Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Westpac Banking share price has climbed 93% in five years, easily topping the market return of 45% (ignoring dividends). On the other hand, the more recent gains haven’t been so impressive, with shareholders gaining just 21%, including dividends.

While the stock has fallen 3.7% this week, it’s worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

During five years of share price growth, Westpac Banking achieved compound earnings per share (EPS) growth of 8.4% per year. This EPS growth is lower than the 14% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that’s hardly shocking given the track record of growth.

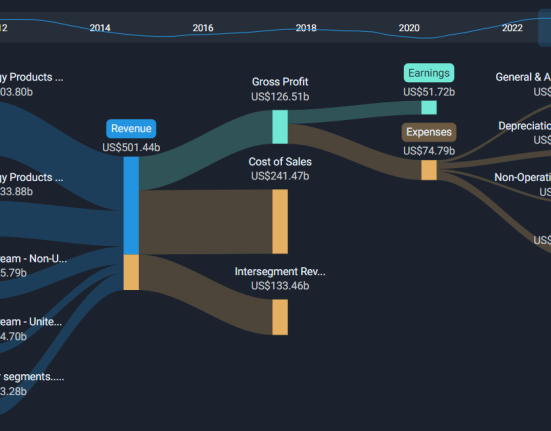

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Westpac Banking’s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Westpac Banking the TSR over the last 5 years was 152%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.