Memphis event tackles cost of living and predatory loans

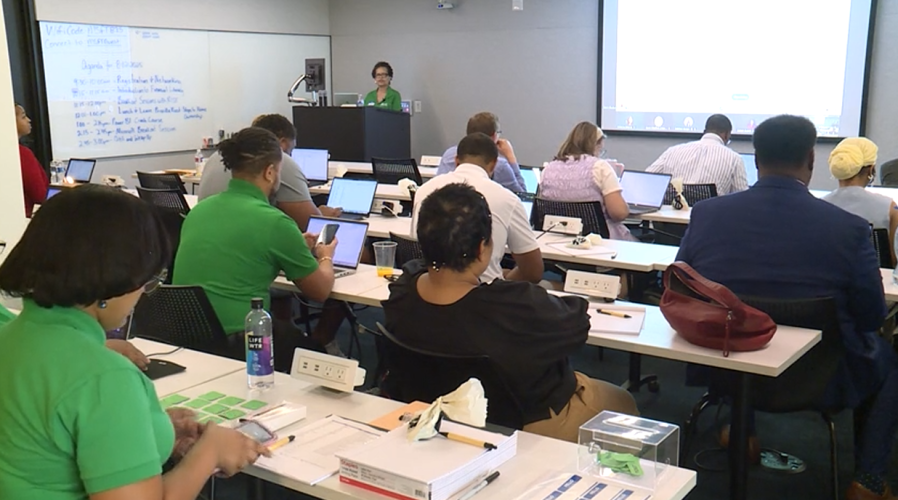

MEMPHIS, Tenn. — As the cost of living continues to rise, some are turning to high-interest loans to help make ends meet. That’s one of the reasons Rise Memphis and Microsoft hosted an event to teach people about financial literacy. “It’s people signing up and not really fully understanding what they’re getting into, not understanding