Crypto Wallet Trends in 2025 (Photo by Smith Collection/Gado/Getty Images)

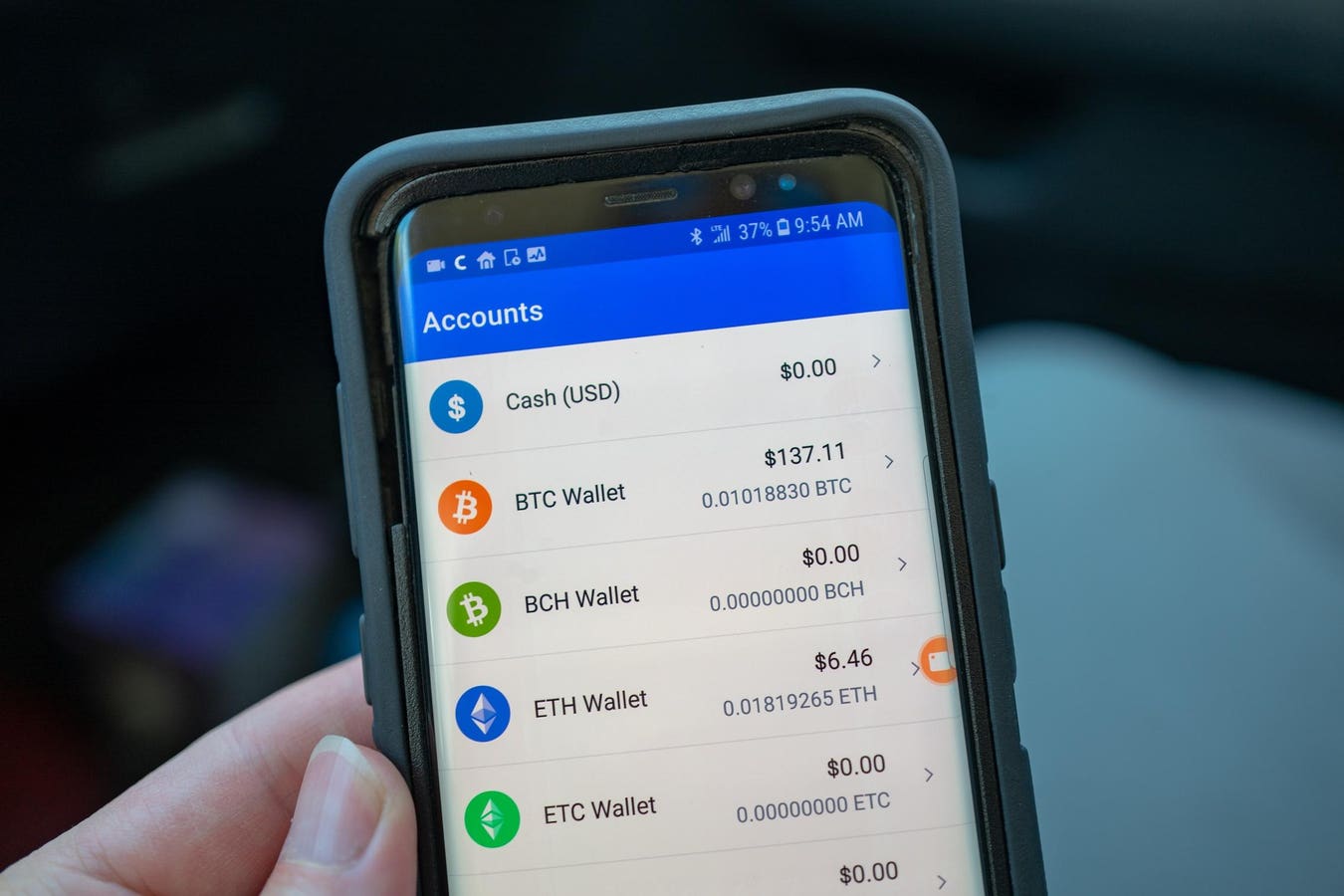

If you’re anything like me, you’ve seen crypto wallets evolve from niche products into indispensable superapps shaping how millions globally interact with blockchain technologies.

But I wanted to see it in the data. So, I found the new report from Dune Analytics and Addressable.io.

Now, having done a deep dive into the Dune and Addressable “Crypto Wallets 2025” report, three transformative themes stand out—smart wallet innovation, wallet ecosystems evolving into financial superapps, and clear geographic trends shaping wallet adoption.

Mats Olsen, Dune’s Co-founder and CTO

Dune’s Co-founder and CTO, Mats Olsen, explained to me, “At Dune, we believe data is the backbone of innovation in web3. Our mission has always been to make crypto data accessible. It’s important to note that wallet data isn’t just a tool for analytics—it’s the foundation for building smarter, more intuitive applications that empower users to own and navigate their digital lives. “

Let’s unpack these powerful shifts and what they mean for the future of crypto.

1. Smart Wallets Are No Longer Optional—They’re Becoming the New Default Crypto Wallet

Smart wallets are unlocking a better crypto UX. These Smart wallets work thanks to new technology called account abstraction and something known as ERC-4337. These let wallets do more advanced things—like letting you log in without a password, making transactions without paying fees yourself, and even recovering your wallet if you lose access.

The Dune and Addressable report pulled out the essentials on Smart Wallets.

The most notable growth story? Coinbase Smart Wallet, which saw weekly active users jump from 15,000 in January 2025 to over 40,000 by April 2025, largely due to its native integration with Base, Coinbase’s Layer 2. This flywheel—app onboarding + onchain execution—has positioned it as the most prominent consumer-facing smart wallet.

And, Base has emerged as the leading network for smart wallet activity, with over 65% of smart account deployments and 87% of all UserOperations by April 2025. It’s become the go-to execution layer for high-frequency, low-cost smart wallet usage.

Although Safe dominates in raw deployment numbers—43 million accounts and 63% market share—many of these are backend implementations, such as those automatically deployed by apps like Worldcoin. In contrast, platforms like Coinbase Smart Wallet are seeing direct consumer usage and growing retention, now approaching 60% returning user rate.

So what’s the real takeaway? Smart wallets are shifting from technical novelty to infrastructure backbone. Whether embedded in apps or powering direct user interactions, they’re defining the next era of Web3 onboarding.

2. Crypto Wallets Are Becoming the Superapps of Web3

Just like superapps in Asia—such as WeChat or Grab—combine everything from payments to messaging into one app, crypto wallets are transforming into all-in-one financial superapps. They’re becoming central hubs where users can manage every aspect of their digital lives.

But what exactly are these wallets doing—and why does it matter?

Today’s wallets go far beyond storing tokens. They now offer integrated tools that make engaging with crypto simple, fast, and powerful:

- Swapping tokens: This allows users to exchange one cryptocurrency for another—like trading ETH for USDC—directly within the wallet. No need for a centralized exchange. It’s quick, user-controlled, and keeps funds secure.

- Earning staking rewards: On certain blockchains, users can “stake” their tokens to help operate the network. In return, they earn passive income—similar to interest, but on the blockchain.

- Bridging assets across chains: Users can move tokens between different blockchains (like Ethereum to Solana) without leaving the wallet. This gives access to more apps, communities, and opportunities across the Web3 ecosystem.

- Accessing DeFi apps: Wallets now connect directly to decentralized finance platforms, letting users lend, borrow, and invest without relying on traditional banks or intermediaries.

- Playing blockchain games: As on-chain assets gain traction, wallets are becoming the gateway to blockchain-based games. Players can store, use, and trade digital items all from one place.

These services once required using multiple platforms and tools. Now, they’re accessible with just a few taps from a single wallet.

And the adoption is real:

- Binance Wallet now handles over 33 million token swaps per week, with nearly $9 billion in transaction volume.

- Phantom, a wallet designed for Solana, reached 10 million swaps weekly, accounting for almost 20% of Solana’s total network activity at peak times.

Phantom Wallet

Supporting this shift are infrastructure providers like Privy and Reown. Privy, for instance, allows apps to create secure wallets at login—in under 200 milliseconds. That makes it easy for new users to get started and for developers to build wallet-native experiences.

And did you know that AI Agents now have their own Crypto Wallets?

In short, wallets are no longer just tools for crypto insiders. They are quickly becoming the financial superapps of Web3—combining banking, investing, gaming, and identity into a single, streamlined experience.

3. Geographic Patterns Reveal Crypto Wallet Adoption Strategies

One of the most eye-opening insights from the Dune Analytics and Addressable report is the clear geographic diversification in wallet adoption.

In Asia, custodial wallets like OKX and Bitget dominate, driven by ease-of-use and strong local brand recognition. OKX alone controls a substantial portion of wallet capital in countries like South Korea and China, highlighting trust in custodial models in these regions.

On the flip side, non-custodial wallets like MetaMask and Phantom have built strong user bases globally, especially in emerging markets. Nigeria, India, Indonesia, and Vietnam consistently rank among top countries in wallet usage.

Here’s the catch: while user numbers soar in these regions, capital concentration remains firmly skewed toward developed markets like the U.S., South Korea, and Europe.

Asaf Nadler, COO and Co-Founder, Addressable

And in chatting with Asaf Nadler, COO and Co-Founder, Addressable, he revealed some more findings. “This report marks the first time we’ve been able to explore the concrete user behavior of over 20 leading wallets across 15 million users—made possible by Addressable’s ability to match wallets to real individuals and their actions. The user data revealed two critical new insights: first, that emerging markets like Nigeria and India aren’t just participating—they’re leading global crypto adoption and may deserve far more strategic focus; and second, that the wallet landscape is highly saturated, with fewer than 10 players dominating user market share. These findings reshape how we think about growth, competition, and the next frontier of crypto adoption.”

This dual dynamic poses fascinating strategic implications. Wallet providers must balance high-volume user acquisition strategies in emerging markets with high-capital management strategies in developed regions. It’s a complex yet thrilling balancing act that will shape the future growth trajectory of wallet ecosystems.

Crypto Wallets at the Core of Crypto’s Next Era

If you’re tracking crypto trends, it’s clear that wallets are no longer peripheral—they’re central to the user journey and blockchain adoption. Smart wallets are rapidly becoming essential infrastructure, financial superapp functionalities are redefining user expectations, and geographic diversification is shaping global adoption strategies.

As we look forward, I see wallets not just as storage or transaction tools, but as comprehensive gateways redefining digital identity, financial inclusion, and crypto usability globally. And as the lines between traditional financial services, web3 infrastructure, and seamless UX continue to blur, wallets will undoubtedly remain at the heart of crypto innovation.

So, what’s next? With standards like Ethereum’s EIP-7702 enabling even traditional wallet users to upgrade to programmable smart accounts, we’re entering a new era where wallets become smarter, more versatile, and integral to every digital interaction.

Buckle up—wallets aren’t just evolving; they’re transforming crypto from niche to mainstream right before our eyes.

Did you enjoy this story about the new Addressable.io and Dune Analytics report on crypto wallets? Don’t miss my next one: Use the blue follow button at the top of the article near my byline to follow more of my work.