Digital banking platform, Dave Inc. DAVE has been on a fiery streak in recent months, up 121% since Nov. 2024. However, according to leading Wall Street analysts, the California-based bank is only just getting started, with plenty of growth in the years ahead.

What Happened: Analysts see strong upside in the stock, with almost all rating it a ‘Buy’ or ‘Overweight’, with an average consensus Price Target of $128, representing an upside of 55%. On the high end, the Price Target stands at $145, or a 75% growth from current levels.

B.Riley RILY raised its outlook on the stock following Dave’s fourth quarter results when it blew past estimates while forecasting growth of 22% for 2025. In addition to the company’s guidance, the analyst cited its ‘robust business momentum and expense leverage’ while issuing its Price Target.

Another analyst, Canaccord adds that during a period of growing concerns surrounding consumer spending and credit at fintech companies, Dave’s performance was rather remarkable. It goes on to admire its tech-enabled operating model, resulting in an impressive gross profit margin of 60%, and allowing it to profit even with small customer account balances.

Experts and analysts further highlight that despite the stock’s rally over the past 5 months, it is still undervalued, trading at just under 14 times forward earnings.

What It Means: This means that the stock has plenty of room to grow, and for investors, this is one of the few fintech opportunities they can get in early, which is profitable, has a proven model, and strong moats, such as its AI underwriting, which keeps getting better with time and more data.

Dave currently has over 10 million users, out of 80 million consumers in the US alone who are in need of financial stability, and 100s of millions more across the globe.

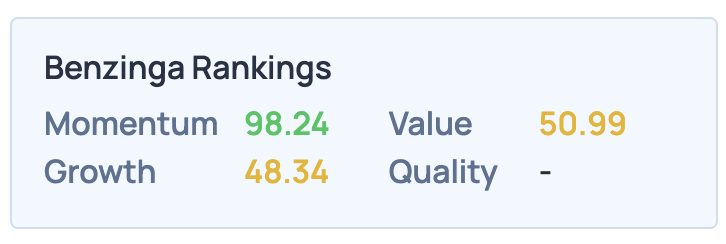

According to the Benzinga Edge, Dave scores an impressive 98th percentile on momentum, and while it lags on certain other fronts, this implies strong near-term upside potential. For a more comprehensive analysis, consider checking out Benzinga Edge Stock Rankings.

Read More:

Photo courtesy: Shutterstock

Momentum98.24

Growth48.34

Quality–

Value50.99

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.