A renowned crypto investor has outlined a brave XRP price prediction saying that Ripple might rally to $3,000 this cycle. The analyst’s bullish forecast comes at a time when bearish headwinds are causing a downturn across the broader crypto market as XRP struggles to sustain levels above the crucial support of $2.

Crypto Investor Shares Brave XRP Price Prediction

Crypto investor Random Crypto Pal has shared a bold XRP price prediction and likened the 2017 XRP price rally to the 2025 price movement. He noted that in 2017, Ripple climbed from $0.003 to $3.31, which was an over 110,000% price gain, If it repeats this pattern, XRP could reach $3,000.

Pal’s bullish prediction has attracted criticism from other crypto investors. In response to his X post, one user noted that in 2017, XRP only needed billions of dollars to achieve the $3.31 price within months. However, for an upswing to $3,000, Ripple needed trillions of dollars in buying demand, which was not feasible.

More importantly, at a price of $3,000 and a circulating supply of $58 billion, XRP would have a $174 trillion market cap. This is more than six times higher than the annual US GDP. It would also be three times bigger than the entire US stock market, which has a market cap of $69 trillion.

This massive market cap valuation shows why a $3,000 XRP price prediction is hilarious. Ripple is unlikely to reach this level with the current amount of token supply.

Ripple Technical Analysis As Another Crash Looms

XRP price today trades at $2.09 with a 3.6% decline in 24 hours. Ripple is on the verge of another crash and might drop below $2 as investors flee from risk assets amid fears of President Trump’s tariffs and reduced odds that the Federal Reserve will trim interest rates.

On the one-day price chart, XRP had formed a rounding top pattern, which signals that the current trend might change to bearish. The height of this rounding top pattern indicates that Ripple could plunge by 17.45% from its current price level of $1.76.

Technical indicators support the bearish setup depicted by the rounding top pattern. The RSI is leaning towards being oversold and depicts bearish momentum while the ADX lime is also tipping north, another sign that the downtrend is strong.

As a recent Coingape article reported, if the XRP price drops below $1.90. It might crash to $1. Given that XRP has already dropped below the neckline of the rounding top, a crash is likely to happen in the near term.

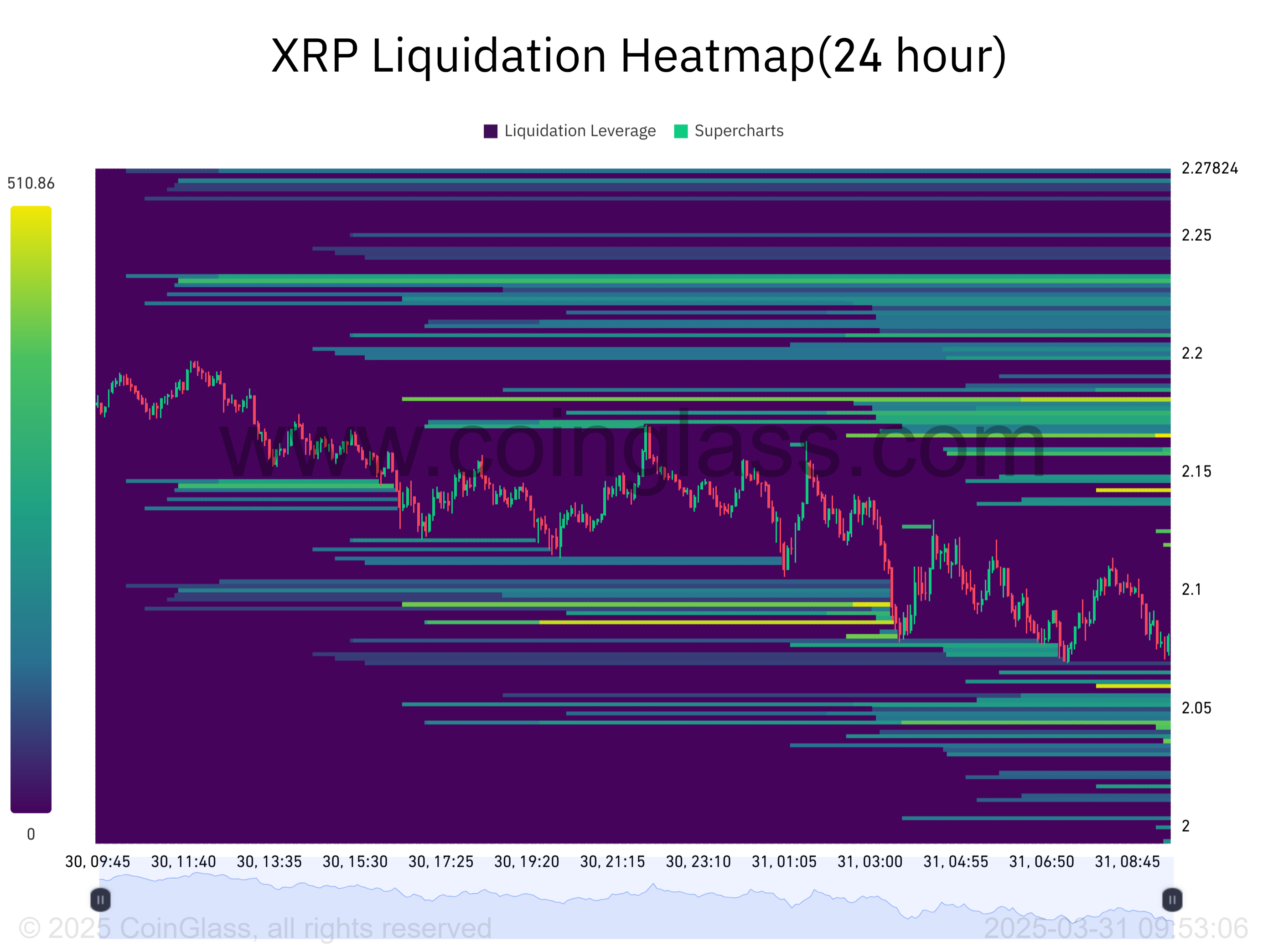

XRP’s Liquidation Heatmap Supports Bearish Outlook

Besides the rounding top pattern, the liquidation heatmap supports the bearish outlook for XRP. Data from Coinglass shows that there is a hot liquidation zone at $2.05, where many long traders are at risk of being liquidated.

These liquidation zones tend to act as a magnet that pulls the price down. Moreover, the closure of long positions increases selling activity around an asset. This hints towards more bearish trends facing Ripple.

Frequently Asked Questions (FAQs)

According to crypto investor Pal, XRP can reach $3,000 if it repeats the 2017 cycle. However, this price target is unrealistic as it would need Ripple to add more than $173 trillion to its market cap.

Ripple has formed a rounding top pattern on the 1-day chart suggesting that the price might drop by 17% from the current price to $1.76.

XRP’s liquidation heatmap shows a strong magnet zone below the current price. XRP might drop to this level and trigger long liquidations that will push the price lower.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: