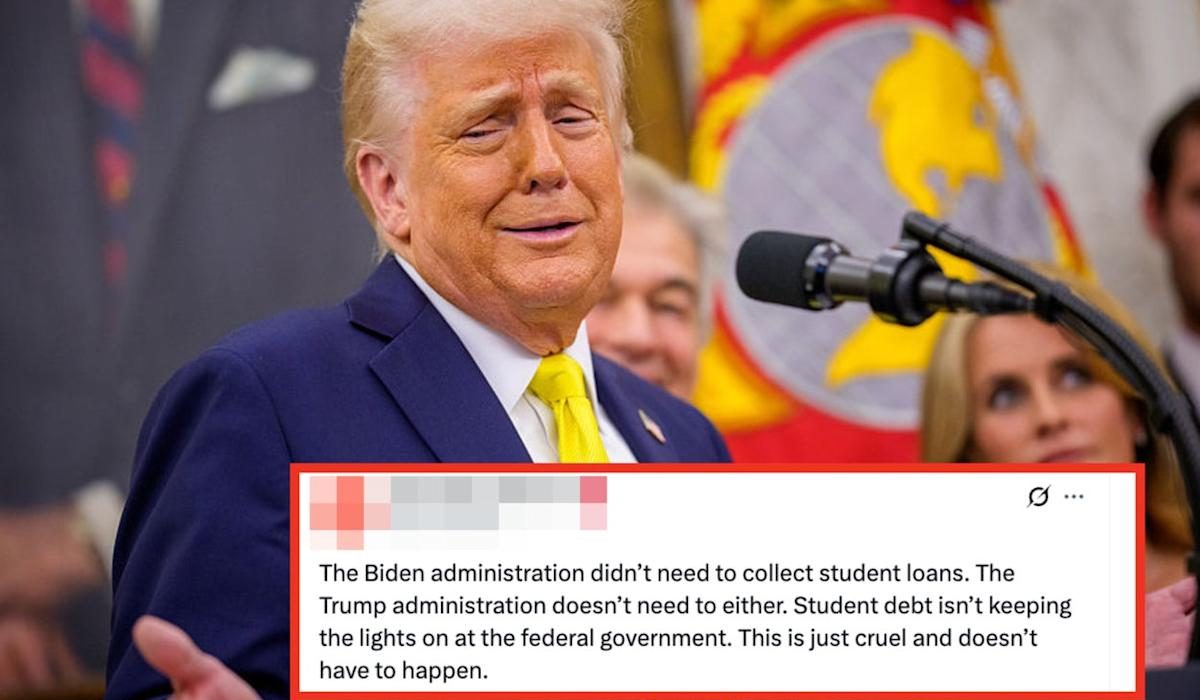

“Everyone Needs To Make A Ton Of F–ing Noise About This” — People Are LIVID Over The Trump Admin’s New Student Loan Decision

The Department of Education recently announced that it will start referring student loans that have gone into default to collections starting May 5. Adam Bettcher / Getty Images for We The 45 Million In a press conference, the White House confirmed it will collect money from people who have defaulted on their student loans by