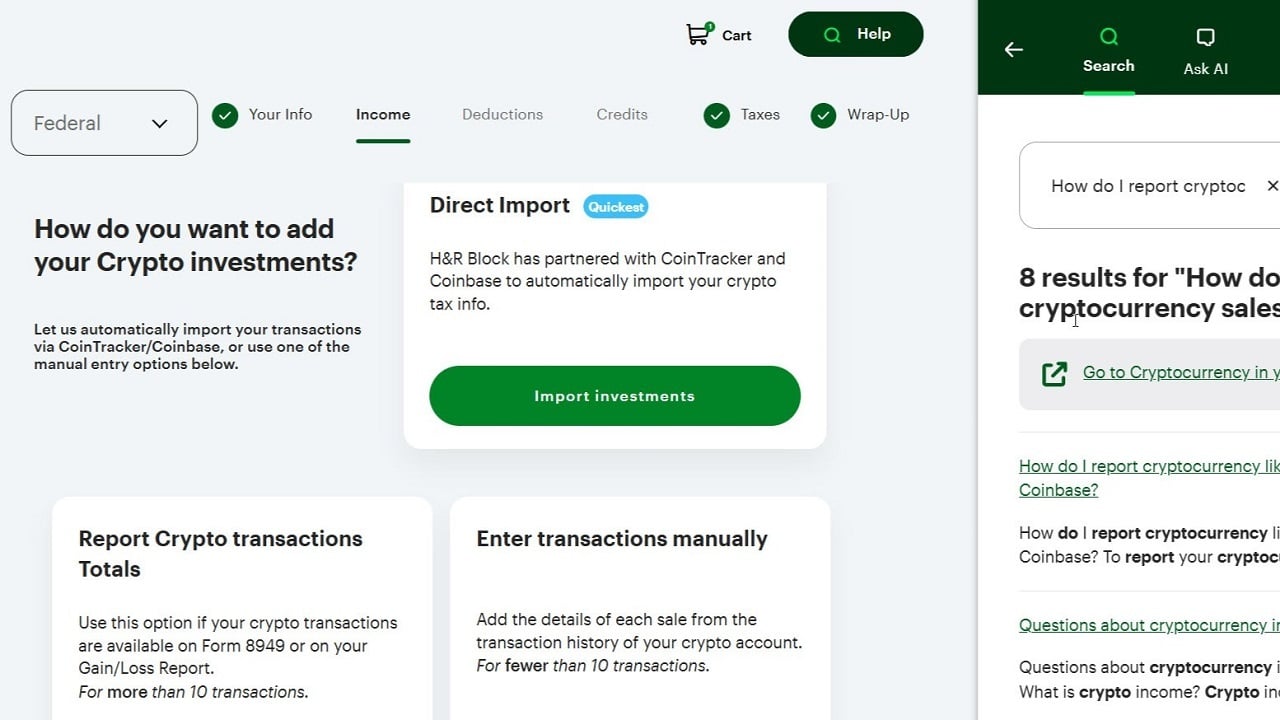

H&R Block provides automated imports through either Coinbase or CoinTracker. You can also report totals from Form 8949 or your Gain/Loss report. H&R Block includes several help files covering cryptocurrency issues and some context-sensitive help, but the guidance isn’t as thorough as it is in TurboTax. The Premium version, which supports crypto reporting, costs $95 for federal returns and $49 per state. If you’re using H&R Block or any other tax app and are a frequent trader, make sure to download your history periodically throughout the year since your exchange might limit you to three months of data, for example.

Cryptocurrency transactions in H&R Block (Credit: H&R Block/PCMag)

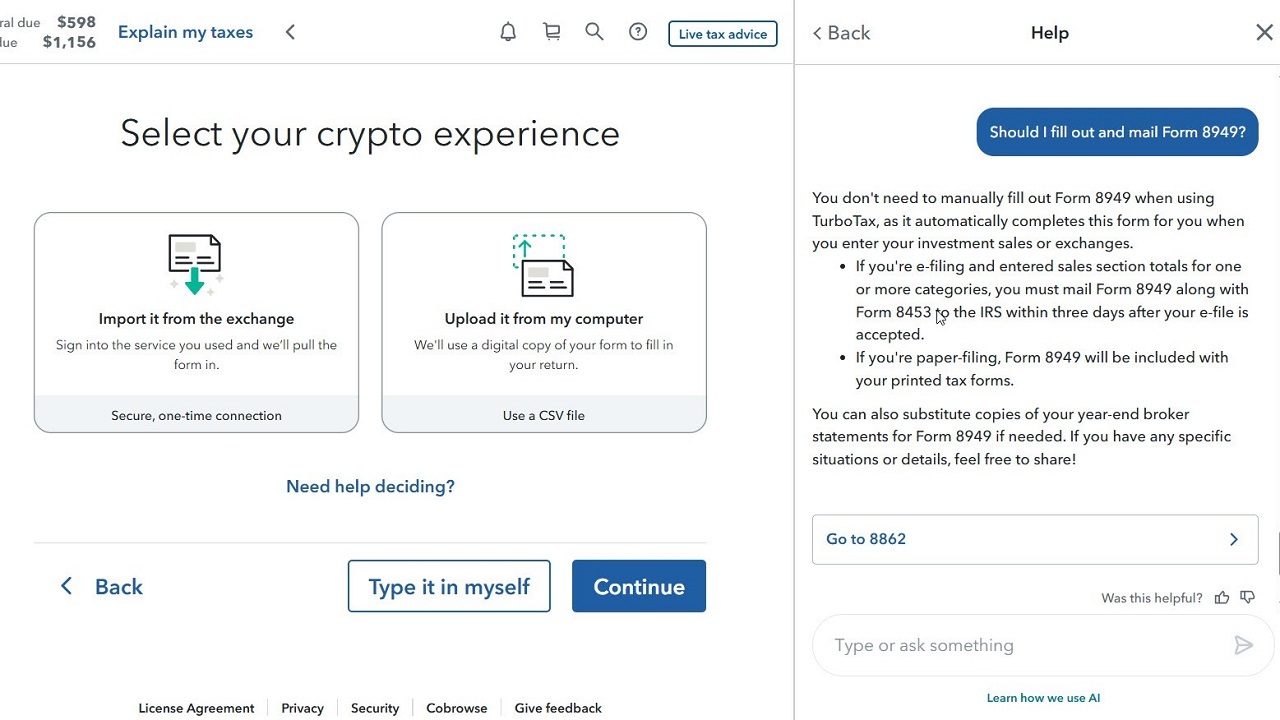

TurboTax goes further than any other app, offering comprehensive Q&As and more—and more understandable—guidance than competitors. You can import up to 4,000 cryptocurrency sales as CSV files. If you have more than that, TurboTax recommends using a tax aggregator like Bitcoin.Tax, CoinTracker, or CryptoTrader. You can also import directly from many financial services like Ethereum, Fidelity Investments, and Robinhood. You need TurboTax Premier (currently $129 for federal returns and $59 per state) to report any kind of investment sales.

Cryptocurrency transactions in TurboTax (Credit: TurboTax/PCMag)

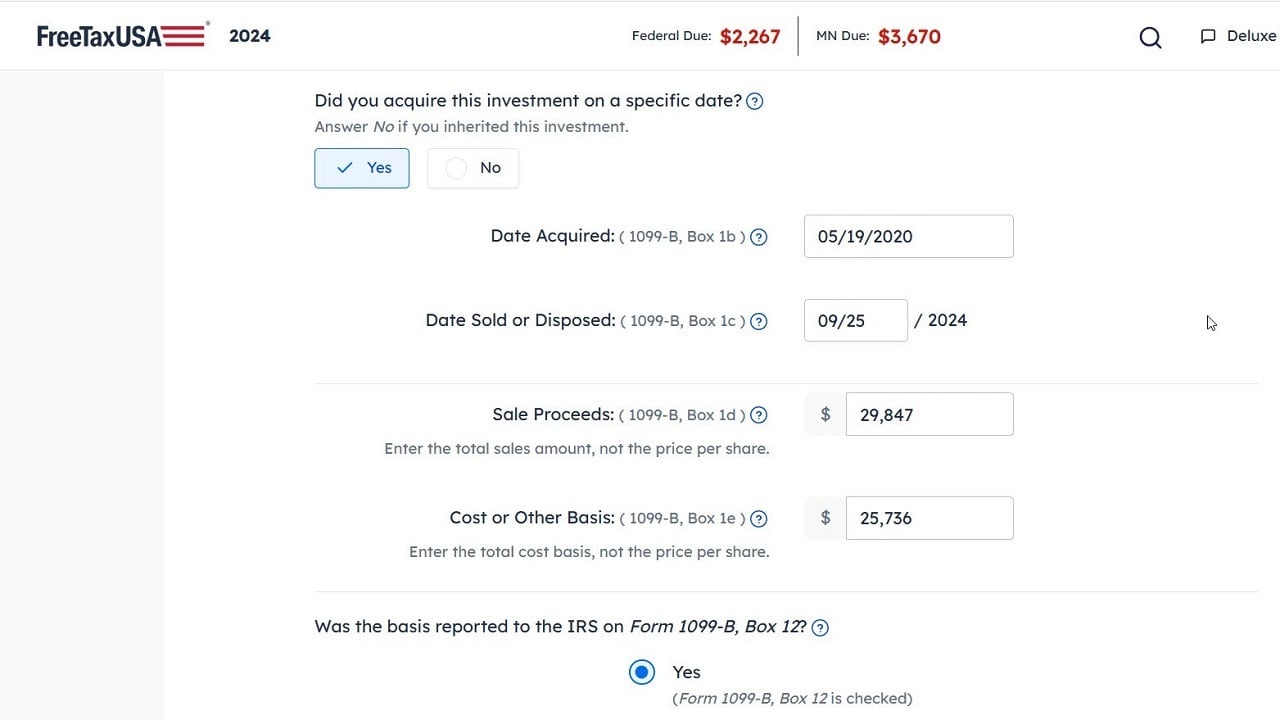

FreeTaxUSA provides a surprising amount of support for a free service (federal only; state returns cost $14.99 each). It has a good article that identifies the different IRS forms where you need to enter transactions based on how you received the cryptocurrency (such as investment, mining, and wages). It also has a series of excellent, understandable FAQs. FreeTaxUSA is also just exceptionally easy to use in general.

Cryptocurrency transactions in FreeTaxUSA (Credit: FreeTaxUSA/PCMag)

Do You Need a Pro for Crypto Tax Prep?

You can give virtual currency as a gift, transfer it between wallets or exchanges, and purchase it with US dollars without creating a taxable situation. But if you have numerous taxable events under your belt or need to catch up from past years, you might need to consult a professional, preferably a CPA who specializes in virtual currency tax issues.

If you’re going to go it alone, we suggest you use TurboTax Premier. But do whatever you need to do to include tax-related cryptocurrency activity thoroughly and accurately on your income tax return. Maintain pristine records and keep them for at least three years. The IRS has required you to report cryptocurrency translocation for years now, so it will certainly scrutinize your records during an audit.

Get Our Best Stories!

This newsletter may contain advertising, deals, or affiliate links.

By clicking the button, you confirm you are 16+ and agree to our

Terms of Use and

Privacy Policy.

You may unsubscribe from the newsletters at any time.

About Kathy Yakal

Contributor

Read the latest from Kathy Yakal

About Michael Muchmore

Lead Software Analyst