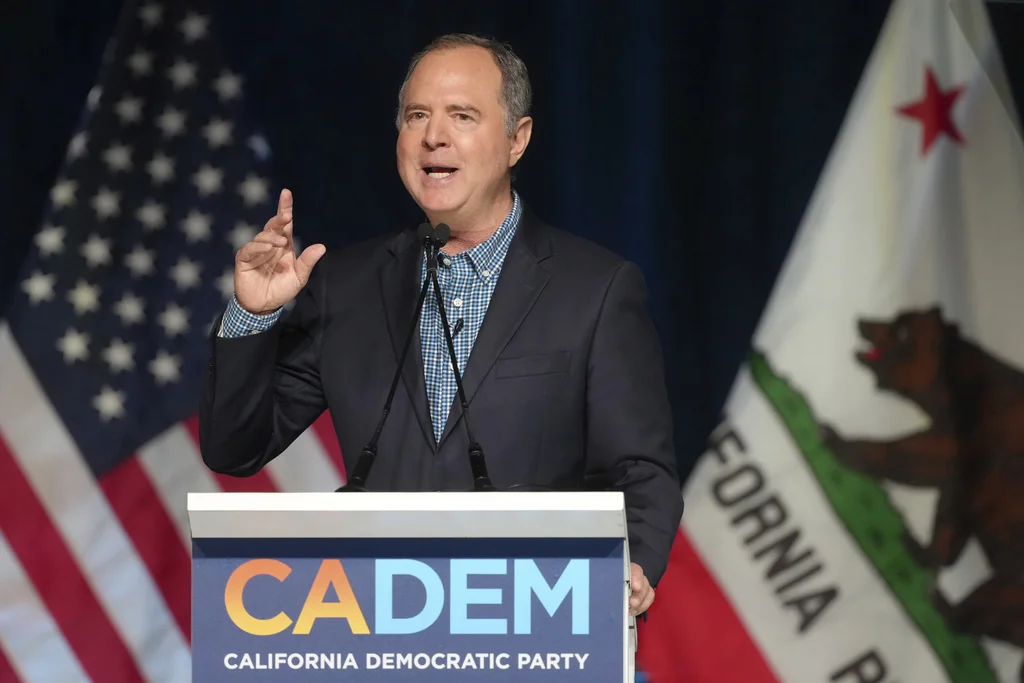

Schiff denies Trump’s claims of mortgage fraud as Fannie Mae investigates senator

Sen. Adam Schiff (D-CA) on Tuesday denied accusations from President Donald Trump that he engaged in “possible mortgage fraud,” calling the allegations an attempt at “political retribution.” Trump and Schiff have been at odds for years, with the Democratic senator having led a House impeachment of the president during his first term and establishing himself