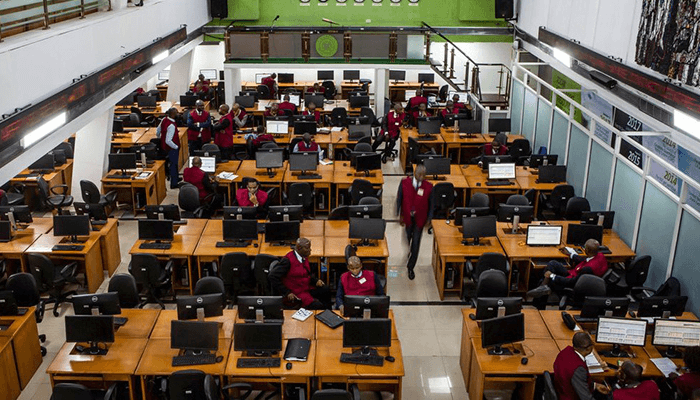

Nigeria’s stock market benchmark performance indicator – the All Share Index (ASI) crossed 130,000 points on Thursday as investors interest in equities persists.

Though the market’s key sectors recorded bargain hunting activities which pushed the Index higher by 0.48 percent, but banking, insurance and oil & gas stocks were the major drivers of Thursday’s rally on the Nigerian Exchange Limited. The market’s year-to-date (YtD) return stood at +29.41 percent.

Japaul Gold, UBA, Access Holdings, Consolidated Hallmark and Nigerian Breweries were actively traded stocks on Thursday as investors in 22,955 deals exchanged 818,387,390 shares worth N22.665 billion.

FTN Cocoa led the market’s league of major advancers after its share price rose from N6 to N6.60, adding 60 kobo or 10 percent.

Read also: NGX is on track for its most active year ever

It was followed by Academy Press which increased from N7.70 to N8.47, after adding 77 kobo or 10 percent.

At the close of trading on Thursday, the Nigerian Exchange Limited (NGX) All-Share Index (ASI) and equities market capitalisation increased further from preceding day’s lows of 132,557.43 points and N83.856 trillion respectively to 133,199.99 point and

N84.262 trillion.

Also, Sovereign Trust Insurance stocks rallied from N1.30 to N1.43, up by 13 kobo or 10 percent.

RT Briscoe moved also from N3.41 to N3.75, adding 34 kobo or 9.97 percent, while another major gainer, The Initiates moved from N13.34 to N14.67, up by N1.33 or 9.97 percent.

“The rally is becoming increasingly reliant on a handful of large caps, while mid- and small-cap names face pressure. Without sector rotation or support from lagging names, the market risks a short-term stall.

“A hold above 132,000pts remains key to keeping sentiment afloat heading into Friday”, said analysts at Lagos-based Vetiva Research in their July 23 post-trading note to investors.