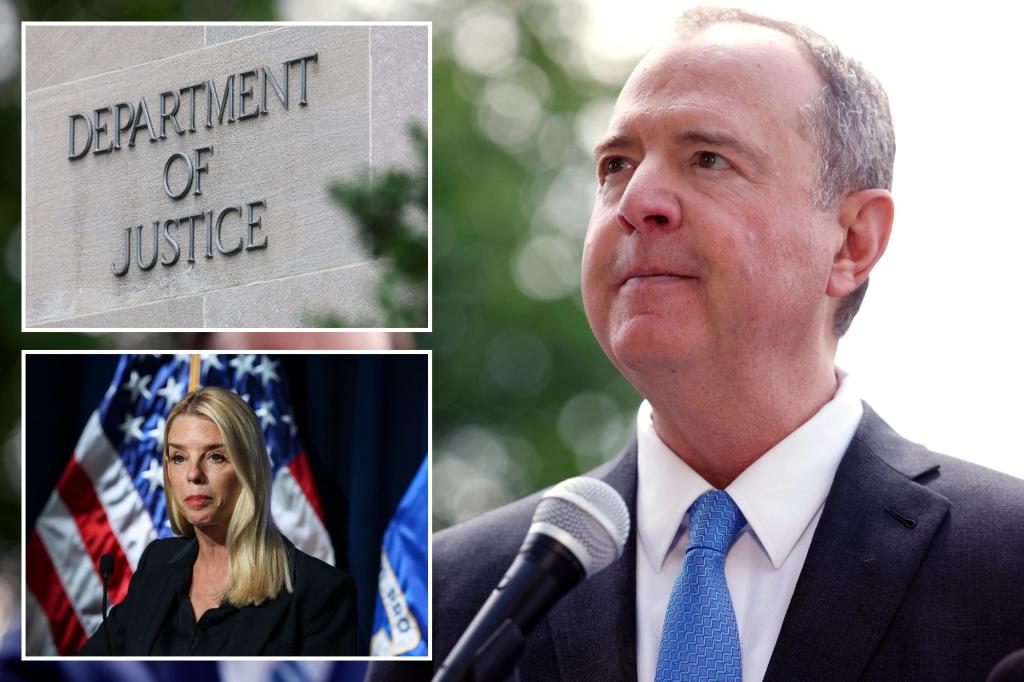

Sen. Adam Schiff under federal criminal investigation for alleged mortgage fraud violations

Sen. Adam Schiff, D-Calif., is under criminal investigation for mortgage fraud, a Trump administration source told Fox News. Fox News host Laura Ingraham broke the news on Tuesday night on “The Ingraham Angle,” saying the source said a criminal investigation is being conducted by the US Attorney’s Office in Maryland on possible charges involving mortgage fraud.