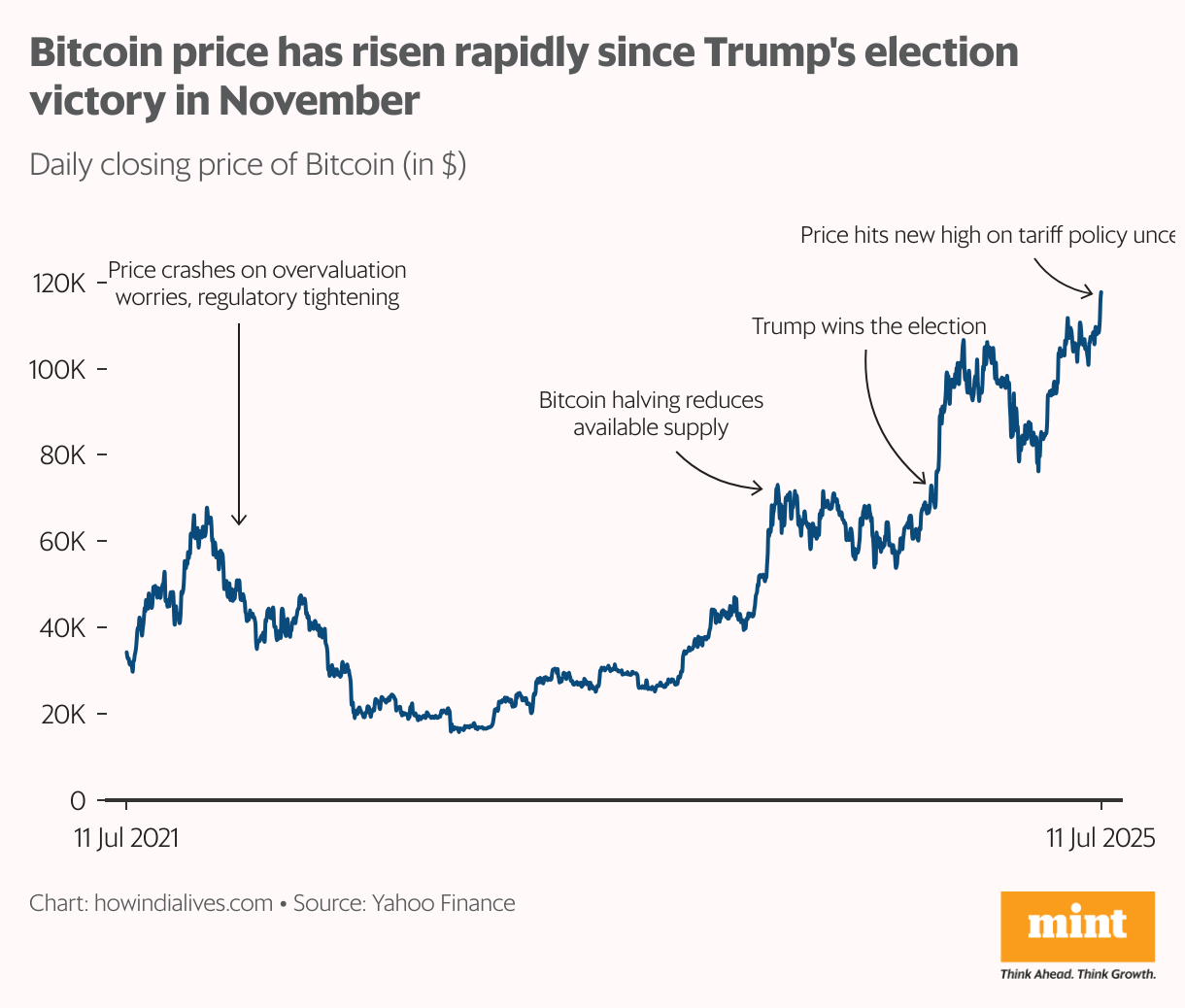

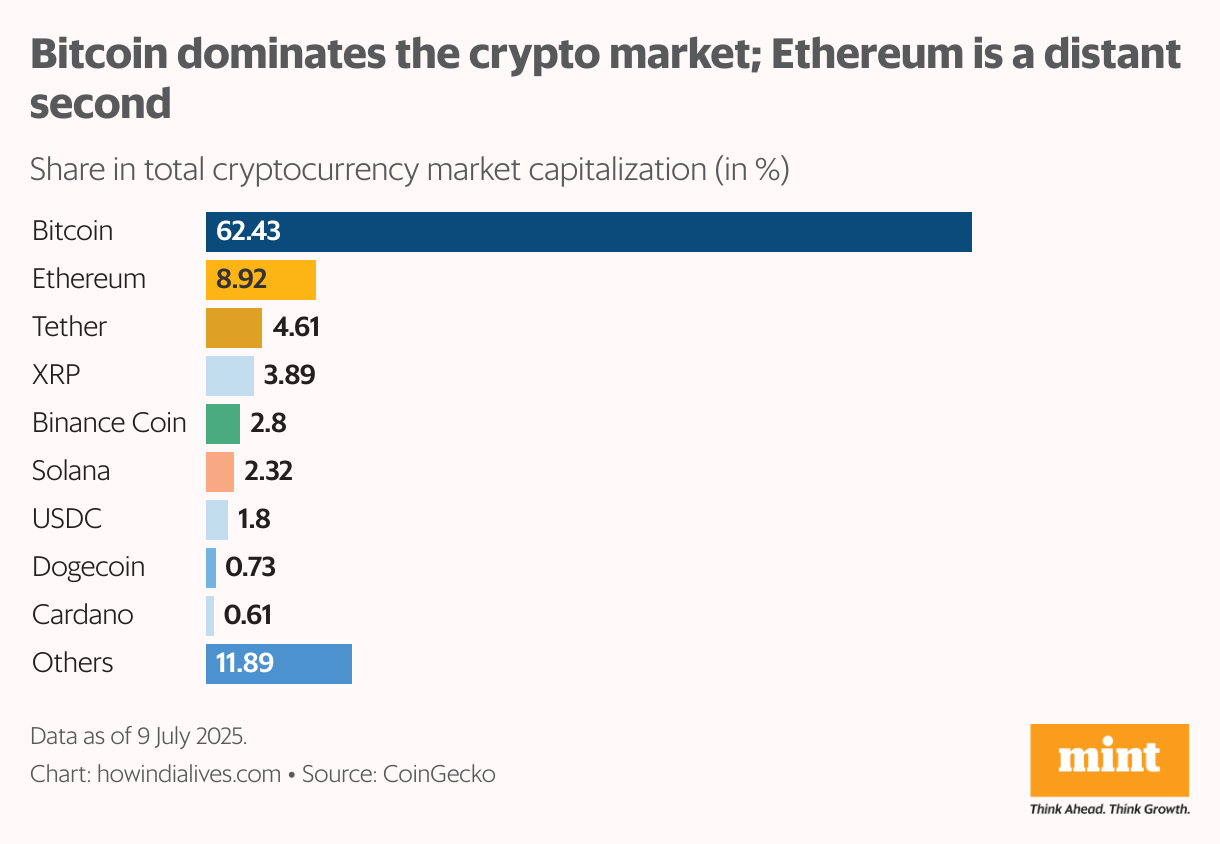

The jump in Bitcoin prices is part of a broader upward trend. Since Trump’s re-election in November, Bitcoin has continued to climb steadily, its market capitalisation now surpassing even that of Google. It is not just Bitcoin. Total crypto market capitalisation has grown from under $2.5 trillion in June 2024 to $3.7 trillion now.

These developments follow a significant shift in US crypto policy. Trump reversed his earlier anti-crypto stance and appointed several pro-crypto figures in key regulatory roles: David Sacks as the White House crypto czar, Paul Atkins to the Securities and Exchange Commission (SEC), and Brian Quintenz to the Commodity Futures Trading Commission (CFTC).

The SEC has dropped multiple enforcement actions and narrowed its interpretation of securities laws. The Justice Department shut its crypto enforcement unit on 4 April.

There were other policy signals, including an executive order prohibiting any US central bank digital currency and the creation of a Strategic Bitcoin Reserve using government-seized assets. Trump has also announced plans for a broader “Crypto Strategic Reserve” to include assets like Ethereum, Solana, and XRP.

Together, these actions signalled regulatory clarity and long-term policy alignment with the crypto sector, leading to higher investor confidence.

Capital moves

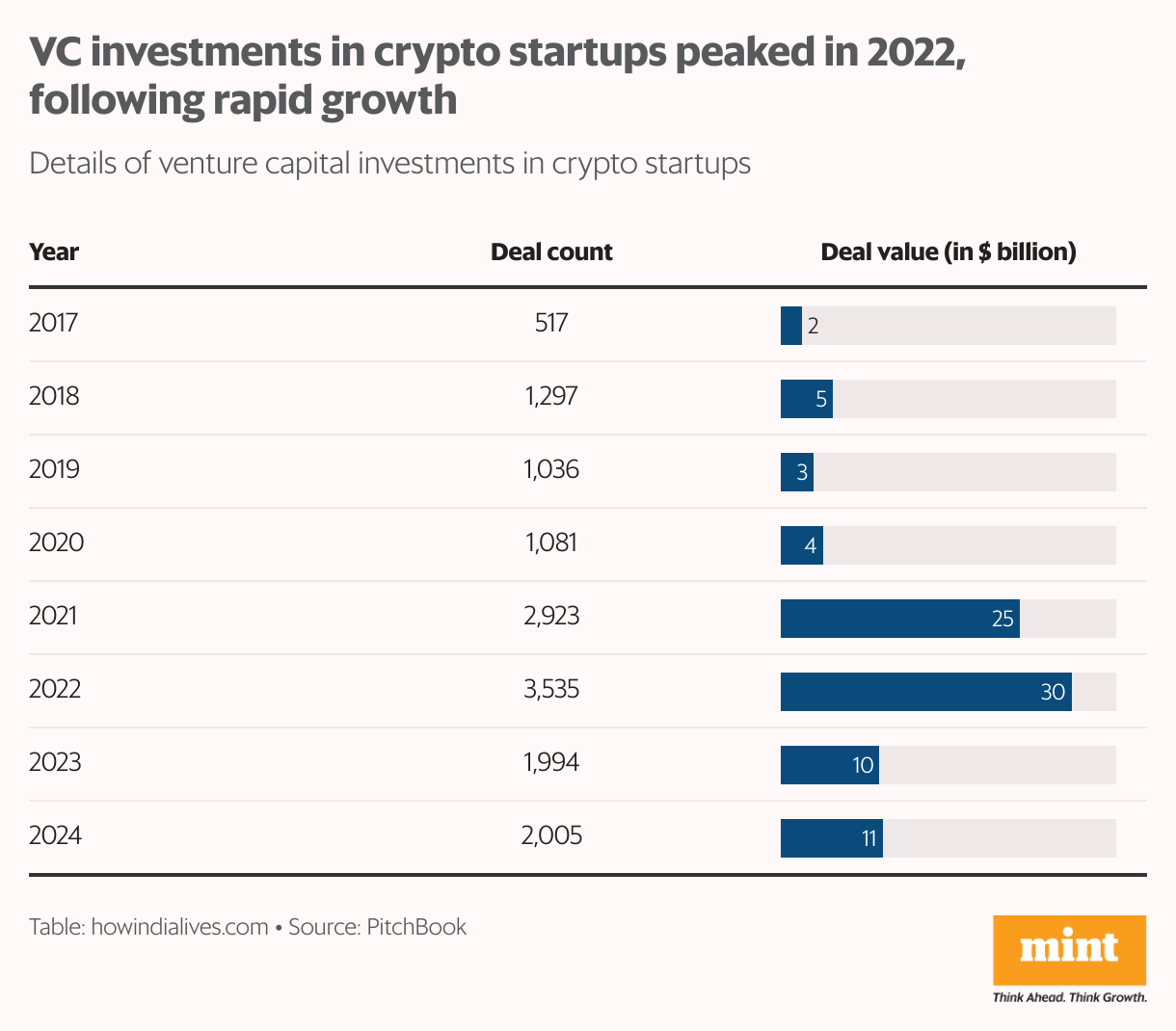

The regulatory clarity has boosted institutional interest in crypto. In the first quarter of 2025, venture capital investment in crypto startups reached $6 billion, according to PitchBook, compared with about $10 billion each in 2024 and 2023, when regulatory uncertainty and enforcement actions deterred large investors.

Asset managers have upped their exposure. Spot Bitcoin and Ethereum exchange-traded funds (ETFs) have seen strong adoption, with cumulative net inflows surpassing $50 billion by mid-2025. Total ETF assets stood near $140 billion, making them among the fastest-growing financial products this year.

The SEC’s rollback of SAB 121, an accounting rule, has removed key custodial barriers for banks. The US Department of Labor has also eased restrictions on crypto allocations in retirement accounts. These moves have helped integrate crypto into mainstream financial products, bringing back banks, pension funds, and institutional allocators.

Token stability

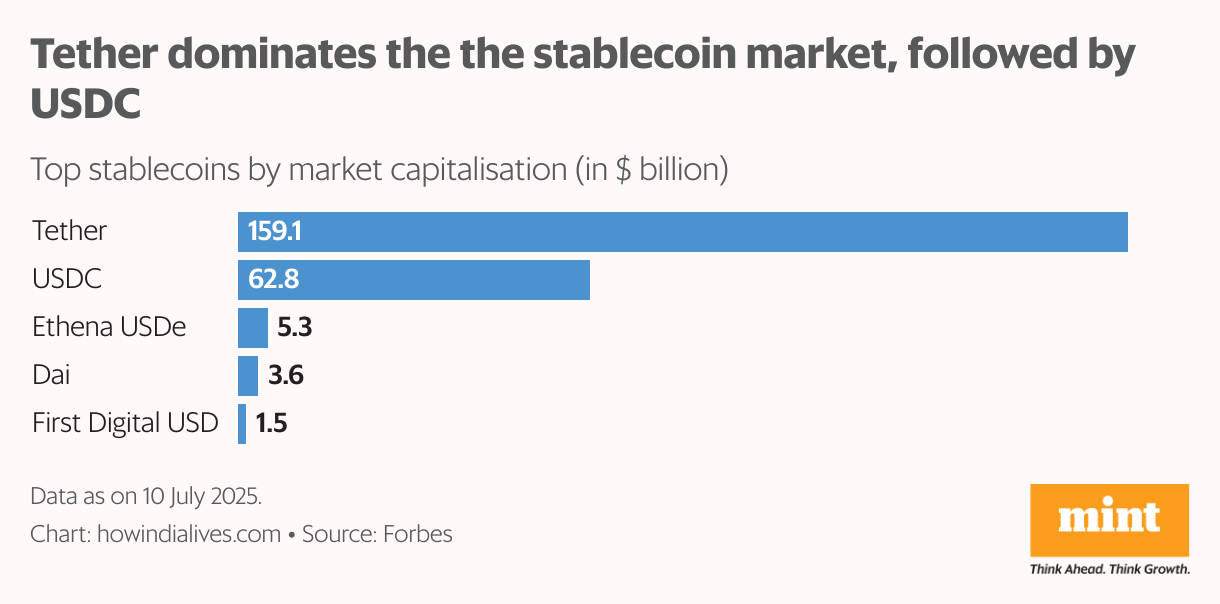

Another area that has seen action under Trump is stablecoins—digital tokens pegged to fiat currencies like the US dollar. According to Forbes, the total market capitalisation of the world’s top five stablecoins is $230 billion. Business-to-business stablecoin payments increased from under $100 million to over $3 billion per month over the past year.

This expansion, again, was driven by regulatory action. In June, the US Senate passed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act. It provided a clear legal framework, mandated strict customer protection standards, and imposed know-your-customer and anti-money laundering compliance.

Adoption has grown across financial services, as companies use stablecoins for payroll, treasury management, and cross-border payments. PayPal and Visa are integrating stablecoins for payments. Stripe launched stablecoin financial accounts in 101 countries. BNY Mellon, a major custody bank, has moved to hold reserves for Ripple’s stablecoin, a sign of stablecoins’ integration into mainstream financial infrastructure. Ripple, which issues the XRP cryptocurrency, launched the RLUSD stablecoin in July.

Risk layer

Recent developments related to cryptocurrencies, however, have renewed concerns over volatility, regulatory gaps, and illicit activity. Bitcoin and other cryptocurrencies remain sensitive to political signals. The GENIUS Act has raised questions about unintended consequences, including financial instability and consumer harm. Market participants cite “random policy shocks” and “instant dumps” linked to presidential remarks.

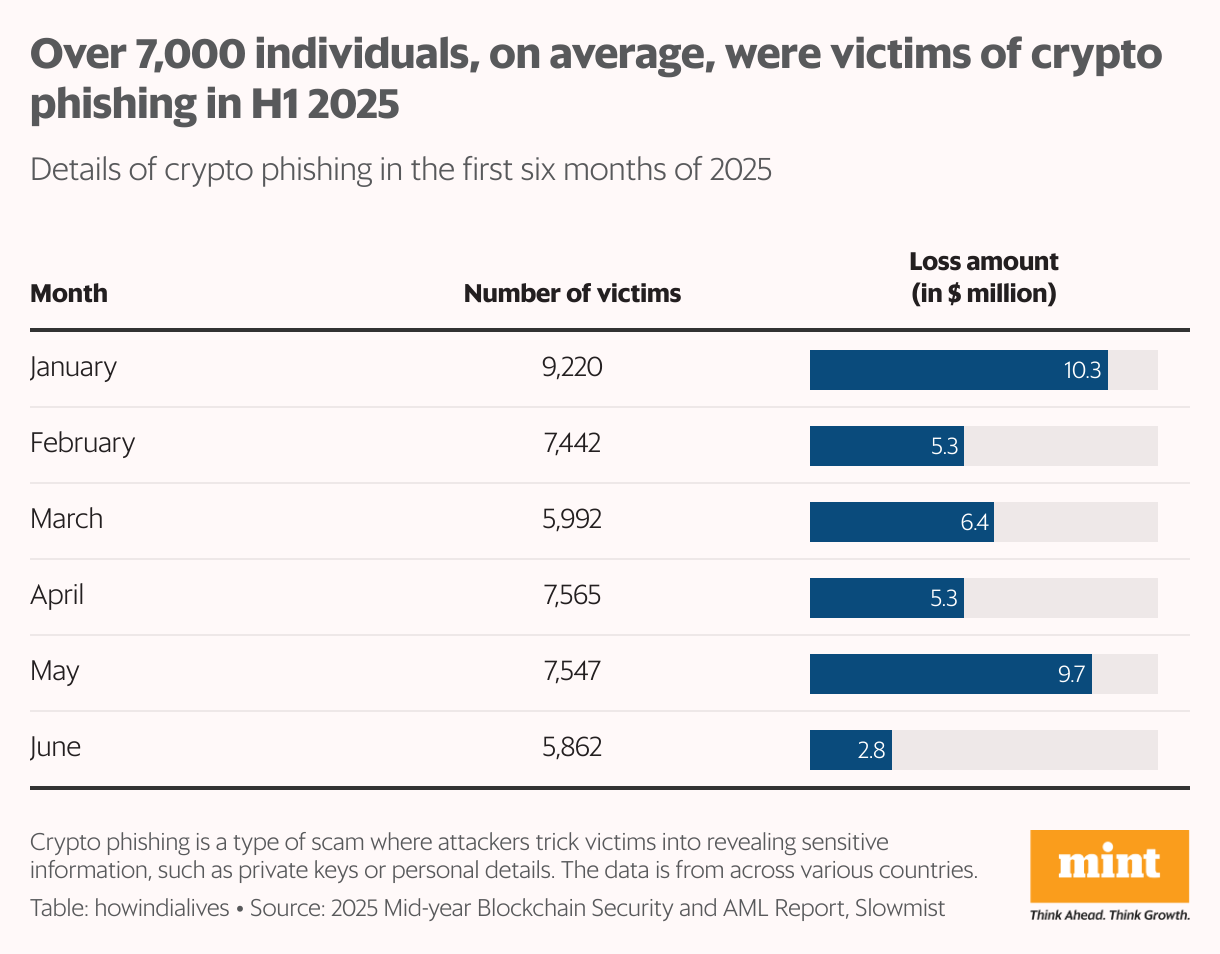

Illicit use remains significant. In 2024, hacks caused $2.2 billion in losses, with stablecoins accounting for 63% of illicit crypto transaction volume. Ransomware payments reached $75 million. In the first half of 2025, crypto phishing attacks in the Web3 ecosystem led to $39.7 million in losses across 43,000 addresses, using tactics such as wallet-level bulk approvals, impersonation via social media, deepfake-led social engineering, and malicious browser tools.

Additional concerns relate to conflicts of interest. Trump has launched the $TRUMP meme coin, followed by a separate digital token from US First Lady Melania Trump. The family also holds stakes in World Liberty Financial, issuer of the USD1 stablecoin and WLFI token. While regulatory clarity has boosted adoption, the close alignment between policy and personal financial interest has raised questions about transparency and governance.

www.howindialives.com is a database and search engine for public data.