- Total Value Locked in the DeFi market is back at the pre-Terra Luna fiasco level due to Ethereum’s recent rally.

- Investors can take profits from DeFi services such as staking, lending, or yield farming.

- Investors should remain cautious as DeFi markets are volatile and carry higher risk.

The Decentralized Finance (DeFi) segment is regaining popularity driven by a surge in Total Value Locked (TVL) and an increasing user base, as investors’ growing risk appetite fuels a capital rotation from Bitcoin (BTC) to Ethereum (ETH), Solana (SOL), and other top layer-1 cryptocurrencies.

By venturing into DeFi-related products, investors can earn passive income from services including staking, lending, or yield farming.

However, earning money in DeFi requires a careful assessment of risks such as rug pulls, hacks, impermanent losses, or market volatility, as well as returns based on yield offerings across multiple platforms, staking or locking periods, among other factors.

What is DeFi?

Similar to the Traditional Finance (TradFi) world, Decentralized Finance (DeFi) services provide an alternative to the conventional financial system by leveraging digital assets.

Ethereum’s programmable blockchain, launched in 2015, marked the beginning of Smart Contracts and Decentralized Applications (dApps), allowing developers to launch Decentralized Exchanges (DEXs) and layer-2 protocols for lending or borrowing, staking, and liquidity provision, among other applications.

Smart contracts are self-executing lines of code based on predetermined conditions, thereby eliminating the need for intermediaries and establishing a trustless mechanism.

DeFi expands the financial inclusion horizon by removing barriers such as account creation or credit scores, while increasing opportunities with 24/7 operations, greater transparency, and easier audits.

DeFi market revives with Ethereum’s return

At the peak of the 2021 bull run, the DeFi market TVL surpassed $178 billion, which reflects the value of assets locked on all the protocols. However, the crash of Terra in May 2022, followed by the FTX exchange collapse in November, sparked a risk-off sentiment among users and led to a sharp drop in TVL to under $40 billion in 2023.

DeFi market TVL. Source: DeFiLlama

More recently, the increased network activity on the Ethereum blockchain and its rising institutional adoption have catalyzed the revival of DeFi. As of August 5, 2025, DeFiLlama data shows the current TVL stands at $134 billion, a significant turnaround from under $40 billion in 2023.

The liquidity in the market has increased to $267.93 billion, driven by the above reasons and the US GENIUS Act, while daily volumes on DEX have surpassed $10 million.

DeFi services to look at to earn passive income

Sidelined investors on the lookout for passive income amid the returning demand should know about the basic DeFi services. These include staking, lending or borrowing, or yield farming.

Staking

Staking offers one of the simplest ways to earn passive income, where investors can deposit or delegate their cryptocurrency on Proof-of-Stake (PoS) chains. These PoS chains utilize validators to verify transactions while incentivizing users through the collection of network fees or direct rewards.

Typically, staking requires a large sum to ensure the credibility of validators. To overcome this limitation for small investors, centralized exchanges (CEXs) act as intermediaries that pool staked crypto and handle the validator duties.

According to a Coingecko report, Cosmos (ATOM) and Polkadot (DOT) offer some of the highest yields, of up to 18.5% and 11.5% annually, respectively. The primary risks associated with staking include fluctuations in the crypto spot prices and penalties for validators.

For example, if 100 ATOM tokens, worth $100 at the time of staking, are locked up for a year, the reward will be 18.5 additional ATOM tokens. However, if the spot price declines, so will the final value of the total 118.5 ATOM tokens, and vice versa.

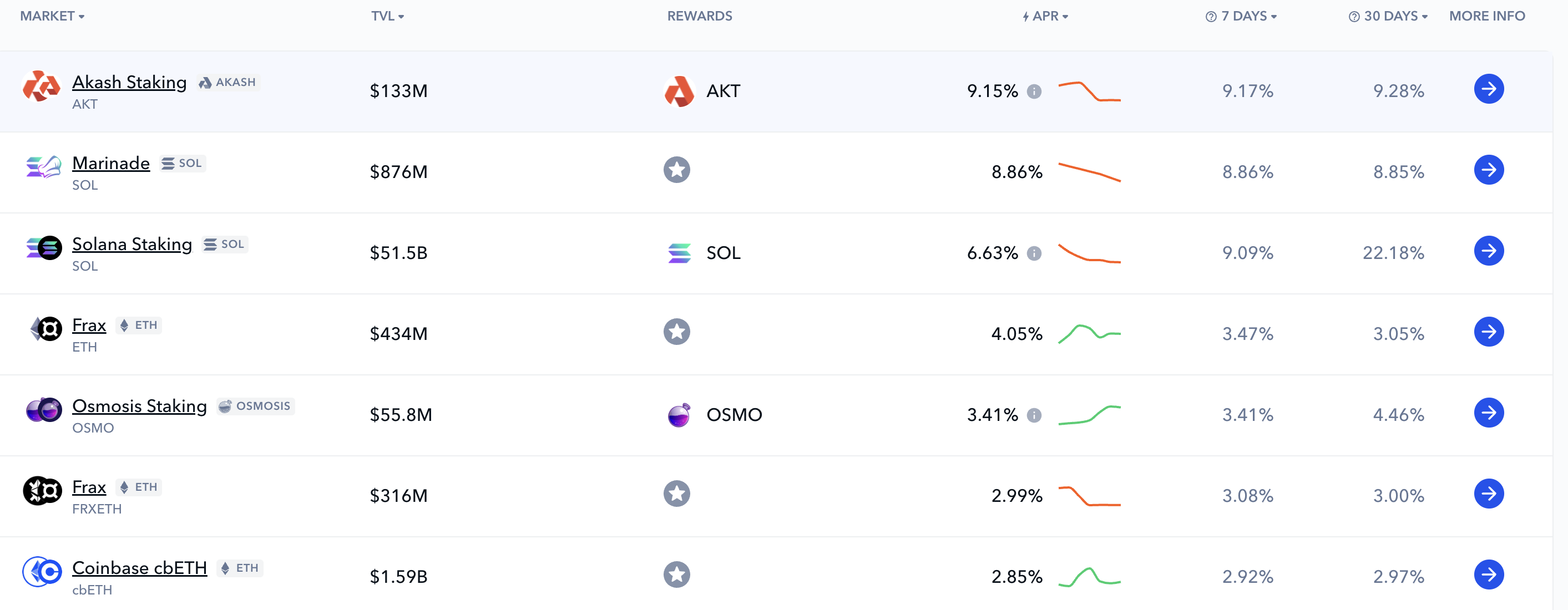

Investors could compare the staking rewards on websites such as Bitcompare or Stakingrewards.

Staking rewards. Source: Bitcompare

Yield farming

Yield farming involves investors depositing crypto tokens, typically in pairs, into a liquidity pool available on DEXs. In return for providing liquidity on such platforms, users are incentivized with higher returns compared to staking.

The greater yields come at increased risk, such as impermanent loss, smart contract bugs, rug pulls, or protocol hacks.

However, one of the key benefits of yield farming is the flexibility to withdraw the deposit pair of tokens, unlike the locking schedule in staking or lending.

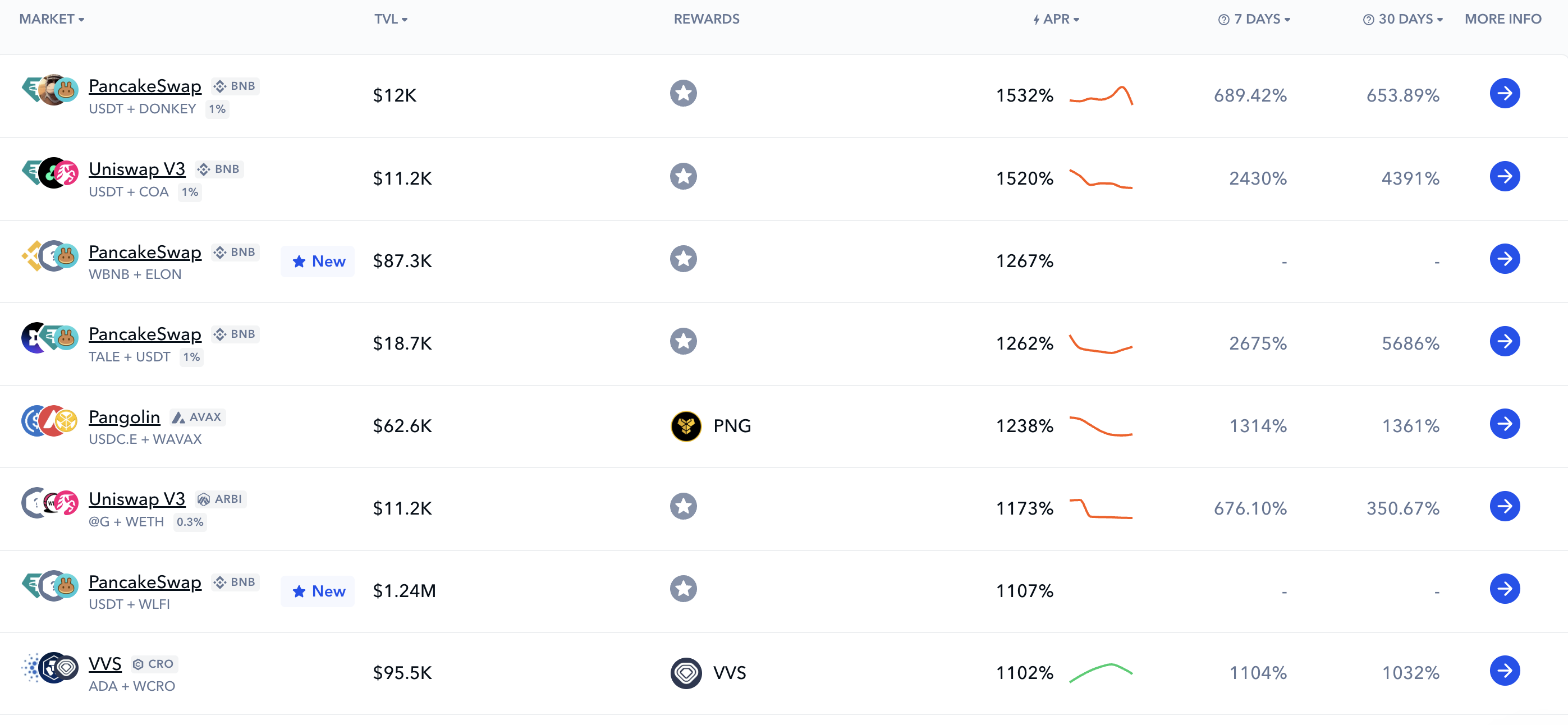

According to De.Fi, the multiple liquidity pools on Uniswap and PancakeSwap offer annual yields from 1,200% to 1,500%.

Yield farming rates. Source: Bitcompare

Lending

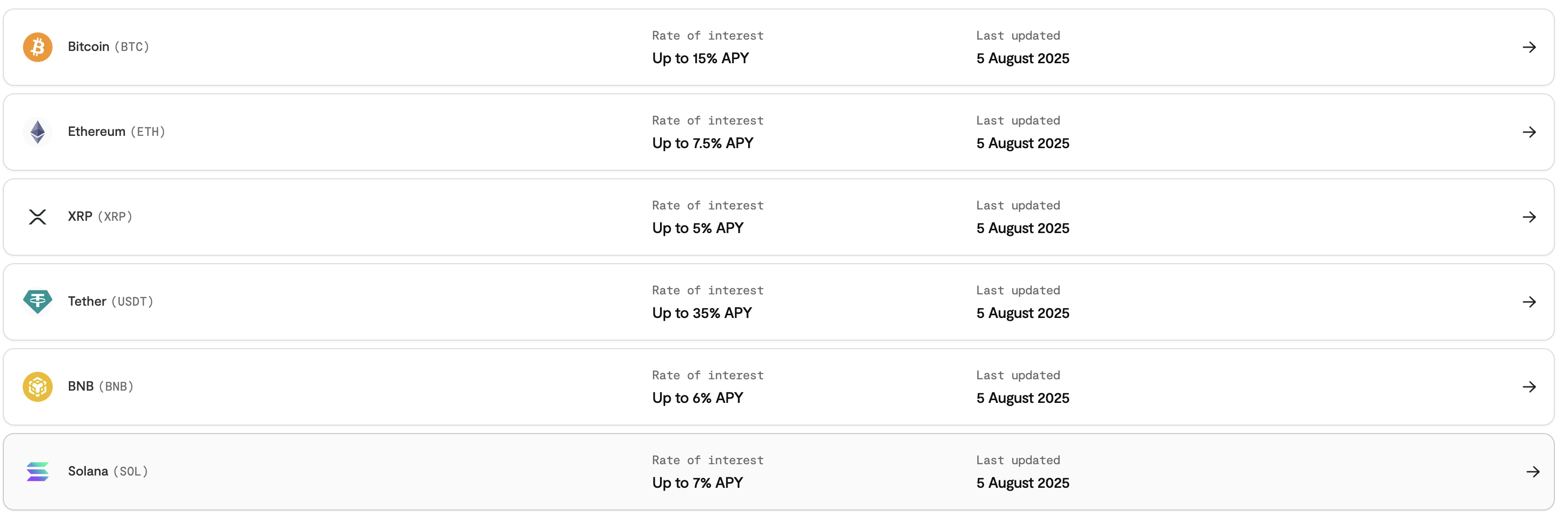

Investors could lend their held crypto tokens to borrowers on multiple DeFi platforms in return for interest. Lenders might have to wait for the predetermined tenure to regain the loaned crypto, with rates ranging from 3% to 15%. Investors can compare the lending rates of different tokens across various platforms on Bitcompare.

Lending rates. Source: Bitcompare

Top DeFi platforms

Investors switching from traditional finance or exploring decentralized finance may find such services in centralized crypto exchanges like Binance, Coinbase, or KuCoin, which have begun to offer multiple DeFi services.

Still, seasoned DeFi users may consider ad-hoc platforms such as Uniswap, Jupiter, or Flare for passive gains or to unlock the DeFi capabilities of tokens like Ripple’s XRP.

Uniswap

Uniswap is the leading decentralized exchange, with over $5.50 billion in TVL, built on the Ethereum blockchain. Users can utilize ERC-20 tokens (cryptocurrency tokens built on the Ethereum chain) to access multiple DeFi services.

Jupiter

Jupiter is a DEX aggregator built on the Solana blockchain, enabling investors to compare prices across multiple DEXs and find the best rates for token swaps. Jupiter also offers flash loans as a means to boost user activity.

Flare

Flare is a layer-1 blockchain designed to unlock the DeFi capabilities of non-Ethereum Virtual Machine (EVM) tokens, such as Ripple’s XRP. Currently, XRP DeFi roles are limited to the XRP Ledger (XRPL), whereas Flare aims to provide XRP staking in exchange for Liquid Staked Tokens (LSTs), which can be used in other services.

Risk Involved in DeFi

Impermanent losses

Investors may face impermanent losses when investing in liquidity pools that are driven by spot market price changes. For example, let’s say a liquidity provider deposits 100 ETH worth $100 and 100 USDT in a DeFi pool for swapping USDT for ETH or vice versa.

In the event that ETH shoots up to $110, arbitrage traders would acquire ETH at a discount. This leaves the provider with more tokens that are less valuable and often results in an opportunity loss when compared to simply holding.

However, the loss is not permanent unless the liquidity provider exits the pool. To offset this, the provider could wait for the token price to revert to its original value.

Rug pulls

Rug pulls commonly occur in many low-level DeFi projects or meme coins, where the project developers dump the majority of the tokens swapped for other valuable crypto. To avoid investing in rug pulls, investors are advised to conduct thorough due diligence.

Hacks

DeFi bridges lack the regulations and encryption found in traditional finance, making them a common target for cybercriminals. In such cases, the decentralization feature often becomes a bug, a roadblock safety measure that could have been performed instantly to secure the lost funds, unlike the traditional finance world. In recent times, the Cetus hack of the Sui ecosystem and the CoinDCX hack in India have raised concerns among investors.

Conclusion

DeFi services offer investors the opportunity to put their crypto to work and generate passive income. However, the risks associated with services such as yield farming or lending act require caution and proper understanding of the services and the crypto tokens involved.

Still, for beginners, features such as staking offer a low-risk option to earn additional returns on crypto holdings.