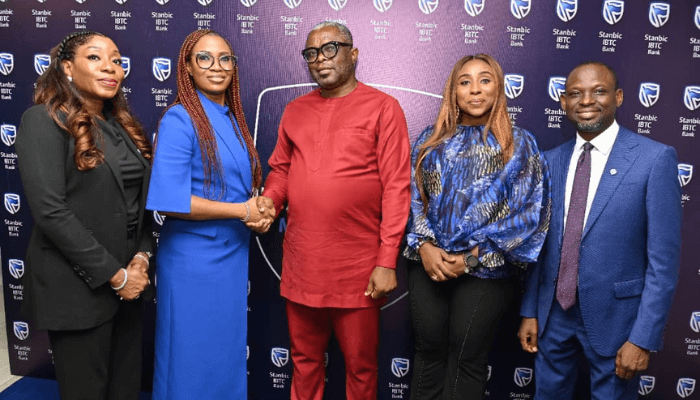

L-R: Layo Ilori-Olaogun, Head, Private Banking, Stanbic IBTC Bank; Bunmi Dayo-Olagunju, Deputy Chief Executive, Stanbic IBTC Bank; Nnamdi Nwokolo, Prize Recipient; Okeke Ezinwa, Prize Recipient and Taiwo Ala, Head, Product, Stanbic IBTC Bank, during the Private Banking Media Parley and Grand Prize Presentation held at Stanbic IBTC Towers, Victoria Island, Lagos.

For many of Africa’s high net-worth individuals, banking is not about transactions, it is about legacy, ease, and trust. While recognising the evolving needs of the rich, Stanbic IBTC Bank recently repositioned its Private Banking offerings to help customers protect their wealth, grow their portfolios, and build enduring legacies.

Private banking is helping Nigerians ensure financial security by creating personalised financial planning to curated investment opportunities across equities, fixed income, and alternative assets.

“This is a wholesome service that not only helps you build wealth, but sustain it, and pass it on to next generations. This event is our way of saying thank you to the clients who trust us to be part of that journey,” said Bunmi Dayo-Olagunju, Deputy Chief Executive, Stanbic IBTC at the loyalty and rewards event for top clients.

The rebranded Private Bank offers enhanced investment returns, streamlined digital loans, exclusive benefits through the Platinum Connection Hub, and personalised support, setting a new benchmark for affluent banking in Nigeria.

Stanbic IBTC also engaged the media in a dialogue to reinforce its commitment to innovative and value-oriented Private Banking (formerly Affluent Banking) services. The bank noted that it takes service delivery to a new level by prioritising its private banking business to provide convenience for its esteemed customers.

“Stanbic IBTC Private Bank is devoted to crafting financial solutions that empower our clients to create and preserve enduring legacies with elegance and precision,” Dayo-Olagunju added.

The Stanbic IBTC Private Banking service offers premium services and solutions to high-net-worth individuals residing in Nigeria and abroad, with the goal of enabling clients to build, grow, and transfer their wealth to future generations.

In a highly competitive banking industry, innovation, unique customer service, and the adoption of emerging technologies have enabled many banks to distinguish themselves in their quest to create value in the financial services sector.

The evening event for loyalty and rewards for the bank’s top clients served as a platform to introduce Stanbic IBTC’s newly enhanced and rebranded private banking suite. The upgraded value propositions include: dedicated relationship managers and support teams, zero cap fees on hybrid current accounts, instant credit card issuance, paperless digital loans, discounted insurance and trust services, exclusive event invitations access to specialised offshore banking and balancing digital with human connection.

Layo Ilori-Olaogun, head, Private Banking, Stanbic IBTC while giving her remarks at the event noted the bank was redefining private banking with unique personalised banking services.

Read also: Stanbic IBTC secures CNY800m term loan agreement with China Development Bank

“Our Private Banking service is seamless with well-trained and equipped relationship managers and support staff assigned to our esteemed customers. This reflects our commitment to providing superior and tailor-made banking services to our customers,” she said.

Ilori-Olaogun further noted that Stanbic IBTC Bank’s digital platforms are secure and stable, aligning with emerging technologies and enabling an efficient and interactive private banking service for its customers.

A Save and Enjoy Promo draw was held under the supervision of the Advertising Regulatory Council of Nigeria (ARCON). Four winners received open business class tickets to the UK, USA, or Canada, offering the freedom to travel in unmatched style. Five others were awarded a one-year Priority Pass, granting access to over 900 airport lounges worldwide.

At the same time, 32 clients received luxury vintage travel boxes, a refined symbol of the exclusivity tied to the bank’s private banking experience. Presented at the event, these rewards honour the confidence that clients place in Stanbic IBTC Private Bank to advance their financial goals.

For the winners, the prizes represent exceptional privileges that elevate their lifestyle. One recipient, holding their business class ticket, remarked, “This reward enhances my global travels, and it is remarkable to feel so valued by Stanbic IBTC Private Bank. They truly understand our aspirations.”

The launch of Stanbic IBTC Private Bank, paired with the Save and Enjoy Promo, highlights the bank’s dedication to rewarding loyalty while fostering wealth creation and preservation.

Obasi Lawson, one of the prize recipients expressed his appreciation, saying he was truly delighted. “In my lifetime, I have never won anything like this. I usually do not even try my luck, so to be one of the winners feels special.

“I know Stanbic IBTC is one of the best banks you can rely on. When they make a promise, they keep it, and they have done it again,” Lawson said.

Here are other things to know about Stanbic IBTC private banking, its future

Stanbic IBTC Private Banking is designed to mould perfectly to your needs by giving you the personal attention you need and deserve. This exceptional offering integrates quality banking and wealth advisory services seamlessly and unobtrusively with your lifestyle. The bank is equipping clients with tools to secure both present and future wealth. These offers are curated according to individual risk profiles and long-term objectives

Stanbic IBTC personalised banking will evolve into the benchmark for private wealth management in Nigeria, combining bespoke financial solutions with global best practices. Its focus on legacy, digital innovation, and holistic advisory services will position it as the trusted partner for affluent individuals and families seeking to create, preserve, and transfer their wealth across generations.

“With our Private Banking Solutions, you will enjoy seamless management of your local and foreign accounts with a single debit card, as well as competitive lending rates and offshore specialised lending. From exclusive networking events to personalised concierge services, we are committed to providing you with a banking experience that is truly tailored to your needs,” Stanbic IBTC noted.