The US-Israel-Iran war tension has affected the crypto price significantly this month. With the escalation and de-escalation, investors’ sentiments have been severely impacted, which was clearly visible in the digital assets’ performance. However, as the days pass and investors get used to the current scenario, a shift in the crypto market is witnessed. Will the tokens explode next? Let’s discuss that.

Crypto Price Tumble Amid US-Israel-Iran War

June 13 marks the beginning of the escalation of the Middle East tension and the crypto price crash. That day, Israel launched the ‘Operation Rising Lion’ and air striked the Iranian nuclear facilities. Iran began a counterattack and even threatened to close the Strait of Hormuz, igniting fears of an oil-market shock.

With that, the crypto market crashed, losing more than a billion in liquidity in one day alone. The continuity of the Israel-Iran war, and especially the joining of the US, escalated the digital asset’s crash. On June 22, the US airstrike on Iran’s nuclear site, and Iran responded with a missile strike on Al-Udeid Air Base in Qatar.

The bull case of this weekend’s events:

While the Israel-Iran war has undeniably escalated with US involvement, it’s not all bad news.

In fact, there may be a situation where this weekend’s events lead to a faster conclusion of this conflict.

This situation would be one where… https://t.co/qnzbrBB7zE

— The Kobeissi Letter (@KobeissiLetter) June 22, 2025

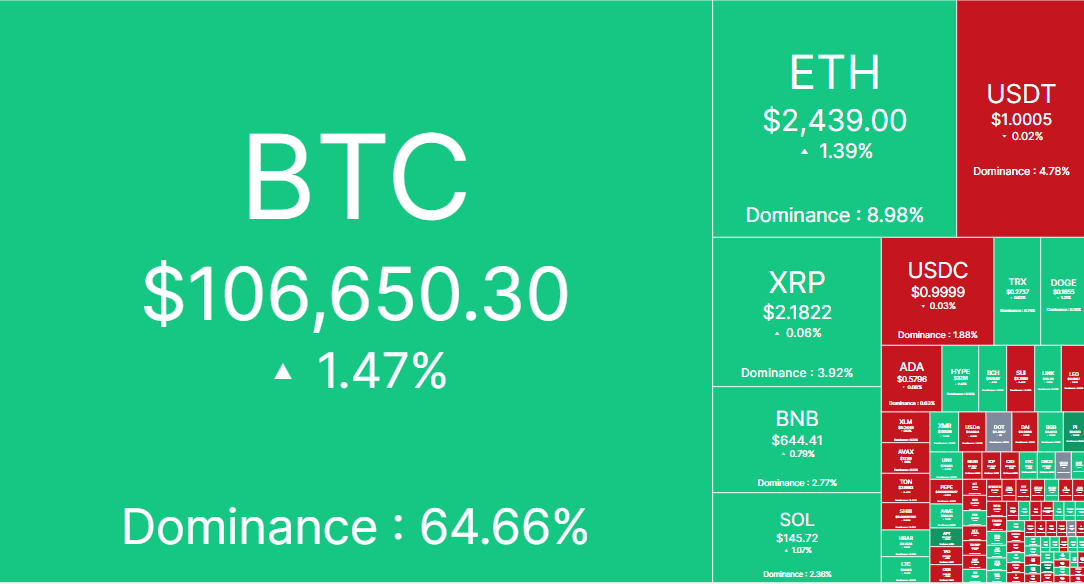

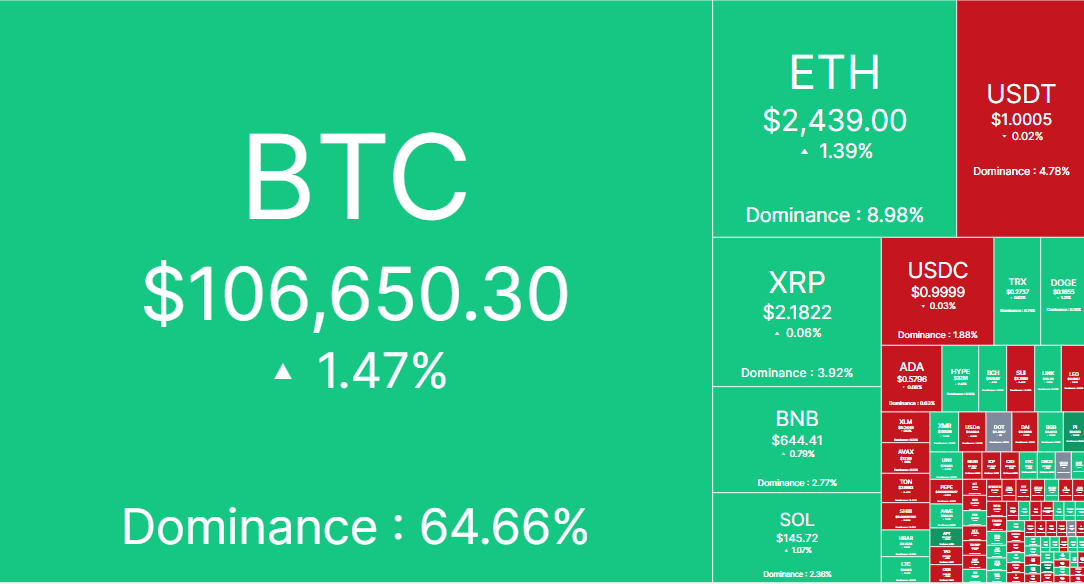

The cease-fire deal followed these events, and the cryptocurrency market flourished. Bitcoin price regained the rally to $106k, Ethereum price shot to $2.5k, and Solana hit $145. The same is true for the rest of the market.

Crypto Price to Explode Next?

The crypto price is on the rise today despite the US-Israel war conflict. The host of the House of Crypto alleged that crypto booms after major fear events. In his 18-minute YouTube video, he claims that historical data shows multiple instances of Bitcoin and altcoins’ strong rebound after sharp sell-offs.

The events include the FTX liquidation fears and geopolitical tension, and each time, the crypto prices exploded weeks or months after the crash. His analysis suggests that the panic selling offers the bottom of the market, which investors take as a buying opportunity.

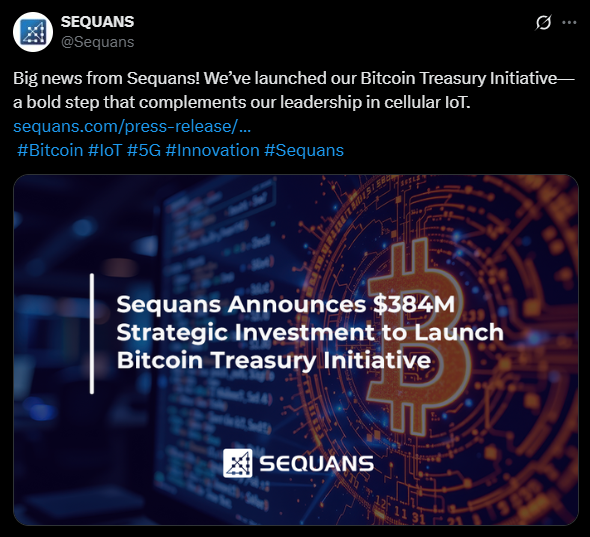

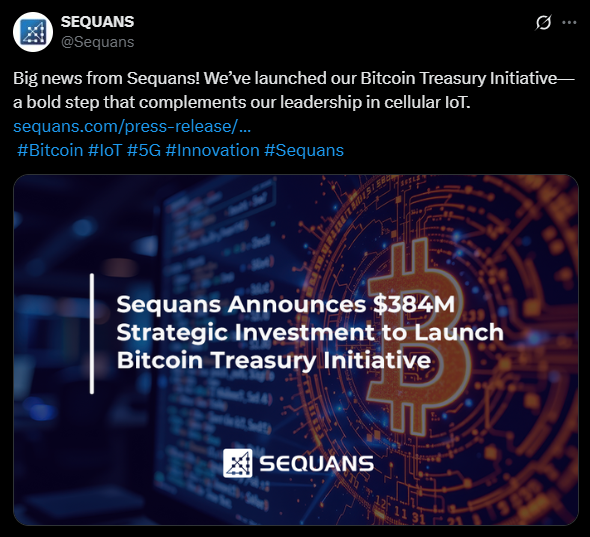

Notably, the whale activity has been relatively high for digital assets. Bitcoin and Ethereum ETF inflows are at their peak as buyers actively put money into them. Besides many more institutions, including Sequans Communications start Bitcoin Treasury.

Others like MicroStrategy and Metaplent continue Bitcoin buying. Additionally, the regulatory development is also coming, as the Genius Act reaches the House. So, not only the US-Israel-Iran war, but also other factors are contributing to the surge today. The same can favor a surge in the future as well, opening the possibility of a crypto price rally.

Individually, Solana, Ethereum, and SEI are showing strong rebounds past the dip. Bitcoin is only 5% away from the ATH. Besides, the exchange reserve dropped to a 10-year low, showcasing investors’ strong confidence in further rallies and desire to hold.

The continuity of the bullish momentum could create bull market-like conditions. However, the geopolitical and macroeconomic barriers are still persistent. Upcoming updates could shift the trajectory, so further continuous analysis is mandatory.

Frequently Asked Questions (FAQs)

The Israel-Iran conflict caused significant volatility in the crypto market, resulting in crypto prices crashing.

Following the ceasefire, Bitcoin and the rest of the crypto market rebounded, showing signs of further recovery.

Investor sentiment, institutional demand, regulatory developments, and others influence the crypto market.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: