8

By Salvatore Cantale, Professor of Finance, and Peter Nathanial, Executive in Residence, International Institute for Management Development (IMD)

By Salvatore Cantale, Professor of Finance, and Peter Nathanial, Executive in Residence, International Institute for Management Development (IMD)

In the evolving financial landscape, banks face the challenge of adapting their business models to not only remain relevant today but also to position themselves as leaders in a future increasingly dominated by complex risks, shifting economic realities and geopolitical tensions. That is, banks (and banking boards) need to find the right balance to manage exploitation and exploration.

In this context, exploitation focuses on refining existing capabilities, improving efficiencies and leveraging existing assets for short-term gains, while exploration involves pursuing new knowledge, innovation and experimentation to capture future opportunities. The balance between the two is critical for organizations to sustain a competitive advantage. A seminal paper published in 1991 emphasized the tension between these activities, highlighting that organizations must manage trade-offs to achieve long-term success.1 We posit that to be able to address the polarity between exploitation and exploration, banks need to navigate two fundamental intermediation roles successfully—namely, “clearinghouses” and “recyclers of capital”.

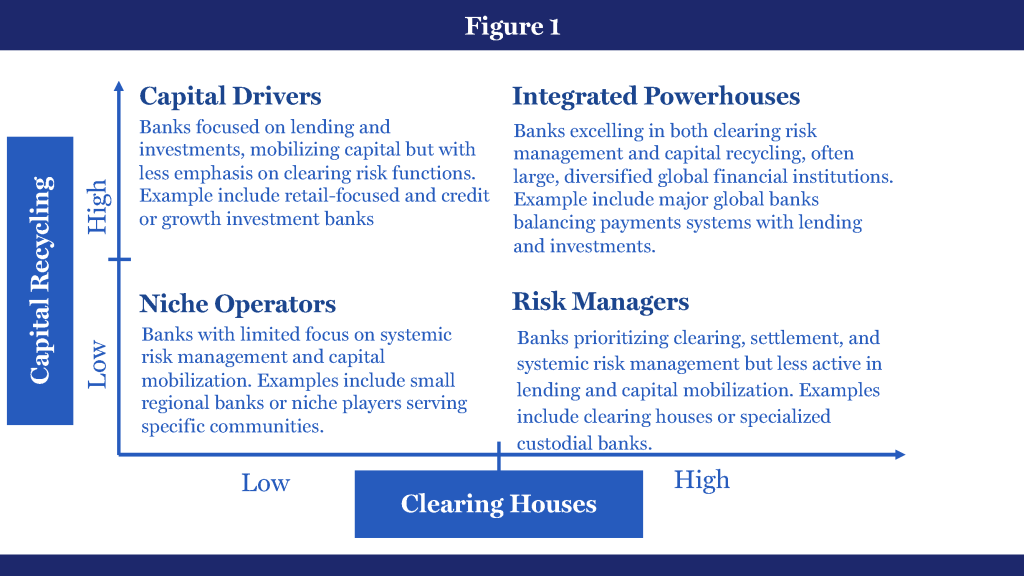

On the one hand, one of banks’ most fundamental needs is to continue acting as comprehensive “clearinghouses” for various types of risk. However, today (and in the future), this role is challenged by non-bank payment providers, CBDCs (central bank digital currencies), AI (artificial intelligence) and technology companies. On the other hand, in addition to managing risks, banks must define their positions with respect to “efficient recyclers of capital”. Capital recycling refers to the process through which banks allocate and redistribute financial resources to areas of the economy where they are needed most. This helps to ensure that capital flows to the sectors and projects with the highest return potential, driving economic growth and development, either through on-balance sheet lending and investing or through the facilitation of capital-market solutions. Efficient capital recycling is especially important in an environment in which global capital markets are increasingly interconnected and the speed and volume of transactions are growing exponentially. Considering how the two roles mix and match, banking boards realize how success can, therefore, be defined differently with respect to the scope and scale that each individual bank wants to achieve (see Figure 1).

To make it more complicated, it is evident that technology plays a large role today and will play an even more significant role in the future. Global IT (information technology) spending is expected to total $5.74 trillion in 2025, an increase of 9.3 percent from 2024, according to a report by Gartner, Inc. We imagine that this number will not grow smaller any time soon. Some of this increase has been fueled by the ever-increasing popularity of generative AI (GenAI) and advanced digital transformation programs—and their applications to business.

In this context, therefore, two relevant questions for boards are: What is the role of technology in ensuring that banks can address their roles as “clearinghouses” and “recyclers of capital”? And how can banking boards ensure that they correctly manage the polarity between exploitation and exploration with respect to technology?

Although the answers are different for different banks, their different geographical locations and the scales and scopes of their operations, three issues quickly rise to the surface.

-

The technological arms race and the peril of meaningless investments

There is a lot of talk about AI and advanced digital transformation in banks, and it is too easy to get into the game and make senseless investment commitments. An integrated powerhouse needs to invest heavily in integrated platforms powered by big-data analytics and predictive AI to optimize both clearing and capital functions today (exploitation) and must also invest in innovations with respect to cross-border payment systems, digital assets and CBDCs to enable leadership in the future (exploration). A niche operator might find it more advantageous to play “wait and see” on heavy investments in AI and advanced digital transformation. We would suggest they invest in smaller AI commitments and secure a seat at the table while still investing in technologies, such as cloud computing and automation, to enable operational efficiency and cost management (exploitation). That is, while for integrated powerhouses, the AI and advanced digital transformation game is an exploitation move, for niche operators, it might well be an exploration move. That is, do not copy and paste what other players are doing. Their strategies might not be suitable for you!

Questions for the board:

- Where would you position your bank in the above matrix?

- Do you balance the need for technological investment between exploitation (short-term optimization) and exploration (long-term innovation)?

- How do you ensure your bank is not merely following trends but investing in technology that aligns with your unique strategic goals and position?

-

You can’t win this race by yourself: Third-party providers and technological dependency

While banks have traditionally relied on internal and proprietary technological infrastructure, the future will see banks increasingly dependent on third-party providers for many of their technology needs. In a world of rapidly advancing technology, it is no longer feasible for banks to build and maintain all the technical infrastructure required to remain competitive. Instead, many banks will turn to external partners to help them access cutting-edge technological solutions, such as cloud computing, cybersecurity platforms, artificial intelligence and blockchain, which will take the form of a technology arms race, the investment in which will be viewed as a measure of readiness for the future by the market.

The integration of third-party technology solutions offers several advantages to banks. First, it allows them to access the latest innovations without investing as heavily in research and development (R&D). Second, it enables banks to scale more efficiently by leveraging external expertise and infrastructure. Finally, it may reduce costs, as third-party providers often have economies of scale and specialized capabilities that individual banks cannot replicate.

Questions for the board:

- What is your strategy for evaluating and selecting third-party technology providers?

- How does the board ensure that partnerships with third-party providers align with the bank’s long-term strategic goals?

- How are you ensuring that the cost savings and efficiencies from third-party solutions do not come at the expense of losing critical capabilities, differentiation or control?

-

The responsibility sits with the board!

Both the investment in technologies (and the right balance between exploitation and exploration) and the likely partnerships the bank will need to create to survive and thrive are part of the board’s responsibilities and need to be part of (today’s) board agenda. The latter point (partnerships) might not come naturally to bank executives, who are often too cautious (often for good reasons) to start external collaborations. It will be the board’s responsibility to manage its relationships with third-party providers carefully to establish and maintain control over critical aspects of operations, such as data security, model bias, hallucination, regulatory compliance, privacy and customer service. This will require robust governance frameworks and clear contractual agreements to mitigate the risks of relying on external vendors. While third-party providers will play a vital role in enabling banks to keep pace with technological changes, banks will still need to maintain a core set of proprietary solutions. These proprietary technologies will help them differentiate themselves in a competitive market and retain control over the critical aspects of their business models. The hybrid approach—combining proprietary and third-party solutions—will likely become the norm in the banking sector in the future. Banking boards, beware!

Questions for the board:

- What governance structures are in place to ensure clear accountability for partnerships and technological investments?

- How is the board preparing to oversee the integration of proprietary and third-party solutions into a cohesive hybrid-technology strategy?

- How do you balance the benefits of outsourcing technological capabilities with the risks of dependency on external vendors?

- What safeguards and governance frameworks are in place to mitigate risks related to third-party solutions (e.g., data security, compliance, operational resilience)?

- How often does the board revisit its technology agenda to ensure it remains relevant in a rapidly evolving environment?

Conclusion

In summary, the future of banking lies in the ability of financial institutions to act as trusted clearinghouses of risk, efficient recyclers of capital and innovators in the face of technological change. Those that can adapt their business models to manage diverse types of risk, leverage both proprietary and third-party technology solutions and maintain a strong presence in capital recycling will lead the way in the coming decades. The future of banking will be shaped by those institutions that can retain the public’s trust while successfully navigating these challenges.

ABOUT THE AUTHOR

Peter Nathanial is an Executive In Residence at the International Institute for Management Development (IMD), the former Group Chief Risk Officer and a Member of the Executive Committee of the Royal Bank of Scotland Group (RBS) and the former Head of Global Risk Oversight at Citigroup. He is also a former Adjunct Professor of Finance at INSEAD and a Co-founder of INSEAD’s certification programme (IDBP) for boards of directors in the banking and financial sector.